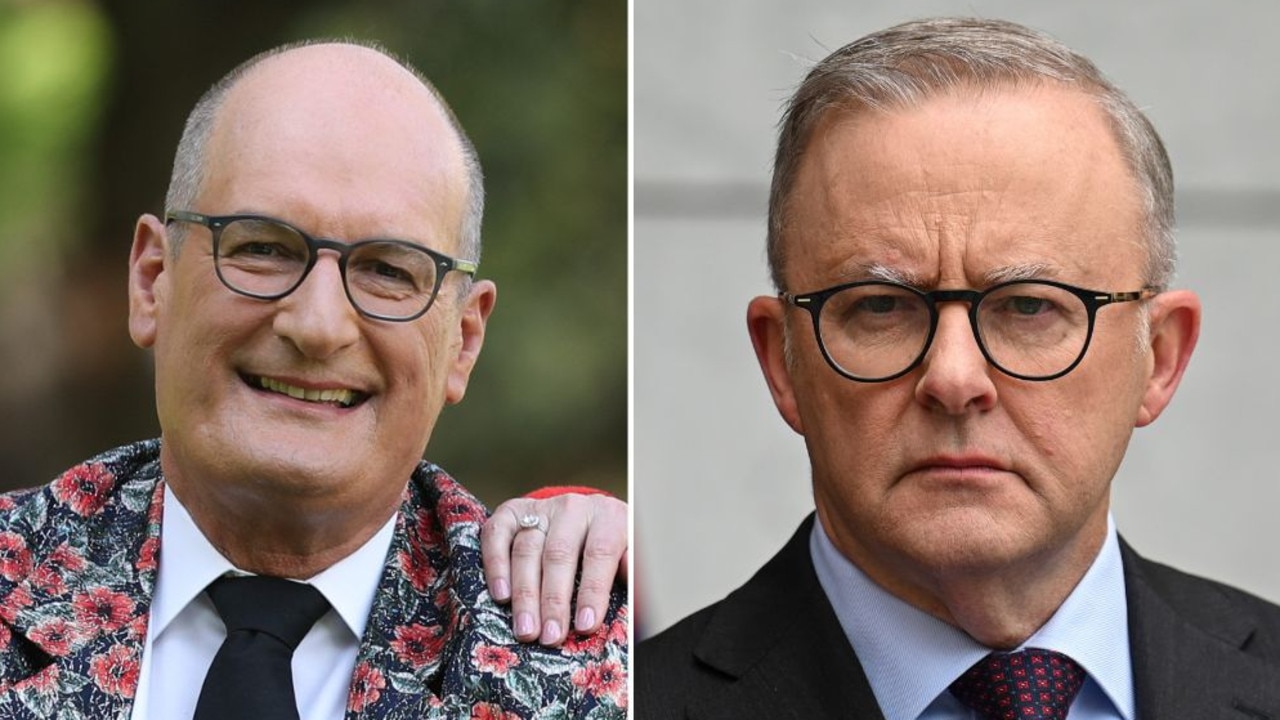

David Koch: Managing money used to be time consuming but now there are apps to help you

MANAGING our money used to involve sitting down together to sift through endless bills, letters and receipts — until apps made it simpler.

MANAGING our money used to involve sitting down together with a bottle of wine to sift through endless bills, letters and receipts with a fine toothed comb.

Now, the wine meant it could actually be a fun activity (especially if you were smart enough to keep a well-ordered filing cabinet), but it certainly was time consuming.

Fast forward to today and technology and smartphones have changed the game completely. Tech savvy types can now control their finances on the go with a few simple clicks or taps.

The trouble is, there are so many apps and products around it’s hard to know which are worth investing your time in. To help out, here are a few of our favourites.

For budgeting

Forget budgeting with pen and paper, let technology do the leg work for you.

PocketBook and MoneyBrilliant are two of our favourite budgeting apps.

Both synchronise with your bank accounts to give you a bird’s eye view of where your money is going. They can also break down your transactions to show exactly where you’re spending, and will even remind you when a regular bill is due for payment or you’re close to hitting your budget.

Pretty clever stuff, but if it sounds a little too complex there is something simpler.

TrackMySpend by ASIC doesn’t come with all the extra bells and whistles, but it does do exactly what it says on the tin… helps you keep track of your spending.

It’s easy to record your expenses, work towards savings goals or keep track of how much a big event like a holiday or wedding is costing.

For power users, it offers many of the same features as the other apps, just without the link to your bank accounts… so, yes, you can tag transactions, set spending limits and set up bill reminders.

It’s also possible to extract your data into a spreadsheet, which is handy for importing it into other systems like accounting software.

For investing

Investing used to be a secret only old men in dark suits knew about, but that stereotype is rapidly shifting thanks to technology.

Acorns is a service which invests your spare change on the stock market.

It connects to your debit card or bank account and rounds up any transactions to the nearest dollar. That change is then transferred to your Acorns account and invested in a portfolio of your choosing.

Depending on your appetite for risk, you can choose a conservative, moderately conservative, moderate, moderately aggressive or aggressive portfolio, each of which will show you exactly where your money is invested.

With easy access to your money at all times, Acorns is a safe and easy way to save money and learn about investing without the need for large amounts of capital.

Stockspot is another service taking the mystery out of investing. It has an online advice engine which uses a smart questionnaire to build out your investment profile and recommend an appropriate investment strategy.

Your money is then invested in a highly diversified portfolio of cheap, index tracking Exchange Traded Funds. The best bit? You can put money in (or take it out) at any time without incurring additional fees, just like a regular bank account.

However, we still highly recommend setting aside an evening every month or so to sit down with your partner and a bottle of wine to go through your finances… Some things never change.