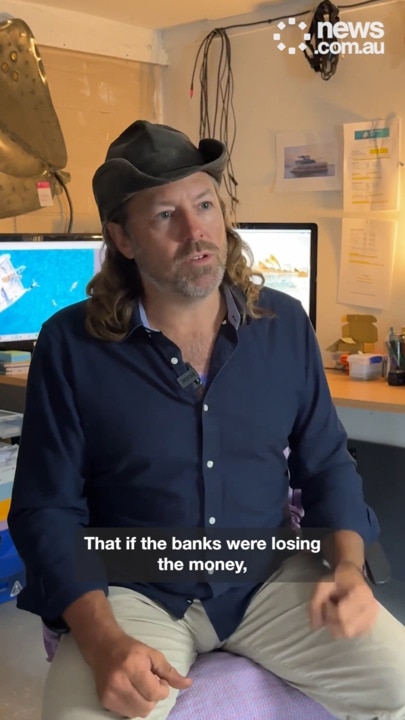

‘Shut me up’: Bank’s gross move after scam leaves Sydney man ‘disgusted’

An Aussie man has been left “disgusted” after a text message he thought would help him resulted in a devastating outcome.

When a text message dropped from his bank, Dean Cropp never thought it would see him lose a “heartbreaking” $42,000 that was crucial to his livelihood.

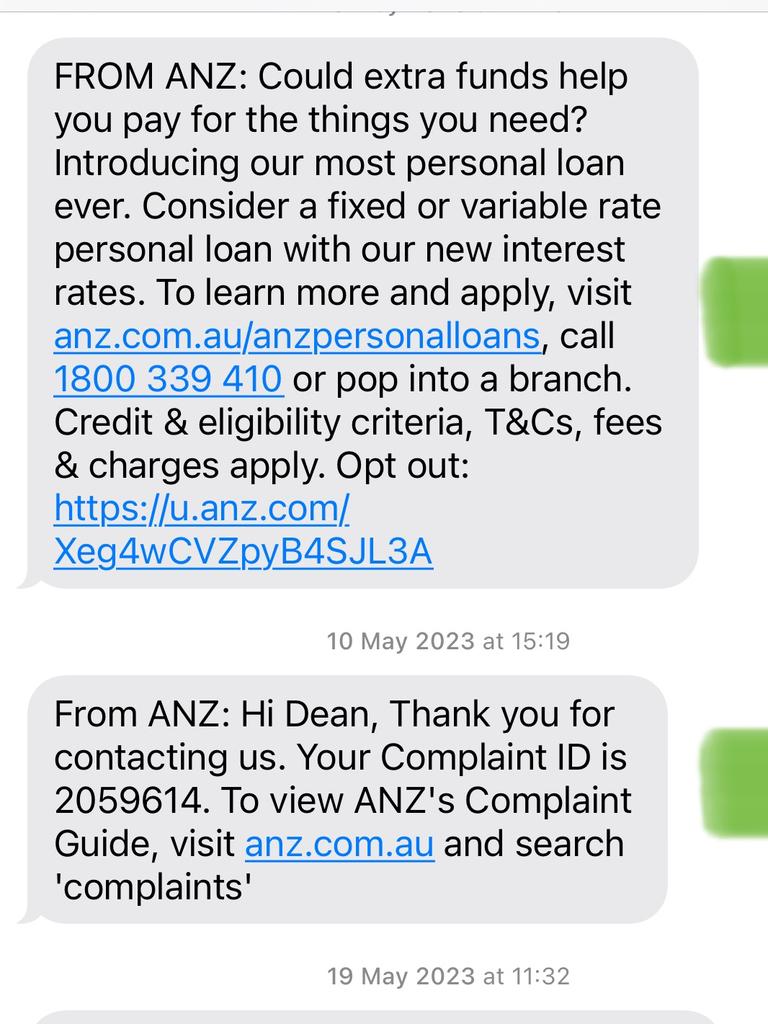

The Sydney man said the message included the last four digits of his account and appeared in the same thread as other legitimate texts, such as one time passcodes from ANZ bank.

He had no idea that the bank’s text messages could be “infiltrated” by scammers.

“The bank uses it to send you passcodes. So you trust it,” he told news.com.au.

Mr Cropp is lending his support to a news.com.au campaign People Before Profit, calling on the federal government to make it mandatory for banks to compensate scam victims – just like in the UK.

