Introducing The Missing $49 Million – news.com.au’s first ever eight-part investigative podcast series.

An Aussie fraudster opened a “Digital Gold” company in the Cayman Islands just two years before he died and took the secret of his $49 million stolen fortune to the grave with him.

And the offshore business bore an uncanny resemblance to a cryptocurrency scheme.

Years after his death, this company quietly collapsed and shareholders were never notified.

Queensland “technopreneur” Alan Metcalfe convinced 600 hopeful mum and dad investors to part with tens of millions of dollars – in many cases their life savings – because he had launched a business that was going to be bigger than Google.

But when Metcalfe died in 2017, those investors were left asking what happened to all their money in a baffling case now being exposed in a news.com.au investigative podcast, The Missing $49 Million.

The latest episode investigates whether their vanished cash ended up in a notorious tax haven 16,000 kilometres away.

The first six episodes of The Missing $49 Million are available to listen to now wherever you get your podcasts. An episode is coming out every week for this eight-part series.

Available on Spotify here and Apple Podcasts here.

Do you know more? Get in touch | alex.turner-cohen@news.com.au

Metcalfe claimed he had discovered the secret to artificial intelligence buried in the Bible in 1999 and went on to launch an internet business called Safe Worlds TV.

The platform was supposed to be a combination of all the major players such as Google, YouTube and Amazon, but the technology was rudimentary at best and promises of launching on the stock market never eventuated.

By 2015, it was getting harder for Metcalfe to squeeze money out of his victims, so he came up with a new idea – he was going to create a digital currency that was backed by gold.

He called it Digital Gold and registered a business in the Cayman Islands that same year.

The Cayman Islands, a British Overseas Territory, is located in the Caribbean and is ranked as the greatest enabler of corporate tax abuse, according to analysis done by campaign group Tax Justice Network.

Indeed, Metcalfe acknowledged the island’s shady reputation and even admitted that paying less tax was a big incentive for basing his business there.

“Why has this new company been incorporated in Grand Cayman?” he wrote to shareholders in 2015.

“Because it needs to be an international entity that can operate globally without conflicting taxation interests. This does not mean that we are seeking to avoid paying taxation. We simply need to avoid paying double taxation. There is nothing illegal in this move.”

Metcalfe began spruiking his Digital Gold idea, calling on investors to give him more money.

It was going to be an alternative to PayPal, he said, and he even went a step further and planned to issue his users with their own Gold Pay debit card.

His ambitions didn’t end there though: his digital gold would be “a safe haven to hold the retirement savings of the world”.

Shares for this Digital Gold standard were selling for just 0. 01 cents each. The minimum investment was 2,000.

Metcalfe said he needed $8 million to turn this concept into something tangible.

And any leftover money would be put towards the purchase of gold and silver as a safe investment option.

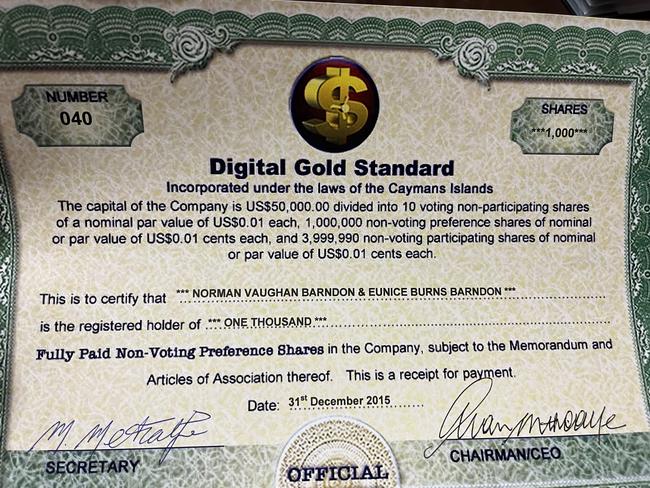

Vaughan Barndon, from Geraldton, Western Australia, had already put money into Alan’s original Safe Worlds investment. The farmer then put more of his cash into Digital Gold. Although Vaughan passed away last year, his son Warren Barndon showed me the certificate he received in exchange for his investment – the only proof Vaughan had that he had even contributed towards the scheme.

My podcast’s producer, Nina Young, had an immediate reaction when she saw the certificate.

“Now that I’ve seen a certificate, the digital gold doesn’t exist. It looks fake. That’s the most fake certificate I’ve ever seen,” she said.

Vaughan’s certificate was the 40th one issued – so that means at least 39 others invested into Digital Gold before him.

As part of Alan’s sales pitch, he referenced the fact his Digital Gold currency was a “transparent” payment method and that he was creating a “private and secure digital wallet”.

He made mention to bitcoin as well – the world’s largest cryptocurrency token.

His Digital Gold was starting to sound a bit like cryptocurrency and an expert thought so too.

“When people hear digital gold, especially today, they think about Bitcoin because it’s often referenced as Digital Gold,” Australian cryptocurrency exchange platform Swyftx analyst Tommy Honan said.

“I believe that the project (Metcalfe’s Digital Gold) white paper itself lends itself directly from what a crypto white paper would look like or a blockchain project would look like.”

At the time Metcalfe was proposing the idea, in 2015, Mr Honan said cryptocurrency was “absolutely a niche” that most “average people” wouldn’t have heard of.

It makes me wonder if Alan had created his own cryptocurrency and if that’s where the missing millions ended up.

Or if he had fallen for a crypto scheme and lost the money to that.

But during my year-long investigation, I haven’t found any evidence of a blockchain transaction coming from Alan Metcalfe, making it impossible to track further.

Metcalfe registered his Digital Gold idea under the business name Digital Gold Standard.

His wife Mary Metcalfe is listed as the sole remaining director of the business, having inherited it after his death.

This business is listed alongside thousands of other businesses that the Cayman Islands’ financial regulator struck off in 2019 because of unpaid administrative fees.

So the business has collapsed and no longer exists.

Investors were never notified of this.

The first six episodes of The Missing $49 Million are available to listen to now wherever you get your podcasts. An episode is coming out every week for this eight-part series.

Available on Spotify here and Apple Podcasts here.

Do you know more? Get in touch | alex.turner-cohen@news.com.au