‘Disgusting’: Aussie investors claim they were fooled by Gold Coast startup

The startup seemed like a great idea but there was just one problem and now investors claim they were duped.

The startup seemed like a great idea but there was just one problem – and investors are now claiming they were duped.

More than 100 Aussies invested around $4 million into a business called AZBalls — a company boasting that it had invented the world’s first alphabetical lottery where you could choose words rather than numbers to hit the jackpot.

The company’s founder and chief executive, Craig Austin, a former truckie, told prospective mum and dad investors he had patented his AZBalls alphabet lottery idea in 2019. This was reiterated in marketing material sent to shareholders and potential shareholders.

“We believe this is the first new lottery concept to be launched into the world market since Powerball in the early 1990s,” Mr Austin wrote in a prospectus.

The company’s revenue stream was supposed to be twofold; first, it would make money from lottery ticket sales. But AZBalls would generate a second income by licensing its patented product to other lottery sellers.

But now, investors have learned there was no patent — and there never was.

Investors also discovered that the AZBalls CEO, Mr Austin, was doing battling in court on a separate matter, leading to significant delays in obtaining an online gaming licence for the business. Meanwhile the chief financial officer of AZBalls was disqualified by ASIC for misconduct involving people’s superannuation funds.

It comes after a news.com.au investigation previously revealed the dubious ways investors money was spent — including Mr Austin using a company card to gamble at the casino, and receiving $308,000 as a salary before the lottery business had even launched.

Tereasa Chatham, 52, and her husband, who live in Bundaberg, invested $50,000 from savings and a self-managed super fund into AZBalls in 2019.

Ms Chatham’s husband had suffered a cardiac arrest and a hypoxic brain injury months before they made their investment, and she has become his full time carer.

They were holding out hope that this investment would come off and even got their friends and daughter involved.

The couple were left shocked when they found out Mr Austin had never secured a patent for the project, despite claiming he had. The company had received a temporary innovation patent but was rejected in its application for a full patent.

“Craig (Austin) at every point stipulated he had a patent and a licence. That’s what we held onto,” Ms Chatham lamented.

“Then we found out there was no patent.

“We’re absolutely gutted. It’s disgusting what (the company) have done,” she said. “I’m not sure how many millions of dollars (the company) have taken from mums and dads.”

Another investor, who wanted their name withheld, said that without a patent, the business essentially “had nothing”.

Do you know more or have a similar story? Get in touch | alex.turner-cohen@news.com.au

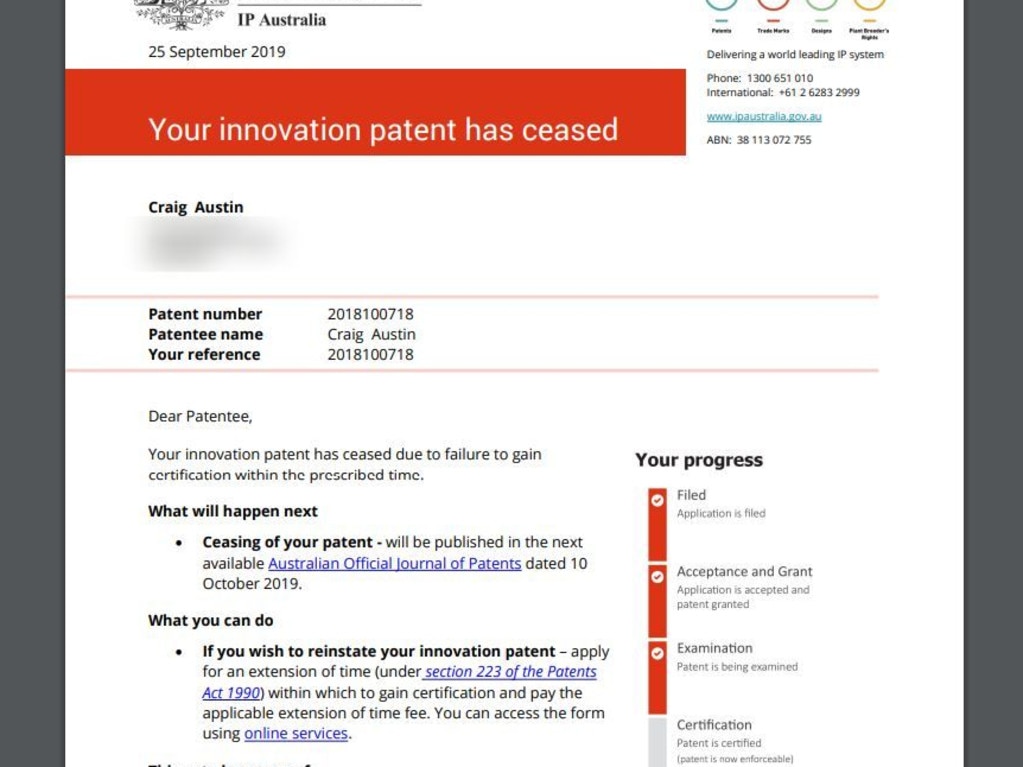

Records show that Mr Austin registered an innovation patent with IP Australia in June 2018.

