Single mum’s home insurance rises to $16k as new report warns more price hikes on the way

A single mum had to do a double take when she received an email in her inbox to make sure she had read it correctly, learning that a new cost was about to break the bank.

A single mum had to do a double-take when she received an email in her inbox to make sure she had read it correctly.

Emma-Lee Lawson, who works as a registered nurse, lives in a newly built house in the coastal Queensland region of Marlborough with her two kids, aged seven and 14.

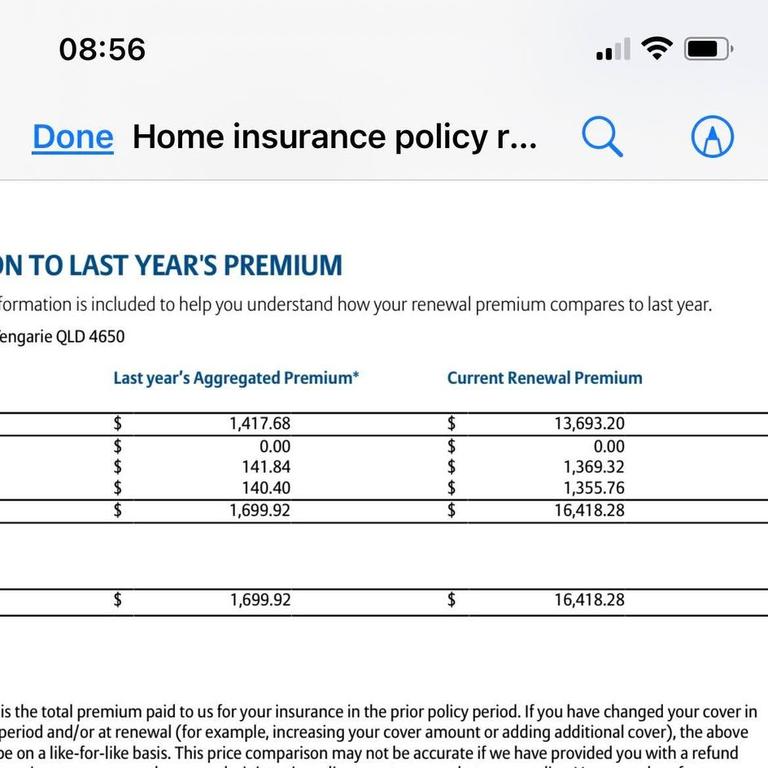

But the email, from her insurer Allianz, warned that her house insurance was up for renewal and revealed the company would increase the price by 10 times the previous amount.

Where before it had cost the mum $1699 to insure the family’s home, she would now have to fork $16,418 to cover the property against flooding.

“I was shocked, I felt sick, (I was) having to re-read what I saw,” the 34-year-old told news.com.au.

“I just can’t afford to add $16,000 plus to my annual budget, especially with already increased living expenses and changes to the home interest rate.”

Parts of Queensland and NSW were hit hard by floods earlier this year, including the region of Marlborough, but the water line did not reach Ms Lawson’s home and she didn’t have to make any kind of insurance claim.

It comes as a new report found insurers are becoming spooked about climate risks, which means Australians are set to pay significantly more in coming years for home insurance.

Ms Lawson fears she won’t be able to keep a roof over the heads of her son and daughter if disaster strikes.

“My insurance has lapsed with them (Allianz) and I have a broker assisting me to find a better deal at the moment but most insurers are asking that I don’t include flood cover to decrease the annual premium,” she said.

In a “worst-case” scenario, the mum said she would not insure her home against floods — but said that would leave her “feeling uneasy”.

News.com.au has contacted Allianz for comment.

A new report by Australian actuarial and consulting firm Finity, released earlier this week, issued a sobering warning for property owners looking to insure their homes while will resonate with people like Ms Lawson.

