Sydney man’s identity theft nightmare continues, five years after initial crime

When several purchases totalling $100,000 appeared in his name, Sydney man Faisal* never imagined it would turn his world upside down for the next five years.

When Sydney man Faisal* bought himself a new car, he never imagined it would turn his world upside down for the next five years.

Since 2018, Faisal* has been dealing with the fallout of identity theft and as recently as this month, debt collectors were chasing him over purchases the criminals made in his name.

Faisal, in his early 50s, had to provide documentation to buy the car at a Sydney dealership and it’s here he believes crucial information such as his address and his driver’s licence were leaked.

A few months later, in late 2018, NSW Police officers contacted him about an ongoing investigation into a syndicate of local scammers as they learned he was one of the victims but by then it was too late.

“They had done the damage,” Faisal told news.com.au.

The criminals had taken out around $60,000 in personal loans and racked up $38,000 of credit debt in his name, as well as buying iPhones from Telstra and Optus and opening up accounts.

Overall, more than $100,000 was borrowed using his identity, and because of his high credit score, most of these organisations granted the loans and credits immediately without finding anything amiss.

Faisal even claims that the thieves carried out online shopping and would collect it from the mailbox of his inner west home.

“I used to notice a black VW tinted window car outside my house regularly,” he recalled. “I didn’t think much of it initially but it was weird. Now putting two and two together they were waiting for products.”

“This destroyed my credit rating totally,” Faisal lamented.

“My credit was absolutely pristine, it was very very good. It was (a score of) 800.”

However, following the fraudulent purchases in 2018, his credit score “plummeted” as it “got worse and worse and worse”.

His score now sits around the 180 mark, and has still not recovered years later.

Faisal had to put a ban on all his credit files and he contacted numerous banks and credit agencies, as well as contacting Telstra and Optus over fraudulent iPhone purchases made. The police also contacted one bank on his behalf.

In a statement to news.com.au, a NSW Police spokesperson said someone had been arrested, charged and processed through the judicial system over this identity theft.

On December 3 2018, police arrested a 40-year-old man at Leichhardt for fraud offences.

At Newtown Police Station, this man was charged with two counts of dishonestly obtain property by deception, use false document to obtain financial advantage, deal with identity info to commit etc indictable offence, possess false document to obtain property, goods suspected stolen in/on premises, and variation application notice after breach.

“The matter has been processed through the judicial court system,” the spokesperson added.

