Why Generation Z are staying ‘broke’ well into their twenties

A 25-year-old woman has revealed what it is really like to be a young person living in Australia right now – and it is far from glamorous.

Generation Z are staying broke well into their twenties thanks to the cost of living crisis.

Having no money is a rite of passage as a young person; it usually takes place in your university days.

You’re studying, working part-time and broke.

Sure, there’s the odd exception to the rule, but for the bulk Aussies they’ve all been through a period at the beginning of their twenties where they’ve been flat broke.

You drink goon, live off pub specials and have barely any savings.

Historically, people usually graduate from university, snag a full-time job and slowly start to make a decent wage.

You don’t become instantly rich but you get more comfortable and you can look back fondly on that period of your life where 2-minute noodles were considered a whole food group.

Generation Z are having a very different experience.

Inflation in Australia is sitting at six per cent, yet wage growth is only hovering around three per cent.

Financial adviser Victoria Devine recently said on her podcast She’s On The Money: “If you’re not getting a 7 per cent pay rise this year, you’re actually financially going backwards.”

This is a concern for all Aussies, but Gen Zers that are starting out their careers are typically on the lowest salaries are really feeling the burn.

Being on $45,000 was hard in 2020, but almost impossible in 2023.

Evie, 25, is a full-time freelance illustrator, and she’s had to face that financially she is going backwards rather than forwards.

“Five years ago in my full-time job I was getting paid less but able to afford more things, which is crazy,” she told news.com.au.

Evie figured by her mid-twenties she’d be thriving or, at the very least, financially stable, but the reality is that she’s still living like a first-year university student.

“There was a week recently that my dinners for the entire week were ALDI mi goreng. Not just mi goreng, but the ALDI brand.”

Evie described that harrowing experience as “sad and damp” but it has also become her normal.

The young creative finds her financial circumstances frustrating, she imagined she’d spend her twenties drinking cocktails and chasing fun experiences, not just scrapping by.

“Your twenties are meant to be about having fun, but fun is now a luxury rather than a given,” she explained.

Evie’s life is the opposite of luxury.

Instead of chowing down at restaurants she’s become an expert in the best value for money with frozen chips.

“I have a bibliographic knowledge of B-grade potato chips due to the ones on special at Woolies being my dinner some nights.”

Things are so grim that she’s still relying on parents for money … even if they don’t realise it.

“My mum still pays my phone bill. Two years ago, she transferred me $50 and must have accidentally put it as a recurring transaction so I get it every fortnight,” she said.

“I still haven’t told her. But she clearly isn’t missing it, so no harm, no foul.”

The reality of the Gen Z plight is what inspired mattress company Koala’s latest campaign Boomer Blocker.

Offering a young person their rent paid for a whole week, so in their words they can live like a “Boomer.”

Miles Thomas, the director of marketing at Koala explained that they are seeing a shift in how young people spend.

“With rental burdens, interest rates and the cost of living all skyrocketing, Aussies everywhere are concerned with keeping a roof over their heads, and we sympathise with that,” he said.

Thomas explained that for young customers, “affordability has never been more important,” and they are trying to address that by launching more affordable products.”

To stop the golden generation from claiming any more good deals, the Koala ‘Boomer Blocker’ is a generationally biased questionnaire Aussies need to answer as part of their application, which has been purposefully designed to try and filter out the older generation.

“Our ‘Live Like a Boomer’ initiative is a double down on our promise to Australian consumers that we want to be part of the solution, not the problem in these weird times,” Thomas said.

However, he assured older shoppers that Koala still “loves” its Boomer customers.

“The Boomer Blocker is just a cheeky acknowledgment of a generational debate that continues to be waged. Australia’s youth are doing it tough right now, this ones for them,” he said.

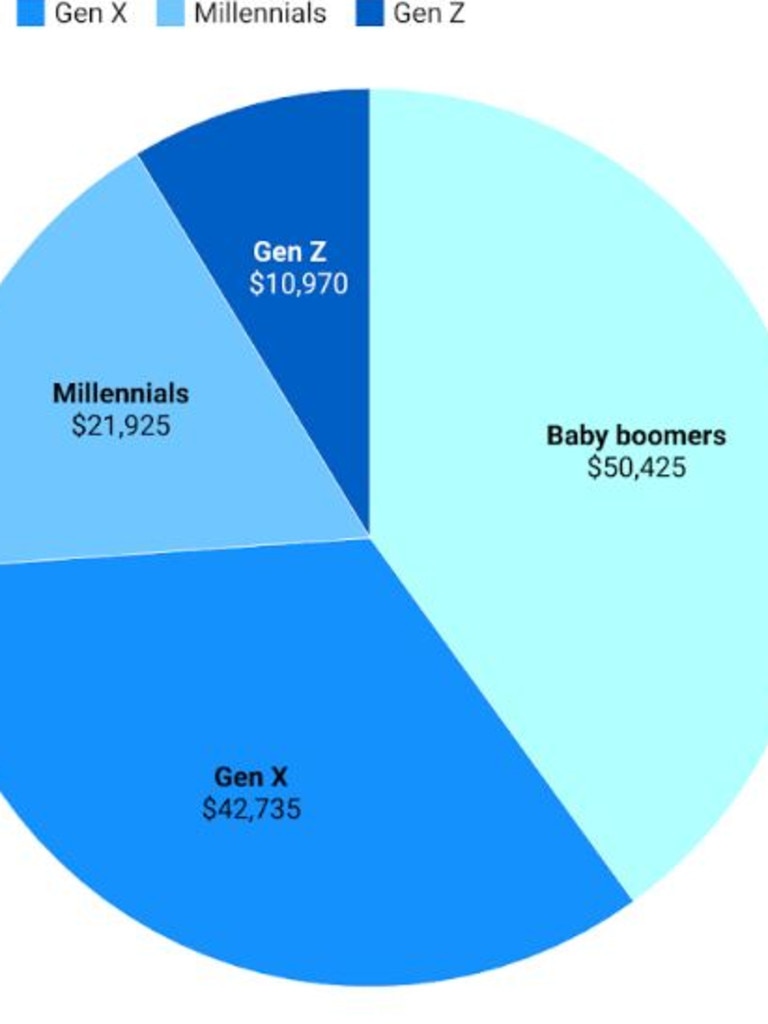

According to Finder’s Cost of Living Report 2023, while rising costs are being felt around the country, young Australians are struggling the most.

Higher vulnerability from having lower savings has led to over half of Gen Zers feeling financially pressured to look for a second job in 2023.

More than 85 per cent have had to reduce their spending due to the rising cost of living and that is compared to 49 per cent of Baby Boomers.

Richard Whitten, money expert at Finder, told news.com.au that data clearly shows that young people are being “hit hardest” by Australia’s current economic situation.

“Our data clearly shows younger people in particular are being hit hardest by the cost of living crunch,” he said.