Investors say he represented this as the final patent certificate.

“He had this thing he could flash around,” said one investor on condition of anonymity, referencing the registration certificate.

“In the fine print it said subject to an examiner’s certification.”

Just months after the innovation patent was issued, in September 2019, an examiner rejected the application.

“Your innovation patent has been examined under section 101B of the Patents Act 1990,” IP Australia wrote.

“I consider that your innovation patent does not meet the requirements of the Act because there are issues with your innovation patent that are explained in the report details.”

AZBalls went on to gain millions of dollars in investment afterwards and marketing material claimed the product was patented.

Mr Austin told news.com.au he was unaware the patent had been rejected and had only discovered that was the case recently.

He also said he believed the patent was valid for eight years, as it stated on the initial certificate.

“When I was telling people that there was a patent it was on this basis,” he said.

“It wasn’t until years later when I asked a patent lawyer to follow-up on an expansion of this to international application that the life cycle was discovered, and that it ceased in September of 2019.

“I did not falsify any information nor did I try and mislead or con anybody.

“Yes, it was a shock for me and everybody to discover this patent certificate wasn’t valid for the eight years as it clearly states on it. I am not a conman. I was acting with good intentions and always do.”

IP Australia confirmed to news.com.au however that they had sent him several warnings on his “nominated channels” that the patent would soon cease in 2019.

An IP Australia spokesperson told news.com.au that all customers receive correspondence when a patent application is assessed, when it lapses or ceases, and when it is certified.

“Mr Austin was granted an innovation patent in June 2018,” they said. “The term of an innovation patent is up to eight years. A granted innovation patent is not legally enforceable unless it is certified following examination.”

They said Mr Austin requested an examination of his patent but on 15 March 2019 but IP Australia told him it had failed to meet the requirements.

“This correspondence outlined that Mr Austin would need to overcome the issues preventing certification by 15 September 2019 otherwise the innovation patent would cease,” the spokesperson said.

“Mr Austin did not provide a response to this request and accordingly IP Australia sent further correspondence to Mr Austin on 25 September 2019 advising that the innovation patent had ceased.”

Mr Austin claimed he had only discovered the patent had ceased years later, in 2022.

Records show he reapplied for the patent in 2023. This application also failed.

Mr Austin was battling a separate court case while AZBalls was in development stage — and this caused further delays for the project.

In order to be able to trade, the startup needed a gaming licence.

But the company failed to pass probity at a Tier One jurisdiction – the most desirable and reputable licence to obtain.

It was here investors learned Mr Austin was up on criminal charges, which is why he had failed to pass the checks and get a licence.

Mr Austin acknowledged this caused a delay in licensing. “It was at the time some criminal charges that were in proceedings that I was found not guilty for later on.

“It was advised not to be part of the probity process in that licence application.

“I have since been cleared and gone through a more in-depth probity process recently with no problems.”

He provided a national police check which showed there are no disclosable court outcomes recorded against him.

After years of trying to progress, AZBalls finally received a gaming licence in November last year from the Tobique Gaming Commission, run by First Nations people in Canada.

It turns out Mr Austin isn’t the only person on the board of AZBalls who has brushed up against the law.

David Sidhu is listed as the chief financial officer of AZBalls.

In February last year, the corporate regulator, ASIC, disqualified Mr Sidhu from acting as a self managed super fund auditor after an investigation found his “conduct did not meet the required standard”.

ASIC said they had “concerns”

Mr Sidhu has been placed him on a public ban list and he’s not allowed to reapply for registration.

An AZBalls investor, who wanted to remain anonymous, said “had the then chairman of the company known that David Sidhu was disbarred by ASIC, it was inconceivable” to make him the chief financial officer.

Mr Austin said in response: “David Sidhu is a contractual CFO service provider and does not provide us with SMSF’s advice”.

News.com.au contacted Mr Sidhu for comment.

alex.turner-cohen@news.com.au