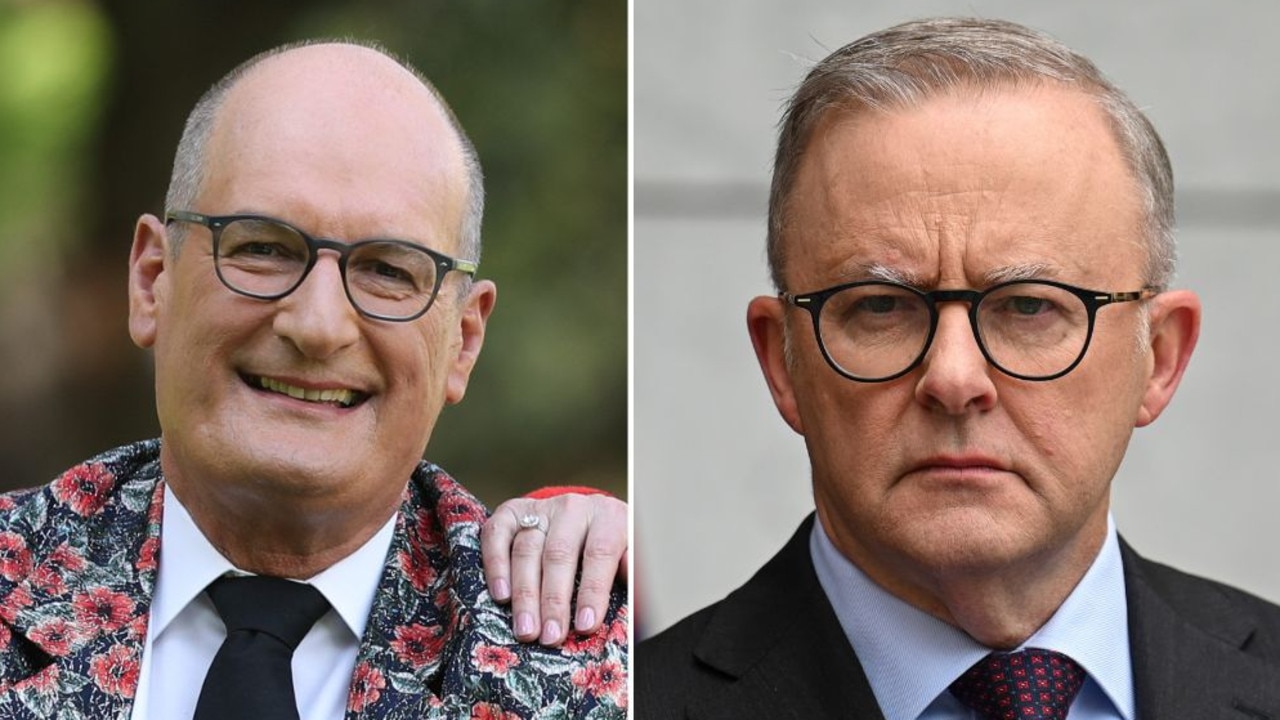

David Koch: everyone has money opinions but you shouldn’t always take their advice

WHETHER you’re at a backyard barbecue or at work, it feels like there’s always someone ready to pounce and give you their take on your money.

WHEN it comes to money … everyone has an opinion.

Whether you’re at a backyard barbecue or the water cooler at work, it feels like there’s always someone ready to pounce and give you their take on your money.

We’re not talking about professionals here … more like friends, family, colleagues or that guy with the hot share tip at the pub.

The trouble is, many commonly accepted theories could do your finances more harm than good. Here are seven common pieces of so-called “financial advice” that you should think twice before following.

1. Avoid shares, they’re too risky

Yes, shares are riskier than money in the bank, but if you manage this risk correctly history shows us the rewards are more than worth it. In fact, over any 10 year period shares have outperformed all other invest asset classes.

The trick is to set clear goals, invest for the long-term and diversify your portfolio. You can also reduce risk by investing in index funds or managed funds rather than direct companies.

Of course, actual professional advice will ensure your investments are suited to your needs. Good advice is always your best investment.

2. Property never goes down

While property is arguably Australia’s favourite investment, you must remember that it is much the same as any other … prices can go up or down.

Or there’s the other classic bit of advice, “property need never go down if you never sell”. Well, that’s just plain stupid. Of course, you have to sell sometime because that’s the only way to actually make a profit.

We’ve had a great run over the past decade or so with dwelling prices across the country seeing stellar growth, but don’t be blinded by past performance.

An economic downturn, proposed government changes to negative gearing or any number of other factors could serve to drive down prices … as has happened in the past.

3. Avoid credit cards

It’s not your credit cards causing problems, it’s your poor spending habits and poor management of that card. You need to stop pointing the finger, and instead take responsibility for how you use your plastic.

Rewards points, convenience, fraud protection and building up a strong credit rating are just some of the benefits that the responsible use of credit cards can yield.

Develop good credit wisdom early on to avoid falling victim to the traps. That starts with making sure you have the right credit card which suits your needs.

4. Start saving for your children’s education as early as you can

Your kid’s education is important, but your financial well being comes first. Always fund your own retirement first before worrying about the kids.

We know that sounds selfish, but if you can’t support yourself when you retire, your children will need to take on the burden and you’ll be miserable. In the long term, this is a cost that will likely dwarf their student loans.

5. You need a financial planner

Seeking financial advice is a great idea, particularly if you have significant assets or your financial situation is more complicated.

On the other hand, if your assets are relatively simple and you’re confident managing them yourself, then you could be better off saving the money, at least in the short-term. There are just so many resources available online if you’re happy to put in the effort.

Consider your situation and act accordingly but, if you’re even a little bit unsure, good professional advice will help you make sure you’re on the right track.

6. Your employer’s 9.5 per cent compulsory super contributions will fund retirement

Depends whether you want to enjoy retirement or not.

Here are the facts. If a married couple (with no debt) needs $60,000 a year to enjoy a comfortable retirement then they’ll need $1.12 million in superannuation … assuming a 5 per cent investment return.

Go to your bank’s superannuation calculator and plug in your personal numbers. You need to get savvy with your super.

Look at salary sacrifice, or by making after-tax deposits from your savings as well. There are different caps and rules for each, so check the ato.gov.au for more details.

And make sure you close any additional accounts and consolidate your super into one place to avoid paying multiple sets of fees.

7. Retire as early as you can

“Tell em they’re dreamin”, is basically the message coming from both sides of politics. An ageing population, contracting workforce and welfare cuts means reduced financial help from Government for retirement.

Rather than clock watching, make a plan.

What do you want to do when you retire? Will you have enough money to do it? Are there still things you want to accomplish in your working life?

Age is just a number, and there are many different ways to reduce your work burden as you age without calling everything off.