Introducing The Missing $49 Million – news.com.au’s first ever eight-part investigative podcast series.

The money trail of a missing $49 million fortune is pointing towards secret businesses a prolific Aussie fraudster opened in the notorious British Virgin Islands.

Queensland man Alan Metcalfe ripped off 600 hopeful mum and dad investors by proclaiming he had made a breakthrough in artificial intelligence technology that would revolutionise the IT world, which he called Safe Worlds.

It was supposed to be a rival to Google, PayPal and eBay but surpass all these tech giants because of its AI capabilities, but then Metcalfe died in 2017.

He appeared to take the secret of their money to the grave with him in a baffling case now being exposed in a news.com.au investigative podcast, The Missing $49 Million.

I’ve already exposed Metcalfe’s life of fraud and more recently, that he had started a digital currency scheme similar to cryptocurrency.

And the latest episode reveals Metcalfe secretly opened businesses at a tax haven in the Caribbean Sea, 16,000 kilometres away from where he was raising money from unknowing, trusting Australians.

In 1999, Metcalfe claimed he stumbled upon the secret code to artificial intelligence that would make him rich.

And that same year, he secretly opened a business in the British Virgin Islands, called IBS BVI Limited.

The IBS part stood for Internet Business Systems, while the BVI acronym was a shortening of the British Virgin Islands.

The British Virgin Islands is ranked as the best tax haven in the world, with the Cayman Islands coming in second and Bermuda third, according to analysis done by campaign group Tax Justice Network.

However, Metcalfe made no mention of the existence of this business when he started taking money from shareholders several years later.

Then in 2010, he opened another business in the British Virgin Islands, this one called IBS Shareholdings Co Limited.

This time, he didn’t keep it totally hidden from shareholders. He told them he was opening this business for tax reasons and claimed he had come to an agreement with investors to transfer their shares into the offshore entity.

However, a few years later investors discovered his links to the islands and claimed this had been done without their permission or consent.

The first six episodes of The Missing $49 Million are available to listen to now wherever you get your podcasts. An episode is coming out every week for this eight-part series.

Available on Spotify here and Apple Podcasts here.

Do you know more? Get in touch | alex.turner-cohen@news.com.au

“For tax reasons, the shares will be held in trust until Safe Worlds is listed and the shares can be sold,” Metcalfe wrote in an email in 2012.

“If they were issued now, it is most likely that the value of the shares would be taxable in the hands of the recipient. A British Virgin Islands Corporation has been established,” he wrote.

For a moment, as I read this, I think I may have stumbled across the final resting place of the missing $49 million.

As SafeWorlds never went public, does that mean the shares and therefore the money is still there in that trust?

A literal pot of gold locked up in a company called IBS, which is registered in another opaque island tax haven on the other side of the world?

But as I keep looking, I’m disappointed.

Both companies were dissolved in July 2023. And they were forcibly shut down by the island’s regulator for failing to pay administrative fees, making me think it’s unlikely they had any money in them at the time of closure.

The islands have their own laws and their own systems, and outsiders don’t always understand them. So, to set up his IBS companies, Alan also used a local firm, Gonzalez-Ruiz & Alemán (BVI) Trust Limited.

Their website advertises the fact they’re the best place to go to protect your assets. They didn’t respond to requests for comment.

Leah Wietholter, an ex-FBI employee who now operates as a private detective, has followed money trails all the way to these opaque tax havens before.

“The fact he (Metcalfe) set up in the British Virgin Islands is interesting to me,” Ms Wietholter said, “because in the British Virgin Islands, you don’t have to disclose who owns what, and it seems like it was a much greater hurdle than even in the Caymans.

“It may even be that he set up businesses there because it’s confidential, but the money isn’t necessarily in the British Virgin Islands,” she said.

Metcalfe registered his main business, Safe Worlds TV, in Pennsylvania, USA. And Ms Wietholter points out this is another odd decision.

“Pennsylvania is a state that is very favourable to privacy and things like that and you don’t have to prove that you are still in business,” she said.

“So again, it’s just like another wise set up there. Especially if you’re not from there.”

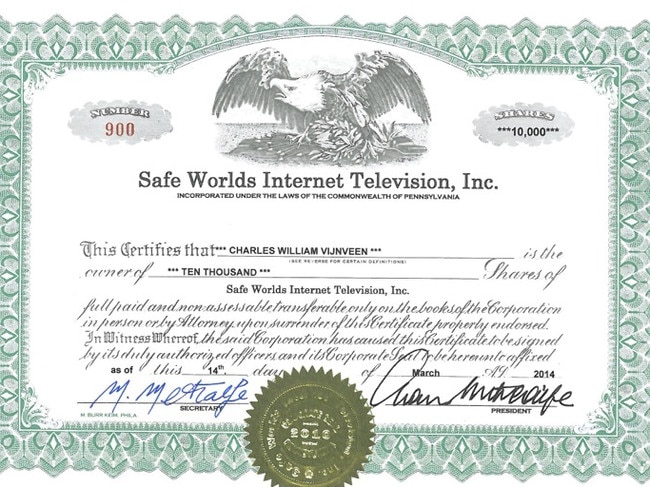

Metcalfe’s shareholders were issued with a share certificate as proof of their investment, which stated the business was registered in Pennsylvania.

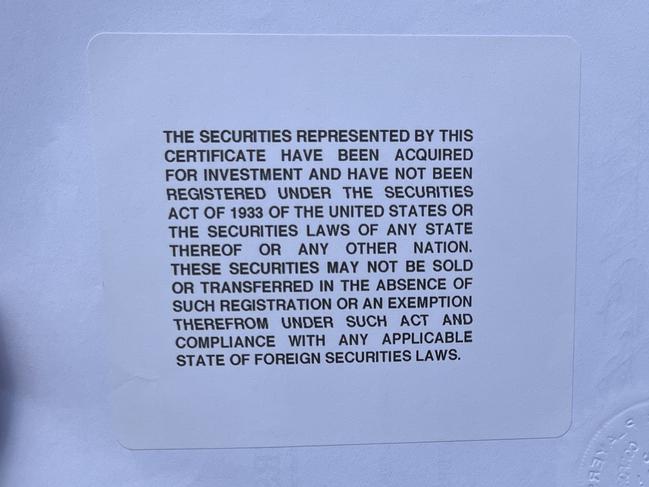

But there’s an odd disclaimer stuck manually on the back of every single one of these certificates that states the business wasn’t registered under any laws in the US, or anywhere else in the world.

“It looks unprofessional, it looks to me like an enormous red flag of a scam that’s stuck on the back of a piece of paper with some sort of label,” University of Sydney white collar crime expert Professor Clinton Free said.

“I fear for the person who holds that. I think they might as well be holding confetti in terms of making any claim on that money.”

When I asked Beste Onay, who works in the University of NSW’s start-up department, she said this was pretty unusual to see in a newly launched company.

“It doesn’t sound legitimate at all,” she said. “It doesn’t sound like they had any of the right legal documents in place. These people should have all received like shareholders agreements.

“Maybe they’re not actually shareholders. Like maybe they just took their money.”

The first six episodes of The Missing $49 Million are available to listen to now wherever you get your podcasts. An episode is coming out every week for this eight-part series.

Available on Spotify here and Apple Podcasts here.

Do you know more? Get in touch | alex.turner-cohen@news.com.au