Does Sydney man’s plan to retire at 35 make sense?

A SYDNEY man says he’s not going to buy a house so he can put all his money into the stockmarket and live a life of leisure by 35. So is the plan as crazy as it sounds?

WHILE Pat Seyrak is not the only millennial who has given up the dream of owning a house, his reasons have nothing to do with affordability.

The 30-year-old engineer has saved close to $300,000, but instead of putting it towards a home he has decided to invest the money in the stockmarket with the aim of retiring in five years’ time.

The Sydney resident is tracking his progress on a blog and has set an ambitious goal of accumulating $1 million in his portfolio.

While at least one of this friends thinks he is crazy, Mr Seyrak believes the plan will allow him to retire at 35 on an annual income of about $40,000.

“I decided about a year ago that I wanted to do this ... so I could stop working and do other things I enjoy, which may be paid or not,” he told news.com.au.

While $40,000 may not sound like a lot to some, Mr Seyrak said he thought it would be more than enough.

“There’s plenty of people earning the minimum wage and living on that and they’re managing to survive,” he said.

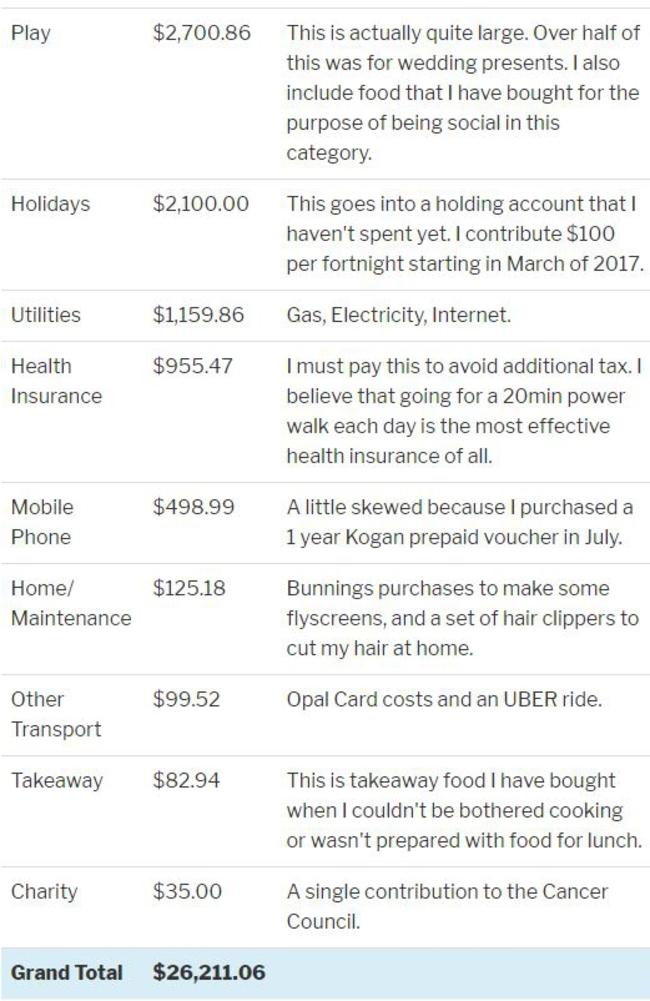

“I tracked all my spending last year and it came to about $20,000 so I’m clearly able to survive on much less than $40,000.”

Mr Seyrak even has a long-term girlfriend who is working towards her own goal.

“I kind of sprung it on her but she’s been on board from the beginning.”

Mr Seyrak acknowledges that living in Sydney will probably be too expensive but notes that cities like Cairns, Adelaide, Ballarat or Hobart are extremely affordable and offer “idyllic lifestyles”.

“Slowly travelling through South-East Asia or South America can also be done at a far cheaper price than it costs to live in some of Australia’s large cities,” he wrote in an article for ABC about his plan.

“While many imagine a life of poverty on $40,000 a year or less, I have found that you can have a truly rich and fulfilling life by ensuring you spend your money on the right things,” he wrote.

“Yearly upgrades to the latest iPhone and smashed avocado at the local cafe several times a week are out, while lots of outdoor time with friends and beautiful home-cooked meals are in.”

In order to get to his goal, Mr Seyrak has dramatically cut his expenses.

Last year got he got his grocery shop down to about $55 a week and spent a total of just $82.94 on takeaway food.

Despite his frugal habits, Mr Seyrak said he still went out and had fun.

“You can spend any amount of money and have a lot of fun, or not,” he said.

“It’s how you spend the money. Put it towards the things that are most valuable to you in life.”

He said the key to saving money was understanding what you were spending it on.

“I think people just need to track their spending and see where their money is going, to see if it’s being wasted, if they would prefer to spend it on something else, if they are getting value from it, or if it’s just dropping out of a leaky bucket and they don’t really know where it’s going.”

Mr Seyrak acknowledged there were risks to his plans as the stockmarket was unpredictable but said he was willing to be flexible.

“The plan I have is fairly conservative but I’m a young person and I have plenty of potential to earn money if I want to,” he said.

“If the market crashes, I could always supplement my income with casual work to get me through that.”

Asked if Mr Seyrak’s plan was feasible, The Airport Economist Tim Harcourt told news.com.au it was possible for Mr Seyrak to achieve his goal.

“He could probably retire at 35 but if we all did it, it wouldn’t be very good for the economy,” he said.

Mr Harcourt said the plan could fall victim to the “fallacy of composition” principle.

Using football as an analogy, Mr Harcourt said spectators may be tempted to bring a box to the game so they can stand on it to see better but if everyone did that, no one would be better off.

“I don’t know if the country could afford everyone retiring at the same time,” he said.

As for his investment strategy, Mr Harcourt said one famous economist James Tobin won a Nobel prize in economics for his theory on “optimal portfolio allocation” that highlighted the risk.

“He (Mr Seyrak) is making a punt to do one thing (invest in the stockmarket),” he said.

“James Tobin won the Nobel prize for essentially saying ‘don’t put all your eggs in one basket’.”