Survey reveals impact of poor wage growth and increased cost of living

Many of us celebrate when that pay cheque hits our account – but for others, it’s a source of worry for one all-too-common reason.

Thousands of Aussies have revealed how they really feel on payday – and it paints a gloomy picture of the country’s economy and soaring cost of living pressures.

For years household expenses have skyrocketed, while at the same time wages have failed to keep up.

Getting a pay rise is more difficult today than it has been over the last few decades, and now Aussies across the country say they’re now well and truly feeling the pinch.

Every two years, news.com.au runs its Cost of Living Survey to find out about our readers’ biggest household money worries.

The results of the most recent survey are in, and news.com.au has kicked off the Money Project in response, revealing the biggest money challenges facing Australian households and giving practical advice on how to get your finances in shape for 2020.

As part of the survey, respondents were also asked if they felt they were on “Struggle Street”, “Barely Coping”, “Doing OK” or on “Easy Street” based on how they believed they were faring financially.

Worryingly, compared to the previous survey, less people categorise themselves as being on “Easy Street”, and have instead shifted to “I’m doing OK” and “I’m barely coping”.

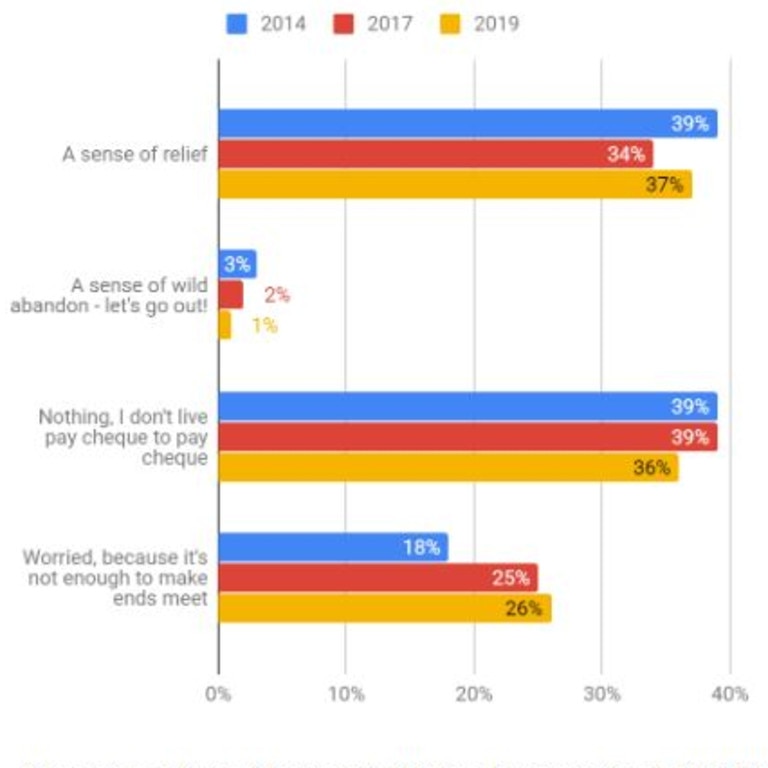

In fact, when we asked people how they felt on payday, 37 per cent described a “sense of relief”, while alarmingly, 26 per cent reported feeling “worried” as they believed their pay was “not enough to make ends meet”.

Meanwhile, just 1 per cent greet payday with celebration and a “sense of wild abandon”, while 36 per cent said it didn’t impact them as they were not living “pay cheque to pay cheque”.

And the common gripe among readers was wage growth failing to keep up with standard household expenditure.

“I was far better off 10 years ago than I am now because the cost of living is out of control and wages have not moved to help cover the basic increases,” one response said.

“My income is just barely covering household expenses, I live from pay-to-pay,” said another.

“The cost of living keeps increasing while my wage does not,” another respondent said. “I can’t even afford to take out a mortgage for a house as I won’t have enough to make the payments and house prices are always on the rise.”

“Wages have remained stagnant and the cost of goods like petrol and houses don’t match our income,” said another. “Therefore we have to be very vigilant when it comes to spending and that affects the economy in the long run.”

With the Reserve Bank tipping wage growth to shrink just 2.2 per through to mid-2022 as the price of child care, health care and general bills surge, it’s little wonder a large portion of the country is struggling to make ends meet.

Prominent economist Stephen Koukoulas says low wage growth is the leading factor contributing to the anxiety of household budgets.

“Five or 10 years ago, when wage growth was 3.5, maybe 4 per cent, the cost of living pressures were more easily absorbed because you were getting a decent pay rise,” the former adviser to Prime Minister Julia Gillard told news.com.au.

“But the gap between inflation, cost of living and incomes has been closing dramatically.”

And RBA governor Philip Lowe has been vocal in his wish for wage growth to at least have a three in front of it.

The low figure combined with last year’s property downturn had put a halt on Aussies splashing their cash and the national economy is struggling as a result.

“For some time now, households had been gradually adjusting their spending to the slower trend rate of income growth,” he told an economics committee in Canberra earlier this month.

“Faced with the reality of slow growth in wages and falling housing prices, many households scaled back their spending and adjusted their finances.”

