127 ASX-listed ‘zombie’ companies on brink of collapse, KPMG research warns

Dozens of ASX-listed companies have entered a ‘zombie’ zone as they are on the brink of collapse and in need of drastic change to turn things around.

Dozens of ASX-listed companies are on the brink of collapse and in need of drastic change to turn things around, with potential investors warned to be on the lookout for ‘zombie’ firms.

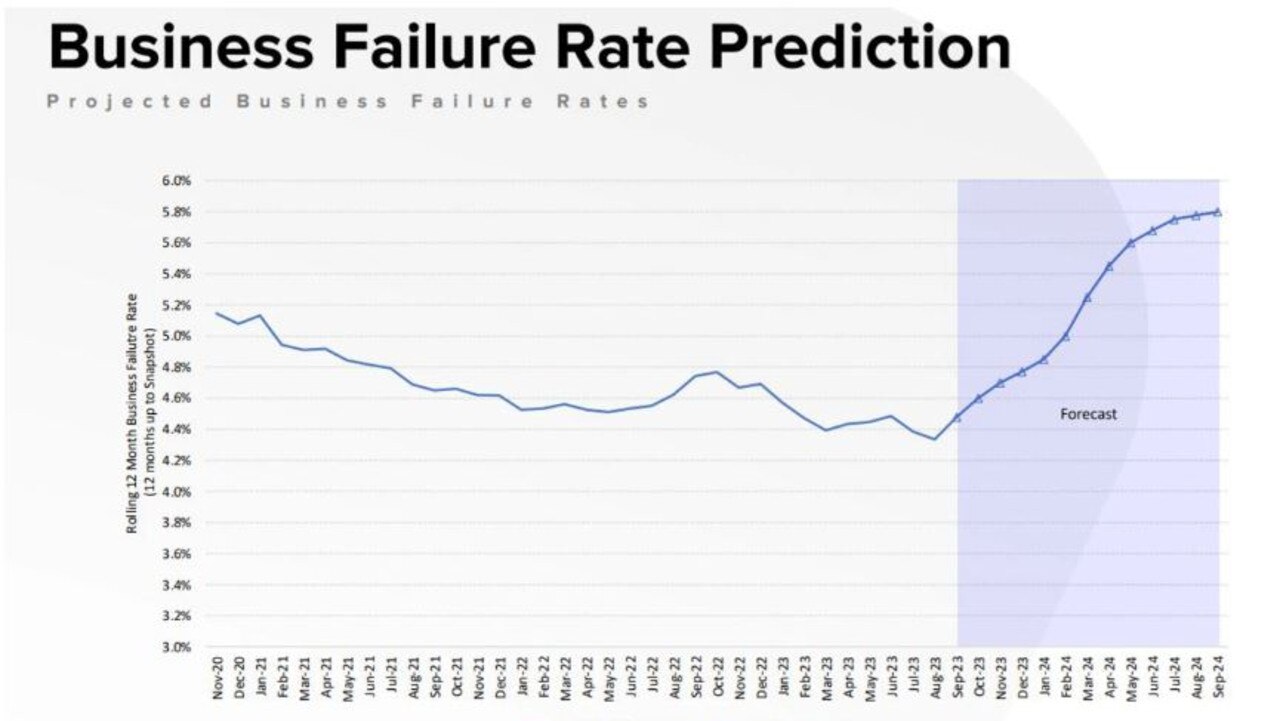

According to data from big four accounting firm KPMG released on Monday, there has been a disconcerting rise in ‘zombie companies’ in the wake of the economic downturn rocking Australia.

A zombie company is defined as a company that generates just enough cash to pay for running costs and interest on their debts, but not much else, making them teeter on the edge of financial ruin.

KPMG ranks all ASX companies out of 100 based on their publicly available results, and zombies typically score zero for nine months in a row due to poor financial health.

In the past six months alone, the number of publicly-listed companies entering the ‘zombie’ zone has increased by 51 per cent.

There are now 127 zombies littered throughout the Australian Securities Exchange, up from just 84 in the previous like period.

KPMG Head of Turnaround and Restructuring Services, Gayle Dickerson, said zombie businesses were on the rise as the cost of living crisis continues to wreak havoc.

“There’s a growing trend of them,” Ms Dickerson told news.com.au. “There are more companies falling into this bucket.”

The average market cap of a zombie company - which is the number of shares multipled by their price - has increased from $20 million to $24 million, meaning bigger companies are facing financial woes.

Zombie companies currently have a total market cap of more than $3 billion, up by 82 per cent in May.

There are some red flags to look out for when investing to ensure you’re not pouring your money into a zombified firm.

“Imminent breaching of loan covenants, having to manage supplier payments to sustain cashflow, significant tax arrears or having a large portion of debt maturing soon while also underperforming are telltale signs a company is perpetually struggling,” Ms Dickerson said.

According to the insolvency expert, the number of distressed companies in Australia’s stock exchange are particularly concentrated around the natural resources and tech sector.

Companies classified in the raw materials and natural resources industry saw an increase of 24 zombie companies while technology and telecommunications had six companies turn into zombies.

For the natural resources sector, she said massive geopolitical events such as the Ukraine-Russia war and the recent conflict in Gaza had caused key materials including petrol to become more expensive and had a major impact on supply chains.

Meanwhile, companies in the technology sector are struggling because outside funding is becoming harder to find, in a phenomenon known as the ‘tech wreck’.

Surprisingly, the construction sector wasn’t named and shamed in KPMG’s new data, even though it is one of the industries driving insolvency rates across the country.

Ms Dickerson said that’s because building companies haven’t been hit as hard on the ASX as most of them are smaller companies that aren’t on the stock market.

It wasn’t all bad news though. Unlike the Global Financial Crisis, she explained there were other options available to floundering companies, such as credit providers outside the big banks.

KPMG’s research comes as 20 ASX-listed companies have gone under in the past year, a massive jump from the previous like period where only eight had to call in external administrators.

The most recent ASX corporate failure was Halo Food Co, which collapsed in August, going into both administration and receivership, despite generating $51 million in revenue.

Some other big names have gone under in the past 12 months, including Australian fintech and buy now pay later firm Open Pay, which shocked Australia and the rest of the world with news of its collapse.

There was also Hills Limited, which originally manufactured the Hills hoist clothesline before selling the brand in 2017, and also Happy Valley Nutrition, an infant formula manufacturer.

In August, news.com.au reported that 70 per cent of all ASX-listed companies were at risk of collapse.

Stock market research firm Stock Doctor found that a whopping 70 per cent of ASX-listed companies were “at serious risk of failure”.