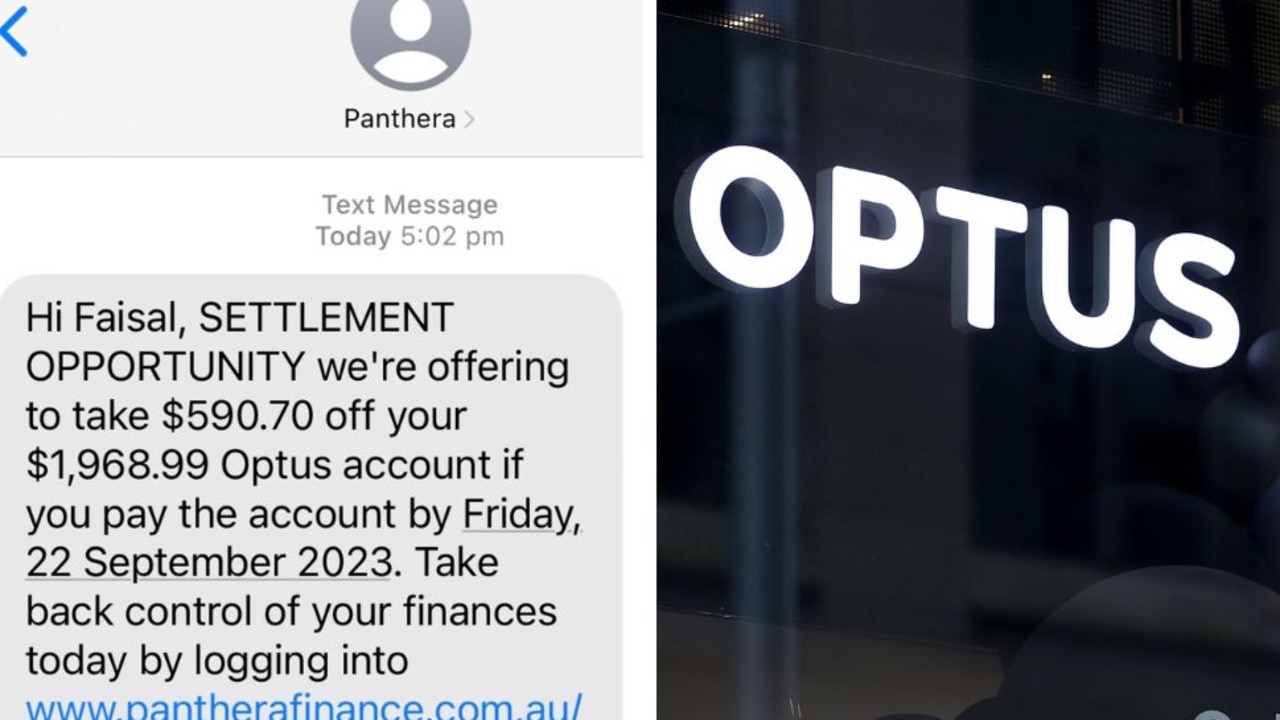

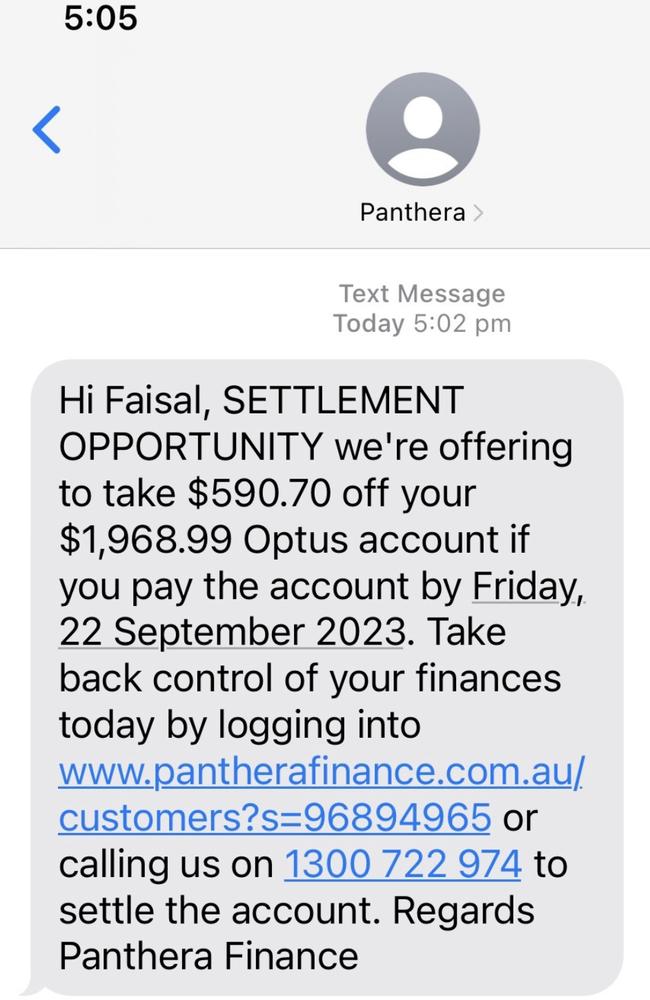

Faisal thought the ordeal was behind him when on September 18, his wife received an alarming text message.

It was from a debt collector demanding he pay back $1968 in just four days.

Have a similar story? Get in touch | alex.turner-cohen@news.com.au

At first, Faisal’s wife thought the text message was spam and was about to delete it when she wondered how the sender knew who her husband was.

When she brought it up with Faisal, he said he felt instant “shock” and that “it brought it all back”.

It turned out Optus had sold his debt for an iPhone purchase on to Australian debt collection agency Panthera Finance.

The text said if he paid up within four days, by September 22, they would provide a $590 discount.

Faisal also has no idea how Panthera Finance obtained his wife’s mobile phone number.

