The everyday Aussie ‘avengers’ leading a double life scamming the scammers

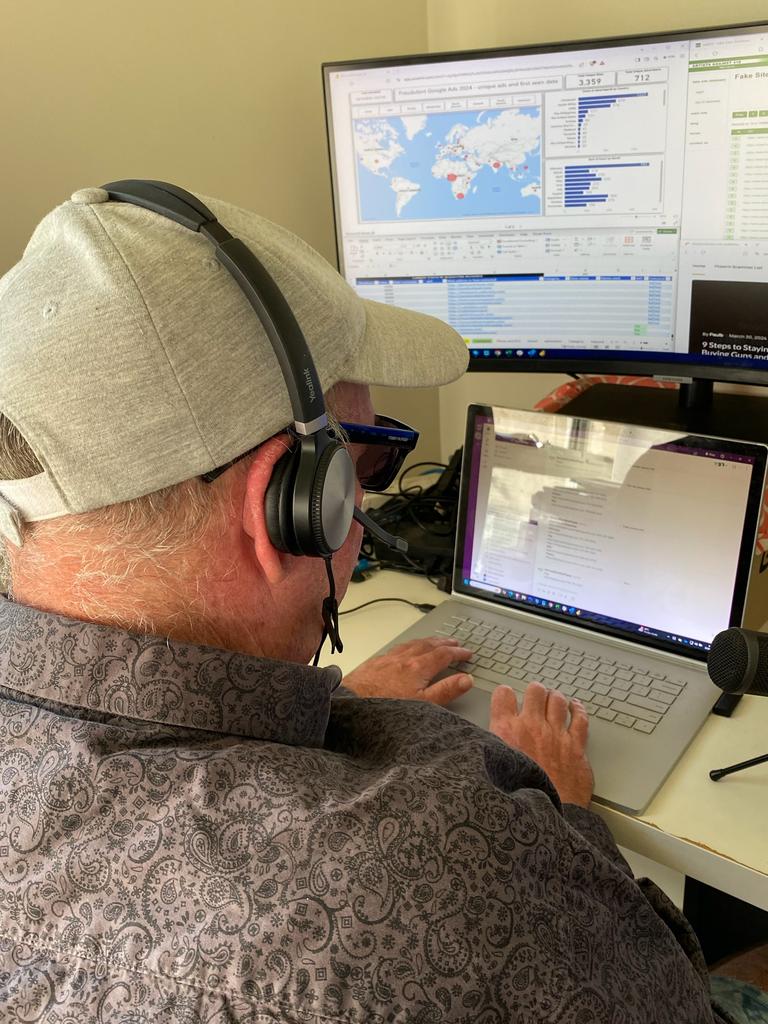

He’s a seemingly ordinary Aussie dad but as soon as he gets home from his 9-5, he begins his second job – catching scammers.

This ordinary Aussie dad might not wear a mask or a cape but he is a real life hero fighting crime – from the comfort of his own home.

The Brisbane father of two is an IT worker by day but an ‘avenger’ by night, taking revenge on scammers.

