This Aussie tried to sue a scammer. Then things went horribly wrong

Fed up with police, this scam victim tried to take matters into her own hands. But that’s when the real nightmare began.

An Aussie woman who lost $200,000 to scammers decided to take matters into her own hands — but it backfired, leaving her even more destitute.

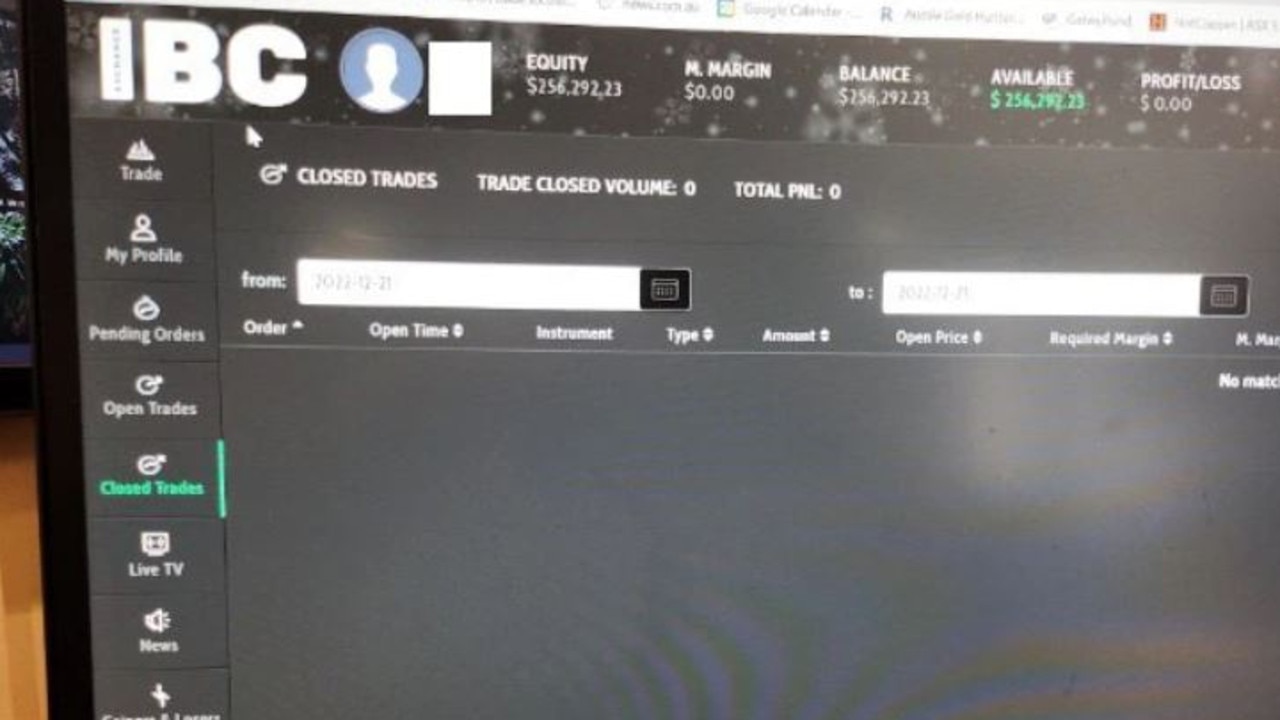

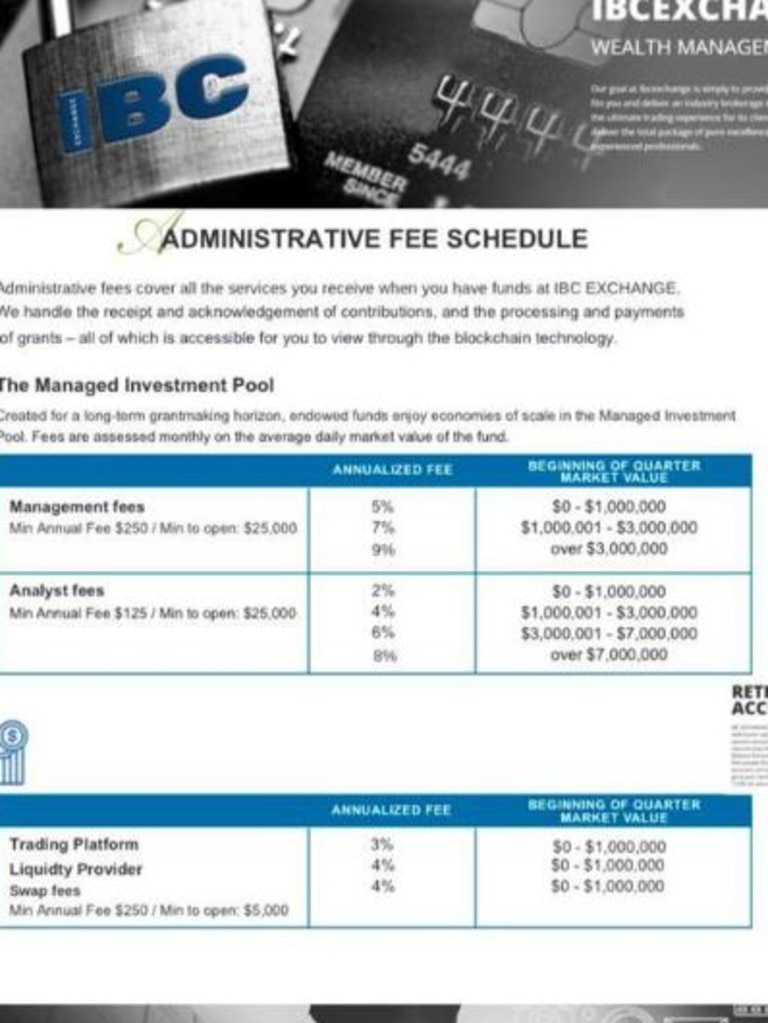

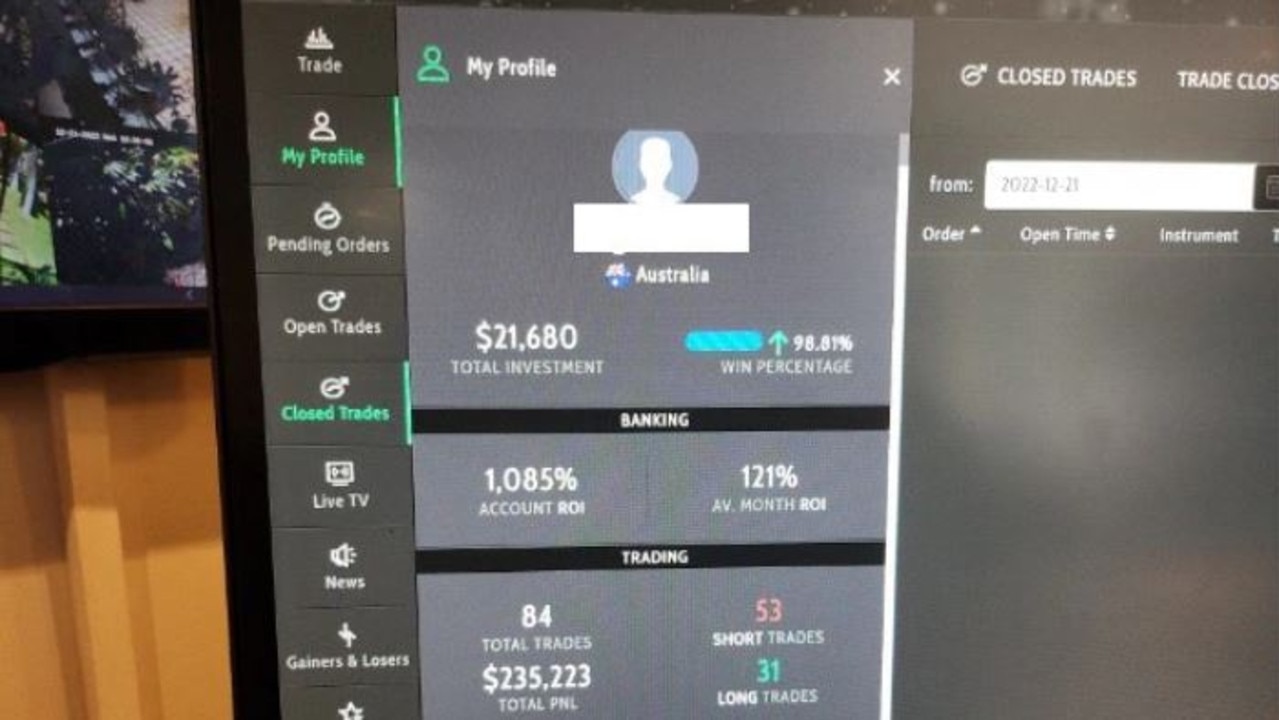

Jasmine, who did not want her real name shared, fell for a fake cryptocurrency trading platform called IBC Exchange which had a highly sophisticated website portal complete with logins and a real-time dashboard of the stock market.

Once she realised it was all a scam, the mum-of-five managed to track down the ‘money mule’ involved — someone the scammers had recruited locally to operate an Australian bank account and then transfer her stolen money overseas.

Jasmine made a report to the police and gave them the name of the mule, a man based in elsewhere in Australia, but authorities did nothing and never laid any charges.

So she tried to sue the money mule in a civil court to recover her money.

Unfortunately, her pro bono lawyer filed the wrong paperwork, allowing the scammer to countersue her and demand she pay their legal fees — putting her on the hook for thousands of dollars more.

And with the legal fight turning complicated and time-consuming, her lawyer abandoned the case.

“I was hysterical,” Jasmine told news.com.au.