In October last year, the UK introduced world leading legislation making compensation mandatory for scam victims within five business days unless in cases of gross negligence.

IT’S TIME BANKS PUT PEOPLE BEFORE PROFIT. SIGN THE PETITION

The fraudsters used a ‘spoofing’ technique where they employ software to disguise their phone number so that text messages appeared in the same text chain as legitimate ANZ messages.

After the text, the 44-year-old received a phone call which he thought was from the bank.

Listening to ANZ’s standard on hold music and going through the usual security details set off no alarm bells for Mr Cropp.

He was told there was unusual activity on his bank account and credit cards and they needed to be shut down.

“I said, look, that’s difficult. I run my whole business through that card and that account. So either I get a card straight away or I need to move money into an account that I can use while you’re shutting this one down and starting up a new one to avoid the fraud,” he said.

He had fallen straight into the trap laid by the scammers – who said a new account could be created and linked to his credit card.

Then Mr Cropp, who owns a small boating business in Sydney called Barefoot Charters, transferred multiple amounts of up to $9000 to the new account over two days totalling $42,000.

But on the third day when he couldn’t see the new account appearing in his ANZ online banking, he was concerned.

He rang ANZ and said he was initially told that a new bank account can take days to appear. But when he pressed the matter and mentioned the account numbers, he was immediately told he had been scammed.

Yet, he said the blame game from the bank began immediately.

“It got pushed back onto me. You’ve been scammed. You’ve got a Trojan virus in your computer … And I’m like, look, I’ve got the account details. I’ve just transferred money only in the last 45 minutes. Let’s find this account,” he said.

Devastatingly, Mr Cropp claimed it took eight hours for the ANZ fraud department to get back to him while he was sure his money was being drained from the scammer’s account.

Meanwhile, he uncovered the scammer’s bank account was with St George after googling the BSB.

“ANZ didn’t bother to contact the bank where the money had gone to. I did that. Privacy concerns mean I couldn’t get any information about that bank account. They were able to freeze what was in there, but it was next to nothing,” he added.

“But this is days and days later now. There was no speed from ANZ to say ‘hey, let’s go and solve this problem. Let’s try and recover this guy’s money.’ It’s not their money.

“Now, if there’d been a bank error and they had accidentally sent me a whole lot of their money, they would be on to me pretty damn quick to get that money back.”

Mr Cropp now believes any Australian could be scammed.

“I never thought that I would get scammed. I thought I was smart enough. I’m pretty tech savvy. I’ve been running a business for 10 years. I’ve I come from a media background. I saw this sort of scam stuff. I thought I was pretty scam aware,” he said.

“But even if you are scam aware … it’s not the bank’s money that’s got lost. They have no impetus to solve the problem because it’s not them losing the money.”

The boat captain said he “hates injustices” adding he was “pretty disgusted” by the way he was treated by ANZ.

“It was shocking and heartbreaking to lose that money,” he said.

The loss has had an echo for years leaving him “exhausted” after his hard work was “snatched” away in matter of days.

“A small-business owner has to end up working himself half to death to make up for the loss. Basically I worked harder rather than laying off any staff, rather than cutting things back,” he said.

When it comes to scam victims, the human toll is often overlooked, Mr Cropp noted.

“We look at money as this paper thing, which is so disposable, but in truth there is a person linked to that and that is really going to affect their life, their health, their capability to have a good life and live comfortably when they are scammed,” he said.

“They might have worked hard all their life and lost money and they have to live by the skin of their teeth for their rest of days – that is what is super unfair and super scary.”

ANZ told Mr Cropp none of his money could be recovered.

After the scam, Mr Cropp received another message in the same thread which stated Johnathan from ANZ Customer Resolution would be calling — which was legitimate.

But he questioned how he could identify if those messages were from the bank or also a scam — revealing the impossible situation victims find themselves in.