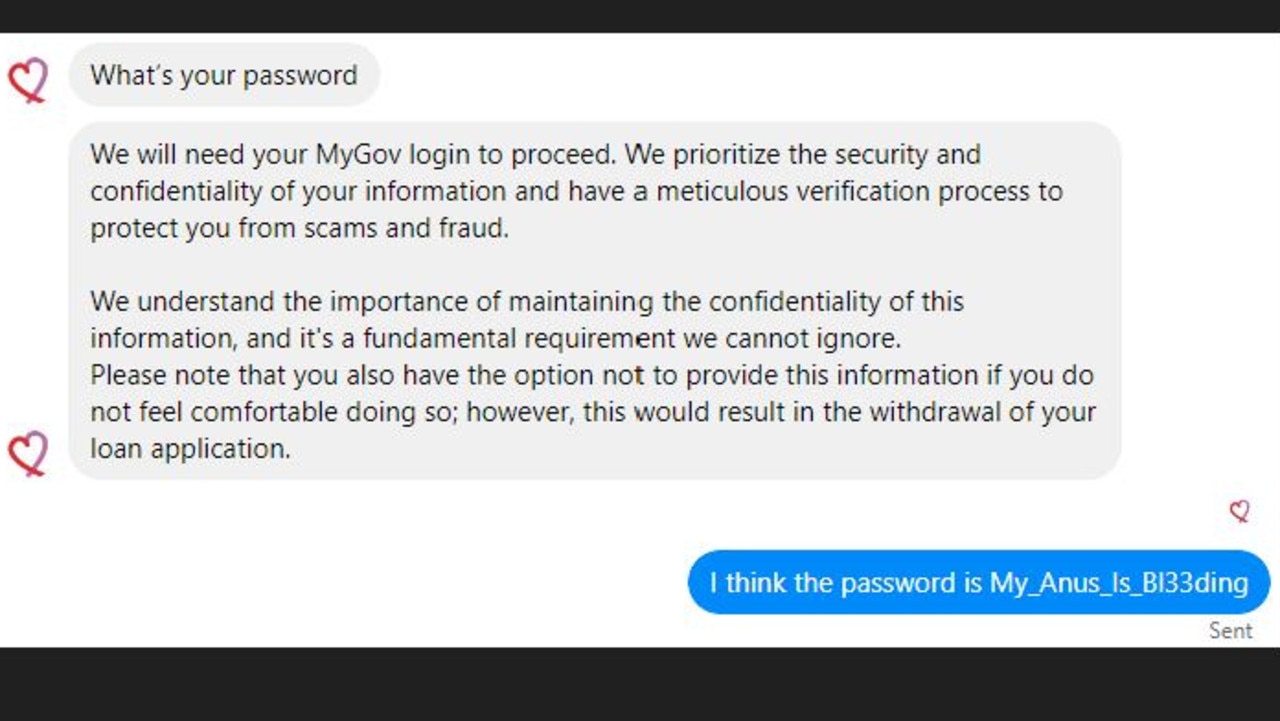

“I’ve been in IT most of my life,” Ben, who asked to be anonymous for obvious reasons, tells news.com.au. “But the fraud side of stuff, the cyber security stuff, has always absolutely fascinated me. I try to find out exactly how these scams work.”

For several years Ben, in his 50s, has been scamming the scammers.

He’s reported 649 mule accounts to the banks in the past year alone as well as warning other victims. He spends about 30 hours a week hunched over his home computer hunting down cyber criminals, with his entire weekends devoted to the hobby.

The Aussie dad and others like him are keeping people safe when their own banks can’t.

Ben is lending his support to news.com.au’s campaign People Before Profit, calling on the federal government to make it mandatory for banks to compensate scam victims – just like in the UK. In October last year, the UK introduced world leading legislation making compensation mandatory for scam victims within five business days except in cases of gross negligence.

IT’S TIME BANKS PUT PEOPLE BEFORE PROFITS. SIGN THE PETITION HERE

He spends his own money on the unusual pastime, renting out a VOIP monthly which allows him to make calls from his computer, as well as buying a few US numbers and having burner SIMs for WhatsApp messaging.

Ben uses aliases so that his real identity is never compromised.