Have you been scammed? Get in touch | alex.turner-cohen@news.com.au

Jasmine tried “every avenue I could find” before she resorted to launching her own legal action.

She made reports to the police and also the Australian Cyber Security Centre. But they did not pursue the scammer’s puppet any further and said her money had been lost overseas.

Jasmine then pinned her hopes on the Australian Financial Complaints Authority (AFCA), an external dispute resolution channel, hoping her bank would be ordered to give back the sum total of her losses.

She even paid an expert to help her navigate the complicated process.

AFCA ruled that the bank should pay her several thousand dollars. After she paid the money to the consultant, that left her just $500.

Still determined to get her stolen earnings back, she then told a lawyer about the money mule and he was confident it would be an open and shut case, deciding to take her on as a client for free.

“I met up with a solicitor. He said ‘we know everything about him, we can sue him for your money'."

But in a twist, the money mule dug his heels in and hired his own lawyers to fight the legal challenge.

They argued he wasn’t a scammer as he hadn’t benefited financially from the scam — instead immediately passing the money on to the fraudsters.

The mule claimed he had signed a contract with an international company he believed he was working for when he transferred the funds. He had only made a small amount for himself through what he thought was a commission.

Jasmine was then hit with a legal letter demanding she reimburse the mule thousands of dollars for his legal costs.

“I’d lost all this money,” Jasmine said. “Then I had paid (the AFCA expert), and then the lawyer, who was partly pro bono, but I paid all the costs for the legal filings. Then to be sued? I feel like an absolute fool.”

But there was more to come.

“My lawyer phoned me and said ‘Look I’m sorry, I’ve spent too much time, I can’t do it anymore’.”

Suddenly she was staring down a lawsuit totally alone.

Scrambling, Jasmine desperately searched for another pro bono lawyer and found Amelia*, a Brisbane lawyer.

Amelia, who news.com.au is not naming as it would narrow down Jasmine’s identity, immediately said they had to withdraw their court case as its legal premise was flawed.

“She said if you lose, you could land up paying the mule’s fees,” Jasmine recalled.

And going through previous cases, there was no legal precedent so the lawyer feared the chances of her recovering $200,000 was unlikely.

Instead, they came to a settlement where Jasmine ended off worse off than she started. She has given up trying to get her money back.

“With my cancer coming back, I can’t afford the stress,” she said.

Jasmine’s pro bono lawyer told news.com.au that the outcome speaks to a broader issue when it comes to scam victims getting justice.

The mule told police he had been defrauded too, so they decided to drop the case.