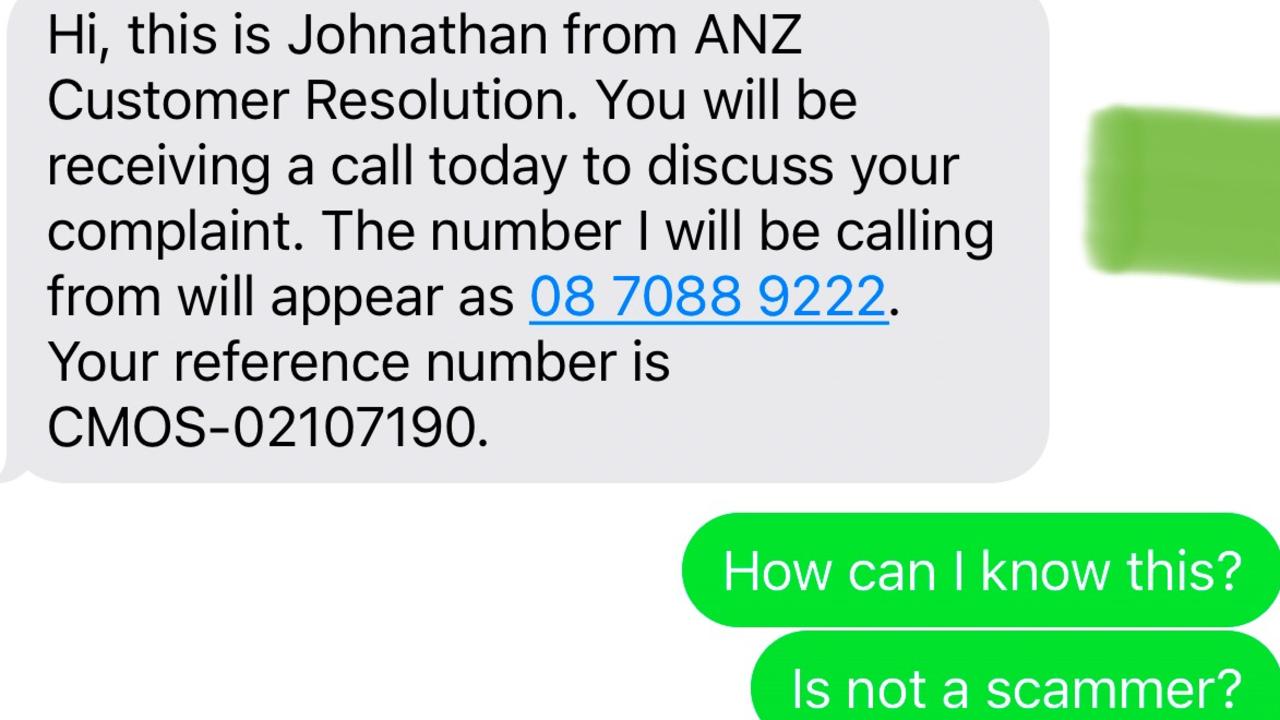

Mr Cropp said he received an offer from ANZ for “full and final settlement” over the incident which was “extremely unfair”.

“If I took that $1000, I … wouldn’t have any option to chase the money in the future,” he added.

“So $40,000 I lost. And they offered me $1000 to shut me up. This is a bank I’ve been with since I was 13. I wouldn’t be with them now if I didn’t have a loan … I’m disgusted by the way they have treated someone who’s been with that bank for decades.”

In a further chilling development, the scammers called him four more times to taunt him after they stole his money.

“Every time they called, I would just try to abuse with them. But the fact that they were calling over and over again means they just had no fear that they were ever going to be traced back,” he said.

An ANZ spokesman said they don’t comment on customer cases but scams are an insidious problem which impact the entire community.

“ANZ has a range of measures in place to help detect and protect our customers from fraud and scams and is continually reviewing and adjusting our capabilities as new fraud and scams emerge and criminals change how they operate,” they said.

“The ways in which criminal syndicates are scamming and defrauding customers is sophisticated and constantly evolving and ANZ encourages customers to be cautious of any unsolicited calls, emails or messages from someone claiming to be from their bank.”

ANZ works with major telecommunications companies on measures that stop scammers from adopting the “ANZ” label in text messages, including reporting instances where ANZ has been impersonated for telcos to block and prevent these attempts, the spokesman said.

“Deeds of settlement are not a standard part of ANZ’s approach to resolving customer complaints,” they noted.

More Coverage

“Instead, our focus is on achieving fair and transparent outcomes for our customers. We always attempt to recover funds customers have lost to scams or fraud.

“However, the ability to recover funds depends on a number of factors including how quickly it is reported to us, whether they are transferred to another financial institution, and the speed in which funds are then on-transferred by scammers. In many instances, cyber criminals on-transfer funds within minutes, or use them to purchase cryptocurrency.”

sarah.sharples@news.com.au