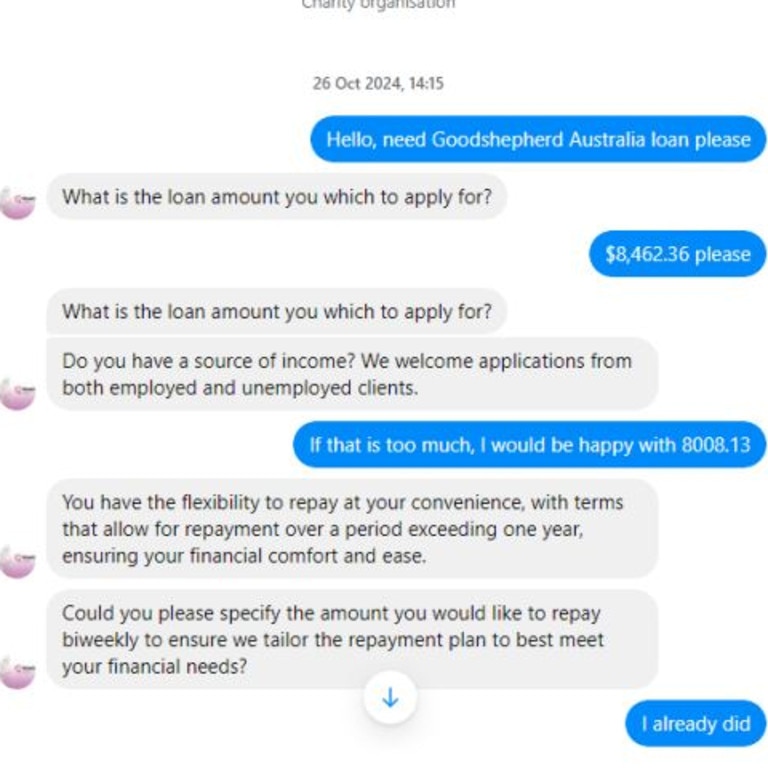

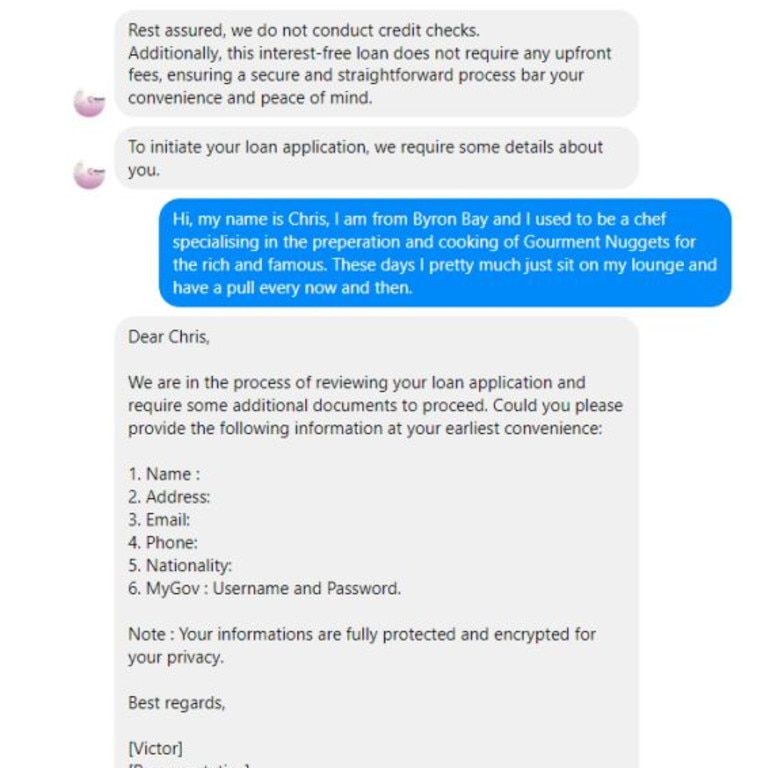

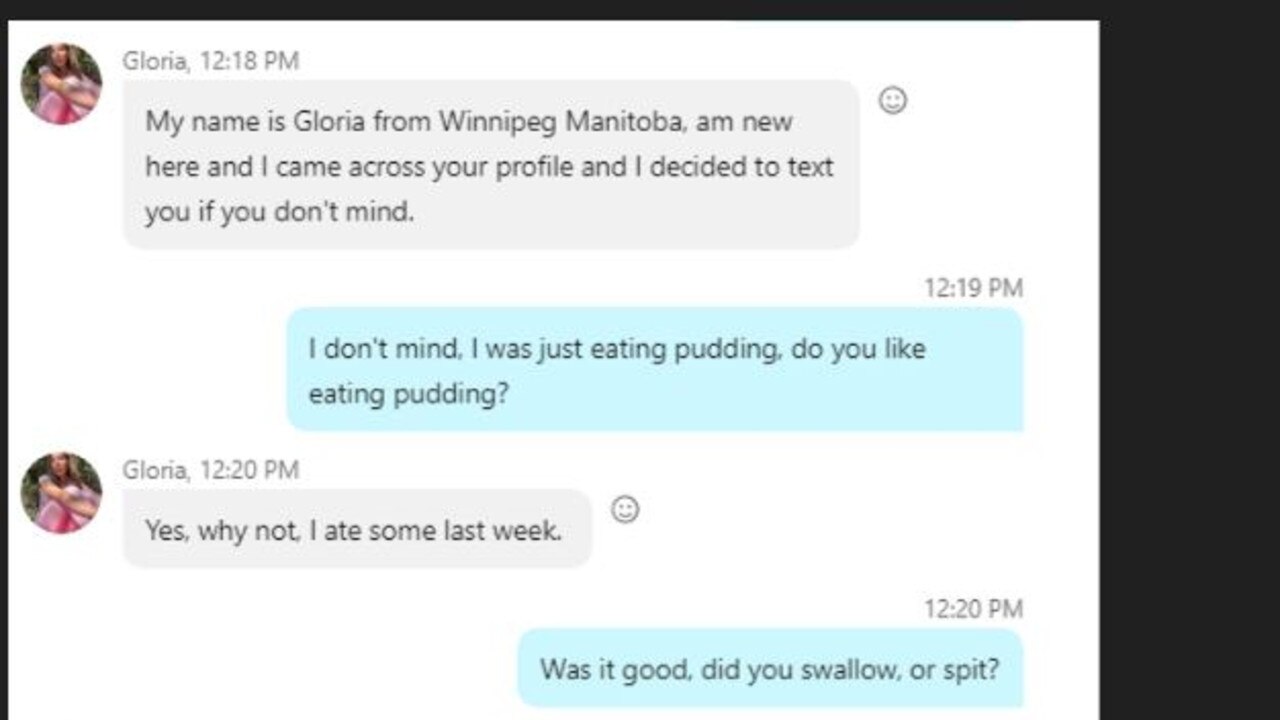

“I’ve found the best method for this stuff is to act as dumb as possible, then (the scammers) let their guard down. Then you can socially engineer it,” Ben said.