But that’s not good enough, according to Amelia.

“The law is very much behind in this type of scam,” she said. “This is like a huge gap between what is happening in the world and what the law should be.”

She said there should be a “higher duty” on strangers and responsible ways to operate a bank account.

The man transferred multiple lots of $10,000 over several days with no consequences.

How the scam worked

Dozens of other Australians that news.com.au knows of have also lost their life savings to the fraudsters behind IBC Exchange.

News.com.au previously reported on another Australian who lost $70,000 to the same scam.

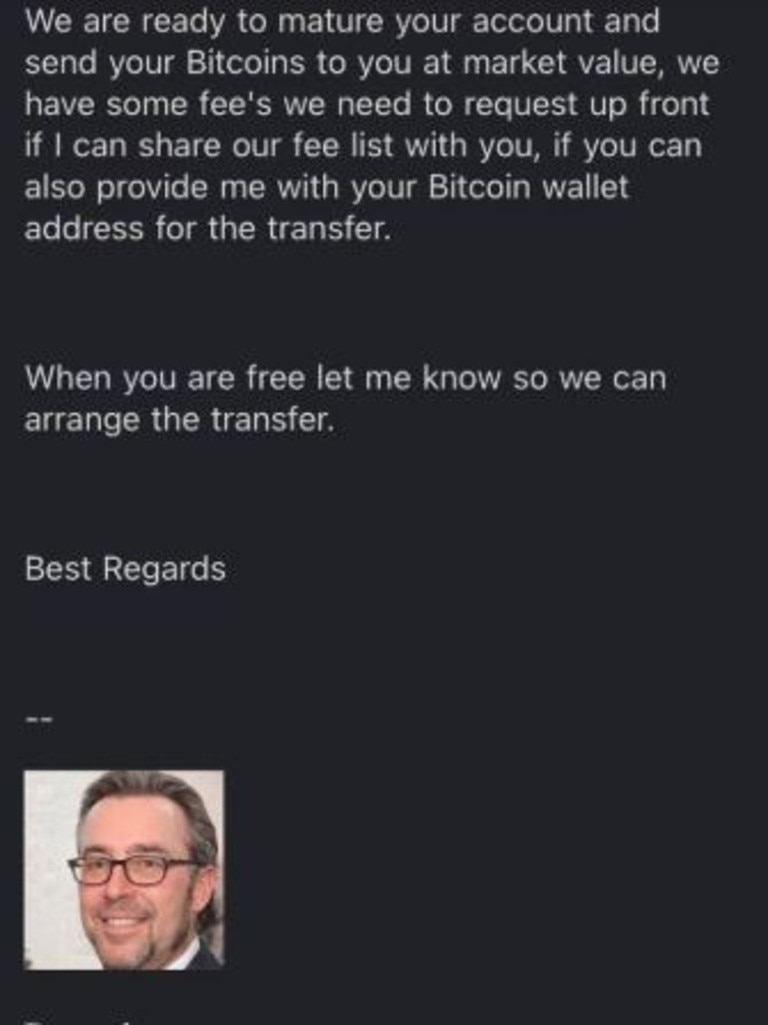

Jasmine and this other victim were both dealing with the same “smooth talking” English man called Richard Gibson, who claimed to be an employee of IBC Exchange.

She also dealt with another employee who called himself Michael Anthony. He had an eastern European accent and he sounded old, Jasmine said.

“I said ‘your voice doesn’t tie up with your photo’. He laughed and said ‘that’s because I’m from Croatia,’” she said.

“He looked very young in the photo and he sounded like a real foreigner.”

When Jasmine tried to withdraw money from her investment but they told her to pay hundreds of thousands of dollars in tax on it.

“I phoned my accountant and my accountant said that’s not right,” she added.

It was then that she realised the entire thing had been a scam.

Usually, Israeli or Chinese crime figures are behind these sophisticated cryptocurrency schemes, according to Australian private investigation firm IFW Global in a submission to parliament made last year.

They generally run call centres from eastern Europe or South East Asia to evade scrutiny and capture.

alex.turner-cohen@news.com.au