‘$360 billion’: One investment booming since Covid

A surprising investment has skyrocketed since the pandemic and it could be a good opportunity for everyday Aussies to make some money.

Since the pandemic there’s been huge growth in the luxury goods market around the world, with an increase in the amount spent on luxury fashion, watches, and fancy handbags to over US$360 billion last year.

This has furthered a trend we’ve been seeing for the past couple of decades, and luxury brands are riding the wave and seeing a huge growth in their share prices as a result.

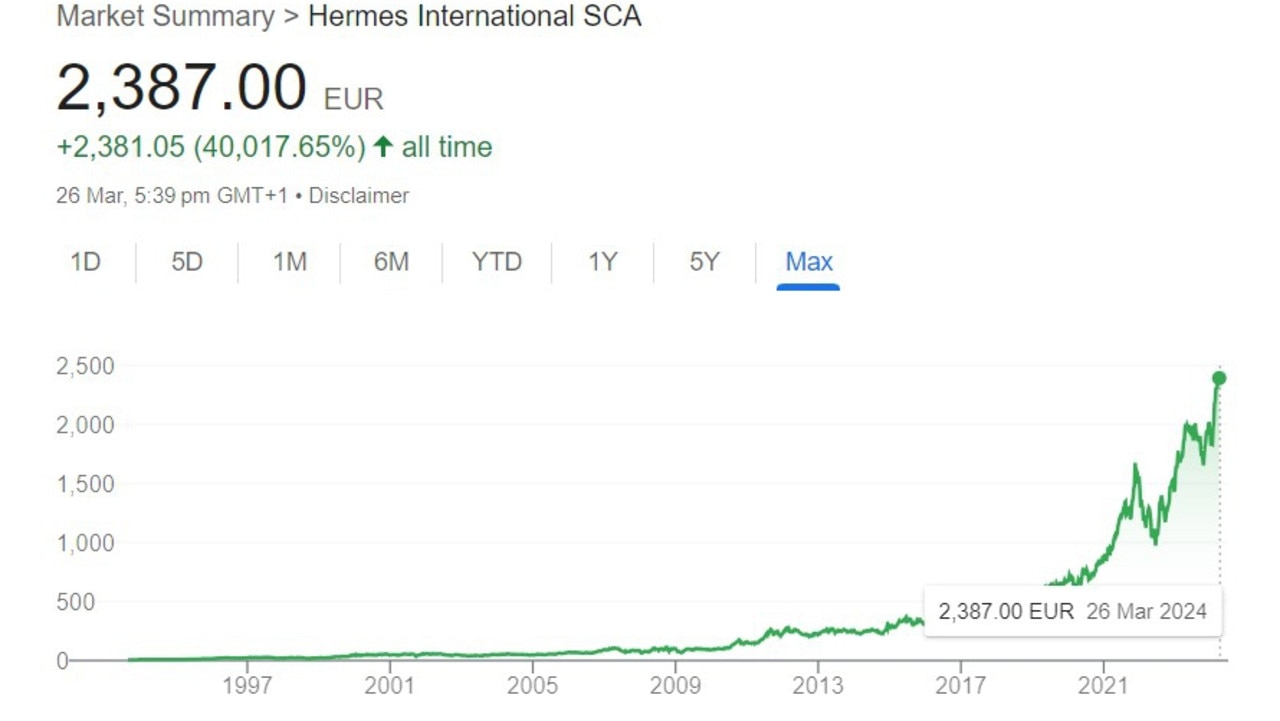

Hermes International alone is now selling over US$11 billion of goods annually, and in the past 20 years has seen an increase in its share price of over 3612 per cent.

This means that if you’d invested $10,000 into Hermes in 2004, it would be worth over $361,200 today. This growth has sparked a lot of interest from investors looking to get a slice of the action.

But are luxury brands a good investment?

How are these brands growing so much?

Particularly since the Covid pandemic there has been a huge increase in the amount of luxury goods being purchased around the world, with an increase in luxury spending from $259 billion globally in 2020 to $354 billion in 2023 – and the market is set to increase further from here.

The luxury goods market is a difficult one for new entrants to break into, and this along with the fact there are a limited number of existing companies in this space has sparked interest from investors and as a result there’s been strong demand for shares in these luxury brands, driving their share prices upwards.

What are the risks?

If you’re investing into these companies, your investment is subject to the ups and downs of the sharemarket. That means that as economic conditions and investment markets change, the value of your investments will fluctuate – sometimes significantly up or down in a short amount of time.

Because you’re investing into a luxury brand that’s selling non-essential items, there is a further level of risk in that these companies can be more sensitive to changes in the economy. If times get really tough in any specific country or around the world, people may choose not to spend thousands of dollars on these luxury items.

Further, if you’re choosing one specific company to invest money with, there is also company specific risk. If the company you choose to invest into makes bad choices, follows the wrong strategy, or gets cancelled, your investments will suffer.

If there is a significant share market downturn, or a period of poor performance in the company you choose to invest with, it’s possible you won’t see a return on your investment for a number of years. Typically when investing into any share investments, conventional wisdom suggests you should be prepared to leave your investments there for seven to ten years to get a return.

The reason this seven to ten year time frame is suggested is because if there is a prolonged investment downturn, it can take this long for things to get back on track.

This means that if you’re investing money that you might want to access in the next couple of years, for example to use as a deposit on purchasing a property, you could find that your investments are down and that it doesn’t make sense to sell and exit your investment.

The result here is that any time you’re investing into shares, you should only invest money you’re prepared to leave for the long term.

How to choose whether these are right for you

Ultimately there are a lot of different ways to be right when it comes to your money and investing, but the right move for you really depends on you. It depends on what’s going on with your money, how much you’re saving, what your plans are in the short and long term, and what’s really important to you.

Everyone’s situation is unique, but there is one way that everyone can plan smart with their investing. If you take the time to map out where your money is at today and how it’s likely to progress into the future, that gives you a baseline. Once you have your baseline set, you can look at the impact of doing different things with your money and investing.

You could look at investing into luxury brands, buying a more diversified fund or ETF, saving money in cash, or buying a property. This will show you how things should progress into the future, and from there you can consider the risks of the different options you’re considering alongside the financial impact.

Often the best strategy for you will be the one that gives you the best combination of both the financial outcomes and having your risk in hand.

The wrap

There’s no denying the amount of interest and growth luxury brands have been seeing in recent years, and if the forecasters are anywhere close to right this is likely to continue well into the future.

This creates an opportunity for investors with the right approach to take advantage. But it’s not for everyone. There are risks that come with this sort of investing approach that are important to manage, and can cause trouble if they aren’t managed well.

Understand your risks, plan smart, and only go into any investment with your eyes wide open – this way you’ll be set to get better outcomes, and have more peace of mind along the way.

Ben Nash is a finance expert commentator, financial adviser and founder of Pivot Wealth. Ben is the creator of the Smart Money Accelerator program that helps people build a second income investing faster.

Ben is also the Author of the brand new book, ‘Replace your salary by Investing’ and the host of the Mo Money podcast, and runs regular free online money education events, you can check out all the details and book your place here

Disclaimer: The information contained in this article is general in nature and does not take into account your personal objectives, financial situation or needs. Therefore, you should consider whether the information is appropriate to your circumstances before acting on it, and where appropriate, seek professional advice from a finance professional.