He’s catfished the catfishers, made the scammers really angry and also managed to warn other innocent victims.

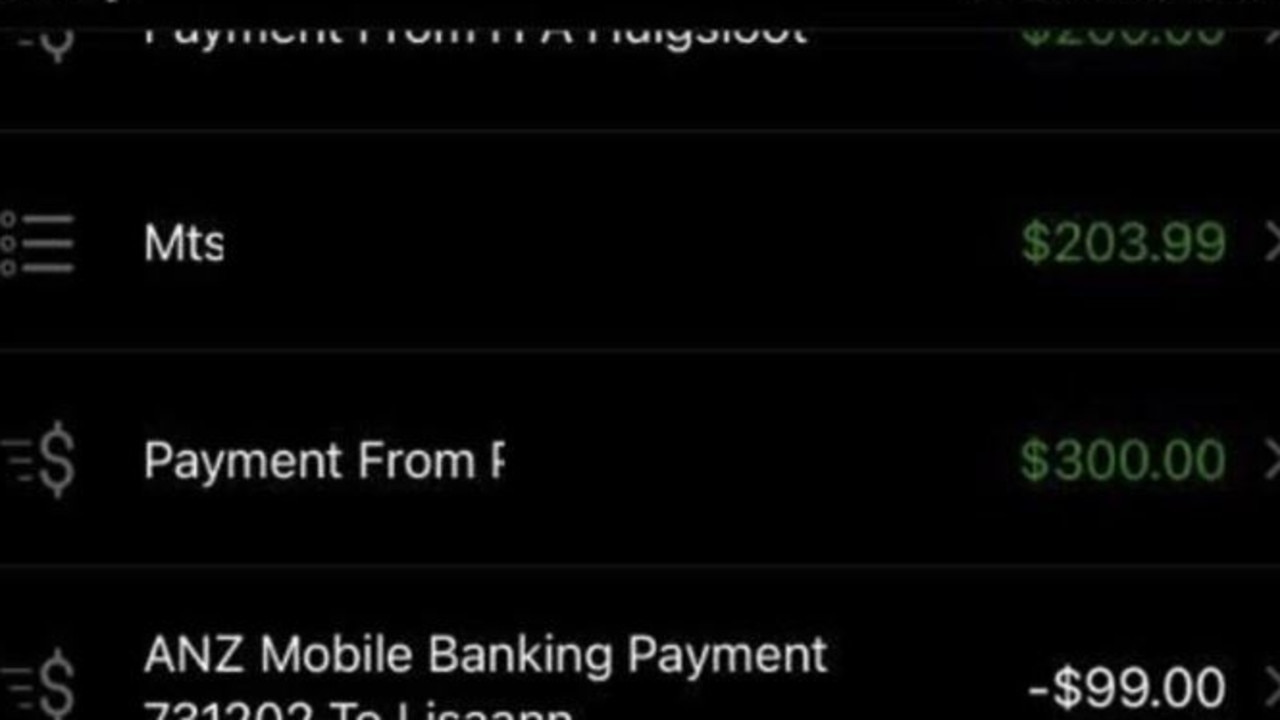

He can sometimes trace other victims by tricking scammers into sending a screenshot of their bank account, allowing him to see who has recently sent money to them.