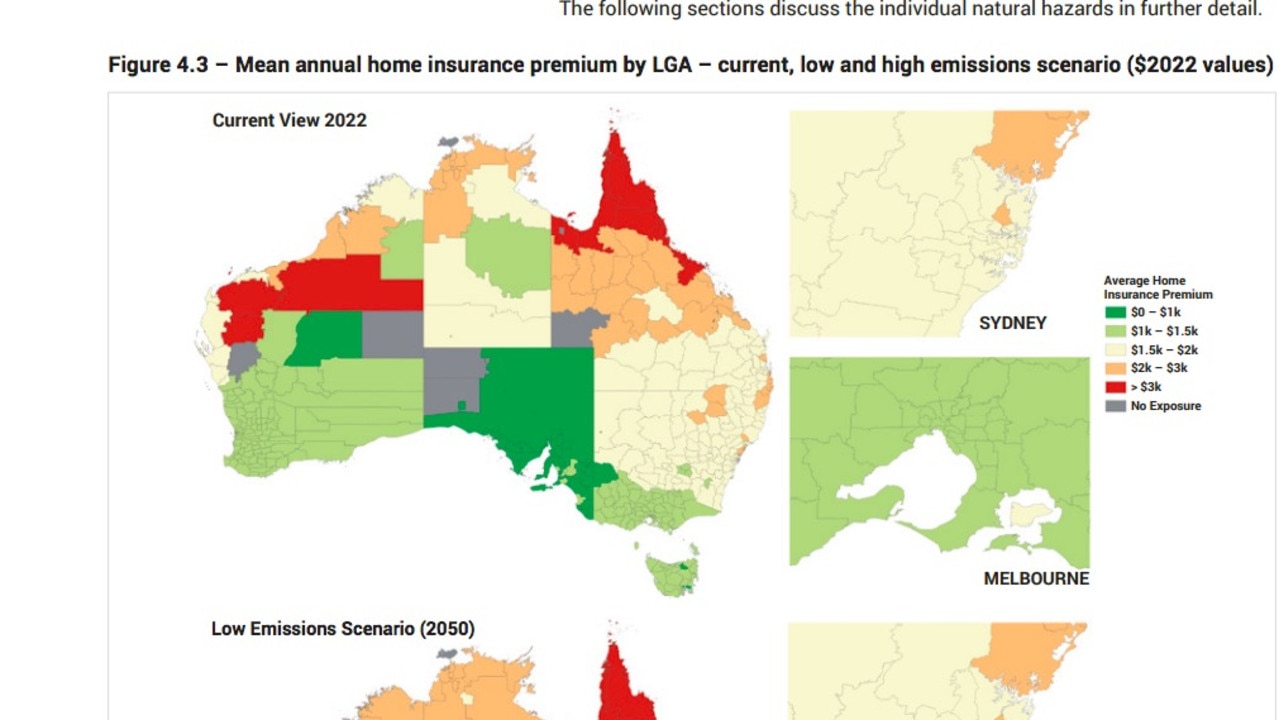

The report titled Home insurance affordability and socio-economic equity in a changing climate, commissioned by the Actuaries Institute, found home insurance rates are going to go up drastically as climate change increases temperatures and as rare natural disasters become more common.

A whopping one million households are already considered “vulnerable” as they struggle to afford hefty premiums in relation to their income.

