Sunshine Coast man loses $30k in life savings by falling victim to scam

A single dad from Queensland has been caught up in a scam that turned his life upside down when he lost $30,000, including all his super.

A single dad is “devastated” after he lost his entire life savings in a scam, with the painful experience forcing him to move back in with his parents.

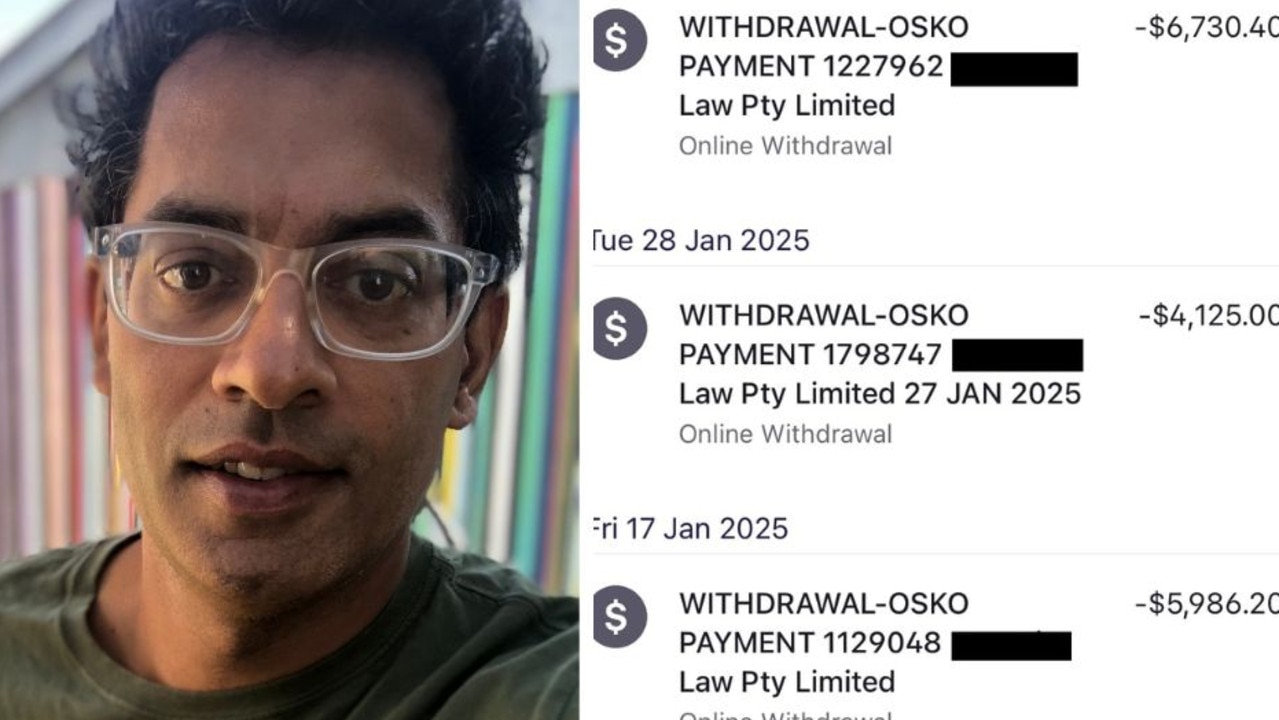

Mark Rose lost $30,000 after he was promised a three-to-one return by investing in a cryptocurrency offer, but when nothing appeared in his account and his inquiries went unanswered he started to panic.

His messages to the scammers show his increasingly desperate pleas for his money to be returned as he realised he had been duped.

The IT worker had spent three years building up his original investment with the cryptocurrency Ripple, taking his money out of his superannuation when the federal government gave people early access during the pandemic.

“I took the $10,000 out of my super before the end of mid-year break and I took $10,000 after the mid-year tax break when you could get your super and then I also added $10,000 in cash that I had been putting in through work,” he told news.com.au.

“I contracted a lot with work so I don’t have much super I only had $23,000 so I basically cleaned that out to get a better return. I wasn’t going to get a better return on super as there was so little in there.

“Then my job contract ended and because of Covid they put the rent up $120 and then I got scammed. This all happened in three weeks.

“I had no cash, no job and I couldn’t afford to pay rent as I’m a single dad, so I had to move out and lob with my oldies downstairs. I’m still there at the moment and I just got another good pretty paying job but all my savings are gone.”

The previous government allowed Australians to take $36 billion out of their superannuation accounts during Covid.

The Sunshine Coast man said he was tricked into the scam a year ago after watching a feed called XRP Bonus Support for a month on the instant messaging service Telegram.

While he was initially sceptical, he said there were hundreds of people from around the world praising the returns made and he spoke to many “happy” customers – but now believes they were all fake accounts.

He said he also made the fatal error of transferring his entire investment in one go.

“That was mistake 101 that you shouldn’t do even if it’s legitimate,” he added.

In a further blow, he said he also lost $100 afterwards to a scammer who promised to help him recover the money.

The 54-year-old said the scam had almost ruined him.

“If I didn’t have my parents and somewhere to live I would be on the street – it crushed me,” he revealed.

“Blokes don’t like to talk about it but I’ve had depression ever since as I will never get the money back – whether its $1 million or $30,000 it’s still everything I have.

“I’ve got less than $500 in the bank now and I’m living pay cheque to pay cheque as it takes so long to save money to have a few extra bob to throw into savings. I have no emergency money and back then I had no where to live, my job finished and I lost all this money on crypto.”