Ben’s work has become less about baiting the scammers and more focused on drawing out details about them so he can shut down their operation as soon as possible.

In one case, he kept a “desperate” scammer on the hook for two years and has convinced them to give away 80 mule bank accounts.

Do you have a similar story or have you been scammed? Get in touch | alex.turner-cohen@news.com.au

In the past year, Ben has noticed a concerning trend among scammers – they’re getting more sophisticated.

“The amount of money people are losing has changed. Now you’re seeing people losing their life savings. The prize money these guys are looking for has gone up,” Ben said.

In the last 12 months, scammers stole about $US1.03 trillion ($A1.65 trillion) globally according to the Global Anti-Scam Alliance. In the most recent reporting period, Australia lost $2.74 billion, the ACCC reported.

Where before scammers with bad English accents would ring you up, Ben said just a few years later they’re hiring English expats in south east Asia to do the same.

And Australians are so desperate they are reaching out to him for help.

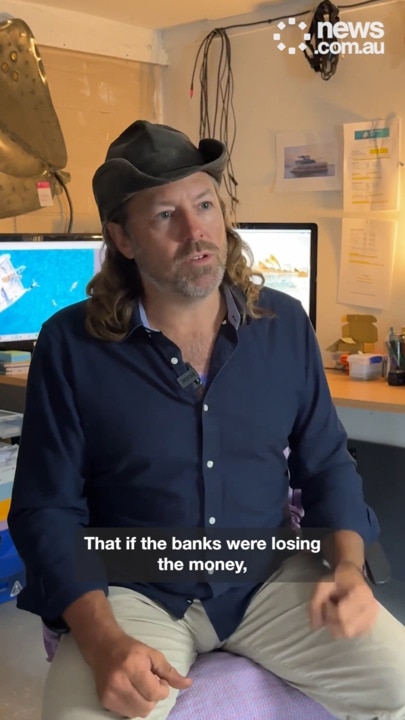

Mr de Hek’s business networking company dried up overnight because of the Covid-19 pandemic, right around the time when scams hit the mainstream.

The 55-year-old Christchurch resident started making videos warning people about what scams he’d found – and hasn’t looked back since.

The Kiwi, who said he deals with a lot of Australian scam victims, told news.com.au he is currently investigating 114 different Ponzi schemes.

Mr de Hek was the first to raise the alarm about cryptocurrency scheme Hyperverse, an investment opportunity being run by Australian Sam Lee.

The crypto fund raised almost $3 billion globally.

US authorities have since charged Mr Lee with conspiracy to commit fraud.

Mr de Hek only makes about $5000 a year from his scam baiting videos, despite spending about 70 hours a week on them.

To get him through financially, he picks up odd jobs including window cleaning, to fund himself on his anti-scam crusade.

Part of his work involves dropping into Zoom meetings being run by accused scammers to “cause havoc”.

“People will leave when they see my name,” he said. “One meeting they said turn on your camera so they can make sure we know who you are.”

Mr de Hek is one of the few scam busters who doesn’t keep his identity hidden – and he’s paid the price.

He regularly receives death threats, with him saying casually “it’s just what you do in this game”.

An American cryptocurrency entrepreneur tried to sue Mr de Hek for defamation over one of his videos.

In mid-2023, Texas-based Stephen Andrew McCullah withdrew his $3.47 million court action after Mr de Hek fought back.

Ben, the crime fighting dad, has worked with YouTubers in the past to warn about specific scams he’s come across.

He’s recently worked with SpookyChicken, the YouTube handle of a scam baiter in Queensland’s Fraser Coast.

Although both men have worked together, they only know each other by their aliases.

Spooky Chicken says his interest in calling out cyber criminals “was a Covid thing”.

“I was sitting at home bored,” he told news.com.au.

He’s currently unemployed so says “pretty much all he does” is research into scammers.

More Coverage

At first, he was working full-time when he got into scam baiting. But after he lost his job, the hobby has encroached onto his life more and more.

Like Ben, he had worked in IT and wanted to put his skills to better use.

alex.turner-cohen@news.com.au