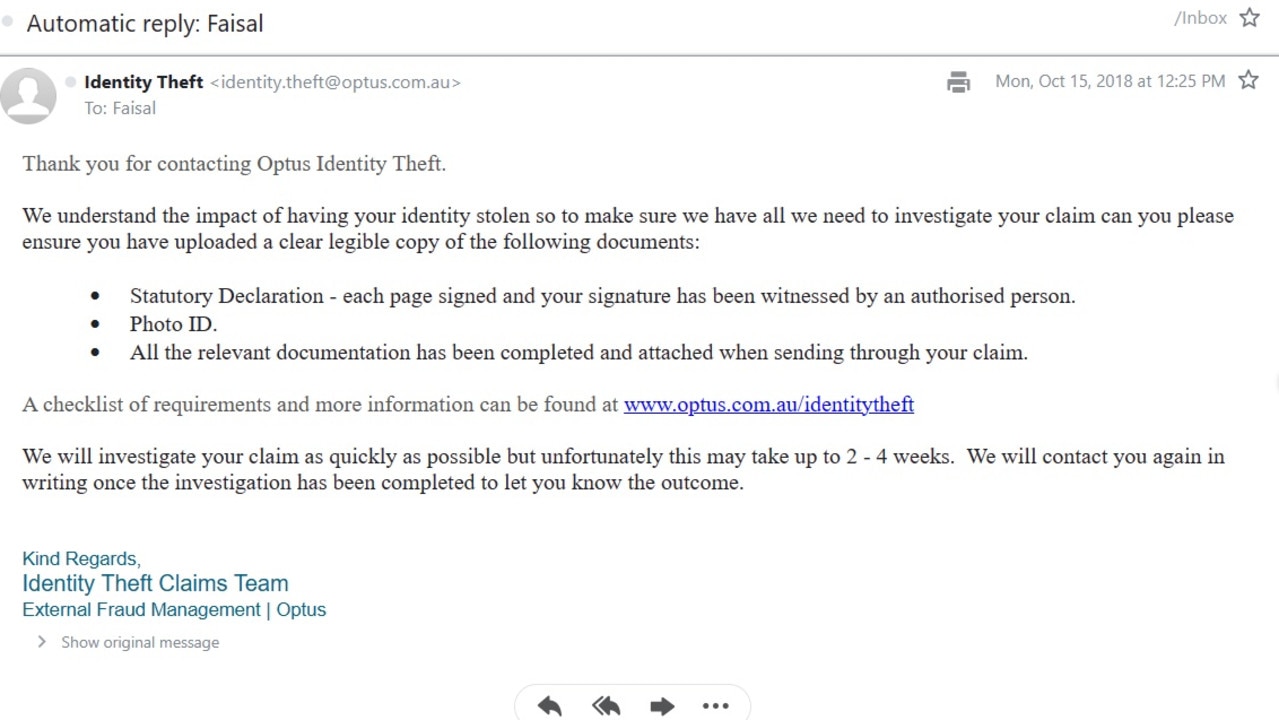

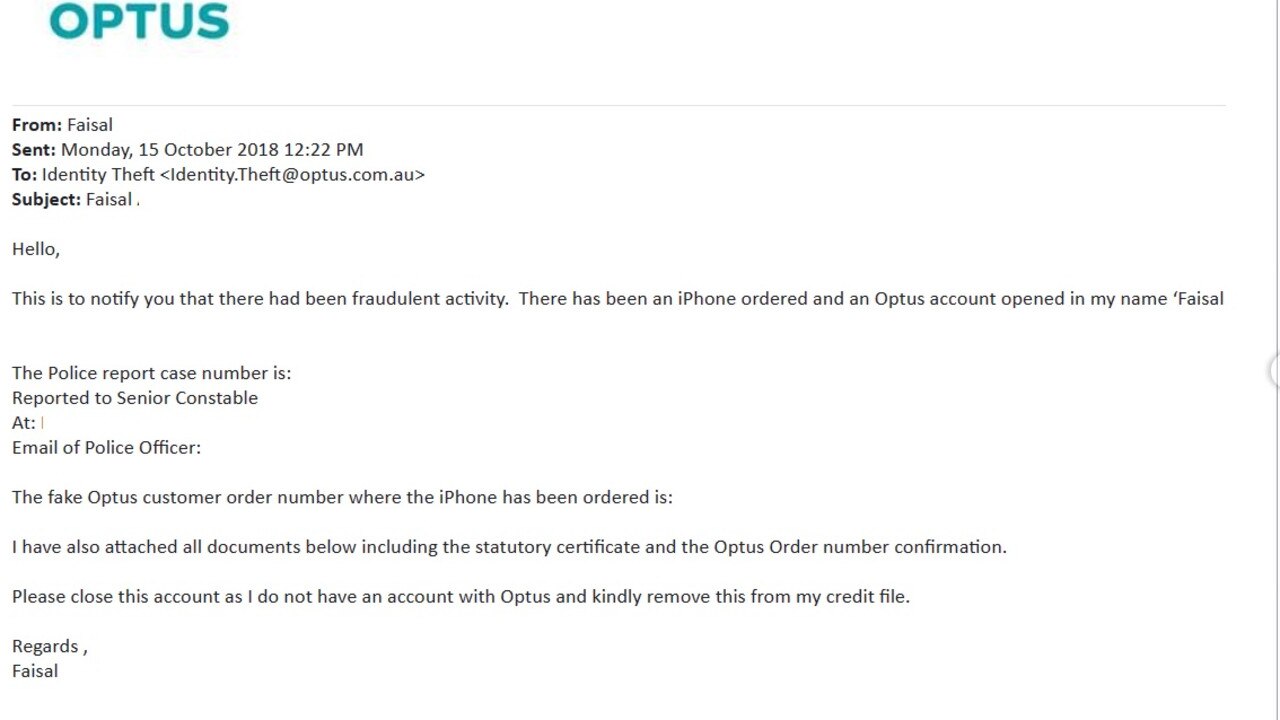

The most frustrating thing of all, he said, is the fact that Optus did not close his case even though he provided them with all the information they requested about his identity theft incident.

Way back in 2018, Optus asked him to supply a police report number and a statutory declaration about the incident, which he did.

“Despite the fact I sent them all the details, despite all the documentation I filled out, they didn’t contact me once to say your debt is still outstanding, so many years have gone by,” he said.

After news.com.au contacted Optus and Panthera Finance explaining the situation, Faisal’s debt was waived.

A spokesperson for Panthera Finance said “Optus has requested to have this account returned to them and has advised that they will be in contact directly with the party to discuss the situation further”.

An Optus spokesperson told news.com.au “the customer does not have any outstanding debt with Optus.”

When news.com.au asked how they were able to sell his debt if no such debt existed, they reiterated their earlier statement.

“We have confirmed with the customer that they have no debt,” they said.

*Name withheld over privacy concerns

alex.turner-cohen@news.com.au