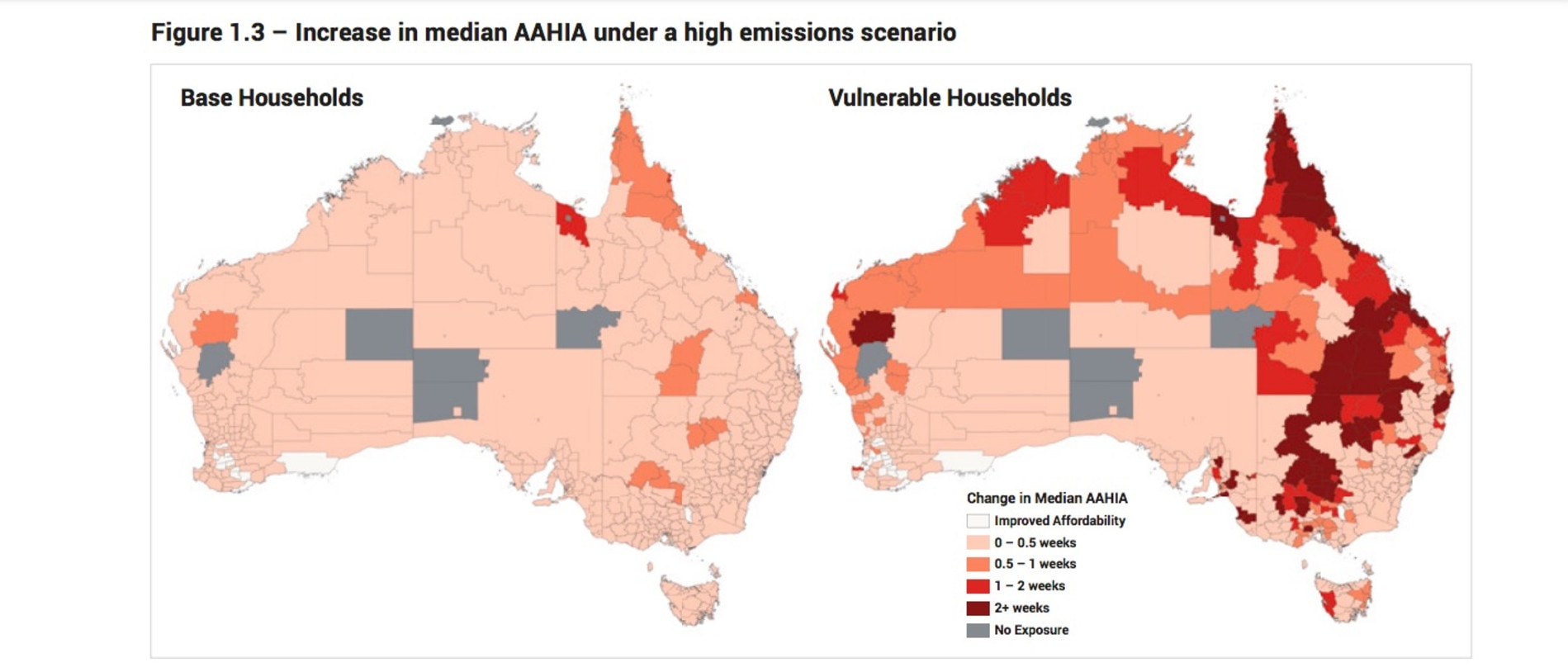

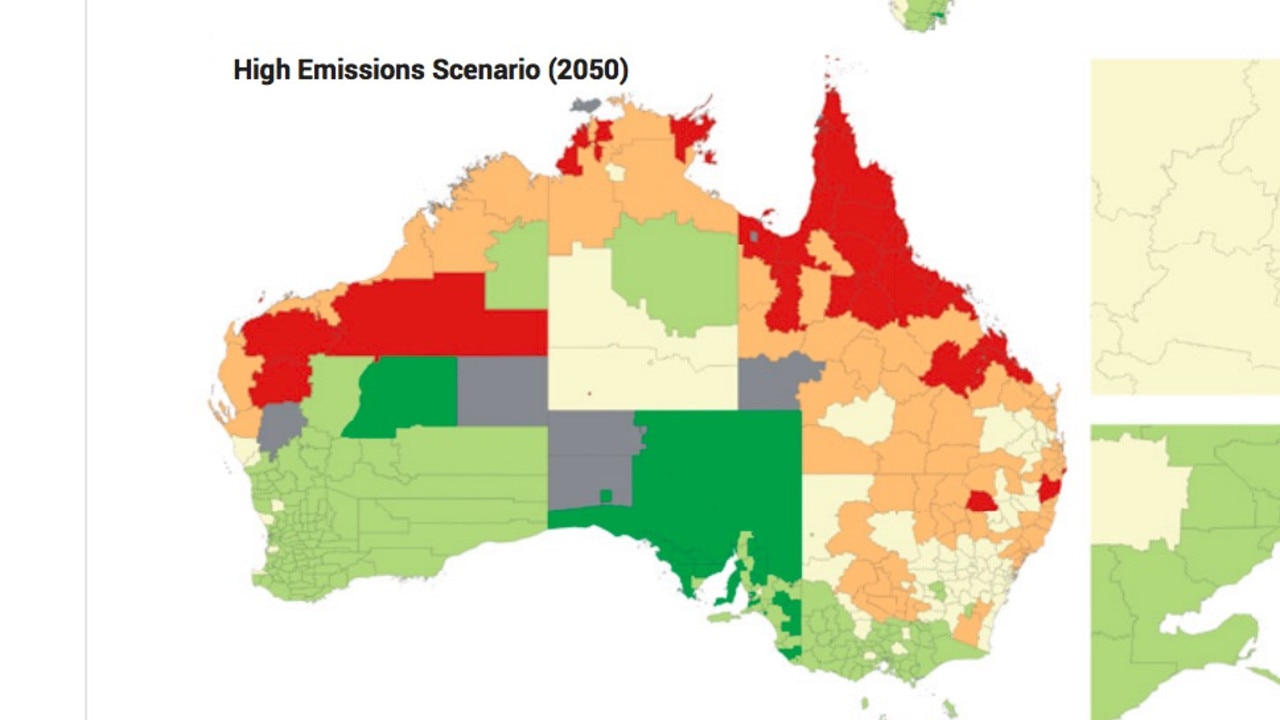

If emissions rates continue as they are currently are to reach 3°C by 2100, then that means by 2050, these vulnerable households will on average be paying $2,523 more to insure their property than they are now.

Finity Consulting principal and the report’s lead author Sharanjit Paddam told news.com.au that although the majority of those vulnerable residences are concentrated in northern NSW, the Northern Territory and Queensland, “in every LGA (local government area) there are people in this vulnerable group”.

In a concerning phenomenon, Mr Paddam explained how vulnerable households are paying an average of 7.4 weeks of their pre-tax annual income on home insurance, while the Australia-wide average is 1.1 weeks.

That means people who can least afford it are paying more than seven times the norm to keep their home insured.

“For households where the annual home insurance premium is over $2,000, half earn less than $65,000,” the report noted.

Households were deemed to be under “extreme affordability pressure” if they spent more than four weeks of their earnings paying home insurance.

“Our most vulnerable people are living in our most vulnerable houses,” Mr Paddam said.