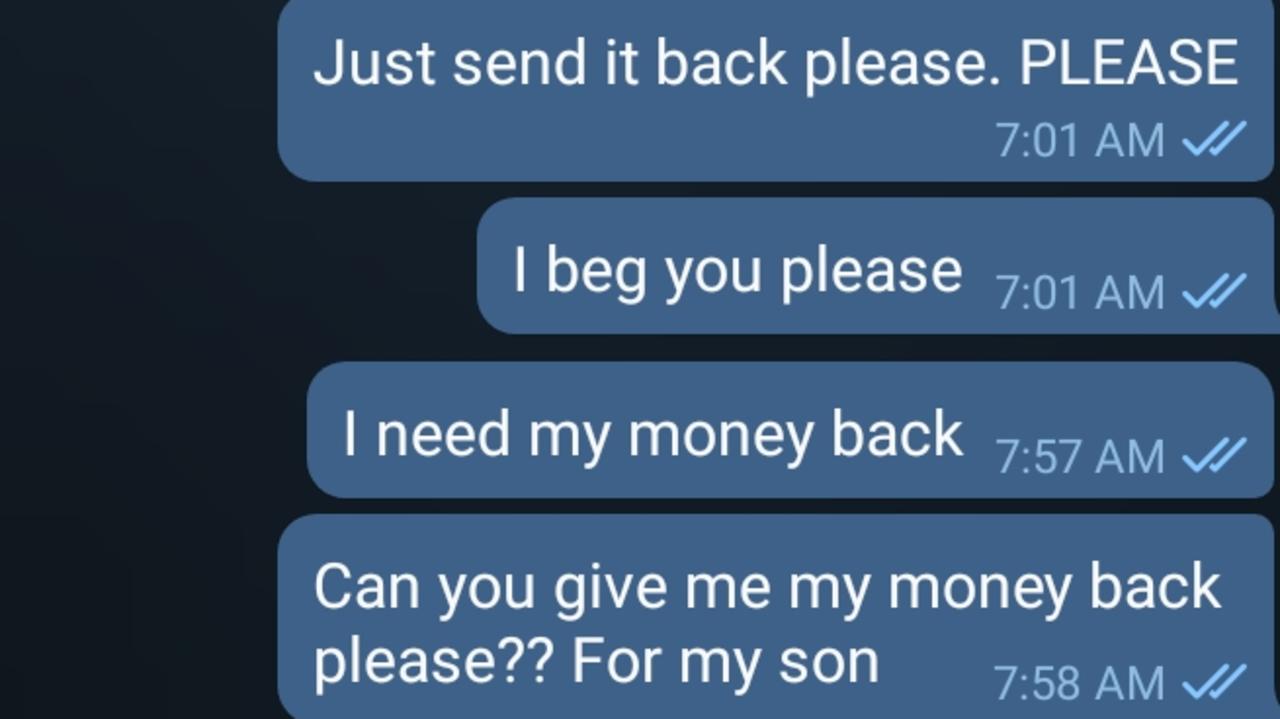

Messages to the scammer show Mr Rose pleading with them to respond to him and telling them he is crying and “really scared”.

“Please please help me … Please don’t steal from me, it’s all I have … Omg what have I done, please help me,” one message reads.

“I’m extremely worried and scared now … please it’s my life savings,” another heartbreaking message reads while the scammer tells him to be calm.

“I’m starting to shake and I’m really nervous, please be honest,” he responds.

Mr Rose added he pleaded with the scammers to give him his money back as the website disappeared.

The IT worker said he can actually track the movement of the cryptocurrency via the technology used for crypto wallets called blockchain.

“One wallet had $13,000 in it on Binance and then they have got some of it as well with smaller amounts and you wonder how many of these wallets are holding scam crypto?” he said.

“You open the wallet and can see they have split up the crypto and moved it on to new wallets and keep moving it. Everything is traceable, you could spend hours tracing it – that’s what sh**s me – you know where its gone to but can’t do anything about it.”

But surprisingly Mr Rose said the experience won’t stop him from investing in crypto again, despite the huge battering the sector has taken in recent times too.

“I will try and build it up again – it’s definitely the way of the future … At my age I have no super now and I can’t get a loan from the bank as I’m too old,” he said.

“I was going to use the savings to try and get a place, so it affects everything in your life. I can’t stay away from crypto and work 9-5 as it will achieve nothing.

“I’ve got to risk trying to get it back and I’ve got to risk trying to get something before I’m too old to work. I couldn’t just sit there and stop, there is nothing I can do to get a return that sufficient to finish work, so I’ve got to keep trying to build my crypto.”

Mr Rose said he reported the crime to Australian authorities.

A Binance Australia spokeswoman said the company actively collaborates with law enforcement and recently hosted workshops in Sydney and Canberra this month, while it also has a scam awareness education program launched last year.

“These trainings were held directly between Binance and Australian law enforcement agencies to emphasise the importance of clear frameworks of escalation and how to better work together on investigating cases,” she said.

Binance has robust transaction monitoring tools detecting, identifying and investigating crypto transactions including but not limited to suspicious wallet, dark web and black-listed addresses, she added.

“Binance encourages affected parties to contact Binance Australia and law enforcement to lodge a formal request for investigation,” she said.

Between January and May last year, Australians lost a whopping amount to investment scams involving crypto with $113 million stolen, according to Scamwatch.

“Australians should be very wary of anyone asking them to invest in or transfer money using cryptocurrency, especially if it’s someone you have only met online.

“Many consumers are unfamiliar with the complexities of cryptocurrency and this can make them more vulnerable to scams,” ACCC Deputy Chair Delia Rickard warned last year.