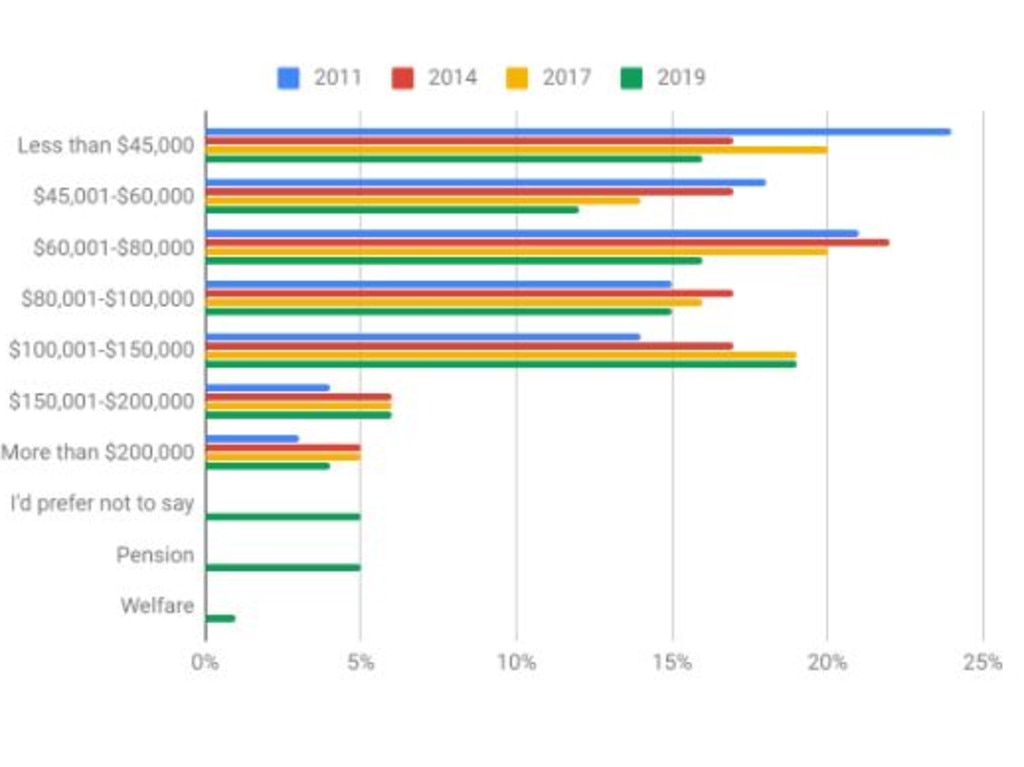

The survey also found there has been an increase in the number of mid to high income earning respondents compared to the last time the survey was run, and there are now more people on average who earn over $100,000 than there were two years ago.

The amount of female respondents with salaries over $100,000 has also increased from 16 per cent in 2017 to 20 per cent in 2019. However, the amount of male respondents with salaries over $100,000 has also increased from 37 per cent in 2017 to 41 per cent in 2019.

But the disparity in the salary gap continues to increase, with the proportion of males earning more than $100,000 increasing, and the percentage of females earning under $80,000 staying the same.

WHAT DO YOU DO?

With wage growth tipped by the RBA to stay still through to 2022, recruitment expert Michael Berger said Australians may need to be proactive in their pursuit of a pay rise.

“Individuals often need to look after themselves and take the lead,” he told news.com.au.

Mr Berger, founder and director of Brisbane-based engineering and construction recruitment firm Talent Blueprint, said Australians should remain level-headed when approaching an employer for a pay rise.

“You need to make a business case to your employer or your manager about why you deserve a pay rise, and emotions must be left at the door,” he said.

“Don’t go with reasons such as ‘my colleague got a pay rise and I want one’ or ‘I deserve to be on the same’.

“Those sort of things related to emotion can lead to disaster.”

Check the calendar for an upcoming work anniversary or look ahead to the end of the financial year and book in a time to speak privately with your manager.

Prepare by jotting down some of your performance indicators and link those to any recent company-wide revenue upgrades.

Timing works both ways, Mr Berger said. Avoid asking when there’s a notable market or industry downturn, for example.

The last thing to consider is the prickly issue of how much money to ask for. The recruitment expert advises those looking for an income bump to do their research and establish an amount that is fair and competitive for the role.

Then ask for a little bit more on the assumption it will be negotiated down.

“Once you’ve got the facts in order, the process of conducting that meeting has got to be strictly business,” Mr Berger said.

“Book some time with your manager and then I’d advise to get a little run sheet and deliver the facts followed by that negotiation.

“You’ve got to leave emotion out of it and it’s got to be a positive discussion.”

IS A RIVAL OFFER WORTHWHILE?

Some disgruntled employees are seduced into taking the aggressive approach of inviting an offer from a rival workplace and giving their boss the ultimatum to pay up or say goodbye.

Mr Berger says this can be a common and successful strategy in some cutthroat corporate industries but for mainstream roles he “doesn’t like the sound of that at all”.

“It just leaves you with no wriggle room,” he said.

“If you actually had an offer and you go back to your employer and say ‘company B has offered me $150,000 and I’m on $120,000 with you. If you don’t match this, I’m going to leave.’ What’s the atmosphere going to be like moving forward with that company?

“Yes they may relent and pay you close to that amount but in the next company downturn or the next time the industry takes a turn and they need to offload staff, guess who they’re looking at?

“You also might not see another pay rise for the next three or four years.”

Are you worried about weak wage growth? Get in touch or comment below | @James_P_Hall | james.hall1@news.com.au