“We think what’s happening here is that people on low incomes have to find cheaper housing, (which) tends to be at the edges of the city, in the outer suburbs.

“A lot of those would then be prone to bushfire areas.”

Metropolitan areas along the east coast also tend to face higher storm risk, including Sydney, Gold Coast and Brisbane.

Although Sydney, Melbourne and Perth are large cities that “typically have lower natural hazard risks and higher incomes” than elsewhere, the green paper said “many communities in these areas already are struggling with limited household income” and that climate change would “exacerbate” these issues.

Queensland emerged as the worst state for home insurance costs, with the largest number of vulnerable people struggling to cough up funds to big insurance companies.

Nationally, the 10 LGAs with the highest affordability pressure all came from Queensland.

On average, residents Aurukun, in far North Queensland, have to fork out 6.6 weeks of their annual income on insurance, the largest amount anywhere in the country.

That was followed by Pormpuraaw (5.5 weeks), Yarrabah (5.4), Torres Strait Island (5.3), Wujal Wujal (5.2), Kowanyama (4.8), Mornington and Hope Vale (4.7), the Northern Peninsula Area (4.3) and Lockhart River (4.1).

Surprisingly, the Sydney suburb of Randwick made it into the state’s list of the 10 most vulnerable LGAs, with a score of 2.1 weeks.

The report outlined a number of recommendations to take pressure of these vulnerable homeowners, including removing state based stamp duty and levies from insurance costs.

These extra costs are proportionate to the amount of insurance paid, which Mr Paddam said was difficult for low income earners with higher premiums.

“We recommend that these taxes are replaced with alternative revenue sources that are more equitable and efficient,” the report added.

They also called on residents in risk-prone areas to receive training to mitigate damage to their homes, for instance, learning how to tie a roof down in the event of a cyclone.

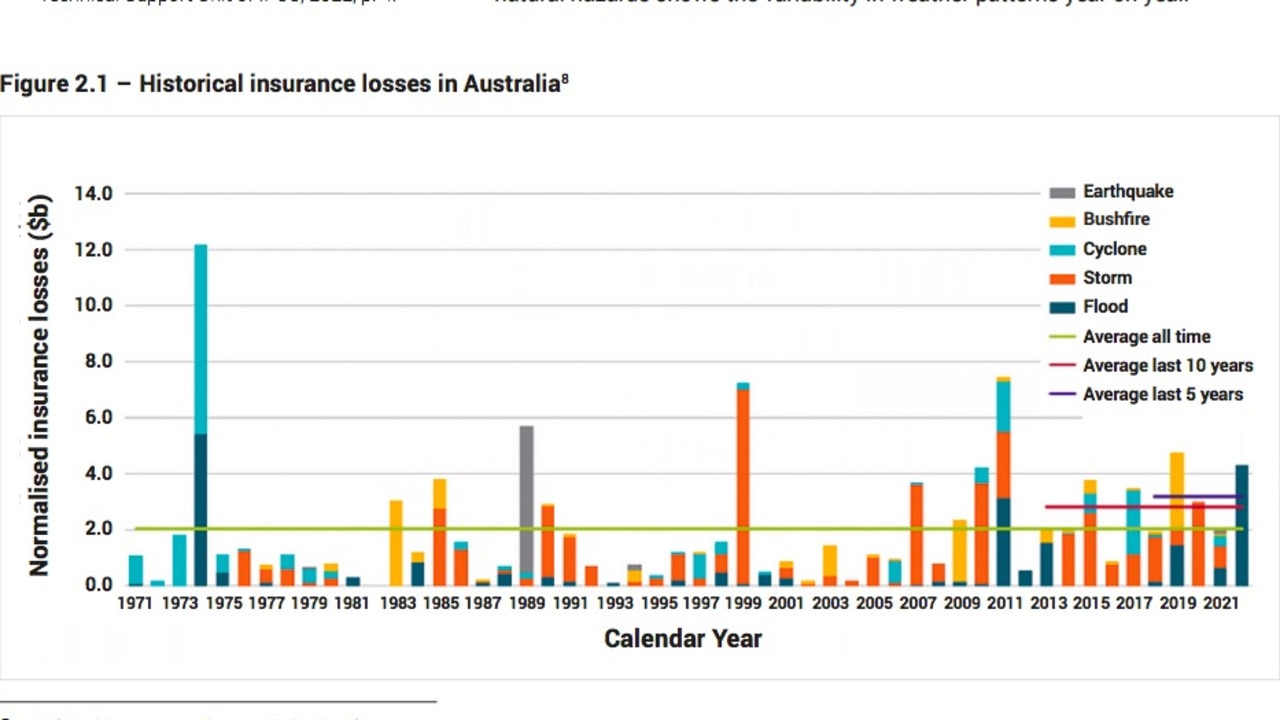

The report also noted that unusual natural disasters are becoming harder to forecast because historical precedents are no longer a reliable way to predict future catastrophes — something that insurers clearly feel about the area that Ms Lawson lives.

“The Australian population is generally well aware that the country is susceptible to natural hazards,” the report stated.

“However, the level of risk exposure is typically understood with reference to historical events …

“A recent example is the extreme flooding affecting eastern Australia in early 2022. Many of the affected communities have faced floods in the past, but were devastated by unprecedented levels of damage.”