Scammers are getting way too clever

IT USED to be easy to spot a scammer. But now they’re coming up with more sophisticated ways of getting our money. Even smart people are fooled.

A SEEMINGLY innocuous message plops into my LinkedIn inbox: “Hello. How are you doing?”

It’s from a stranger called Andrick and this fact, along with LinkedIn supposedly being a social media platform designed for business purposes only, makes me instantly suspicious.

“Is this a work query? Or are you trying to use LinkedIn to pick up?” I reply.

Then comes a slightly predictable — and mildly hilarious — answer (which surely must have been underpinned by Google translate): “I know here is a business site but your profile caught my attention with your beautiful smile on your beautiful face. That I could not let it go without telling how deep I appreciate you here.i we like us to know more better about our self if you don’t mind,” Andrick writes.

Anyone else smell the stench of a romance scam coming on? When I click on Andrick’s image, it appears to be a blurry off-centre photo of a photo depicting some rugged bloke with a square jaw. Poor Andrick. He’s not really my type. So despite our “deep” connection, I disconnect from him on LinkedIn.

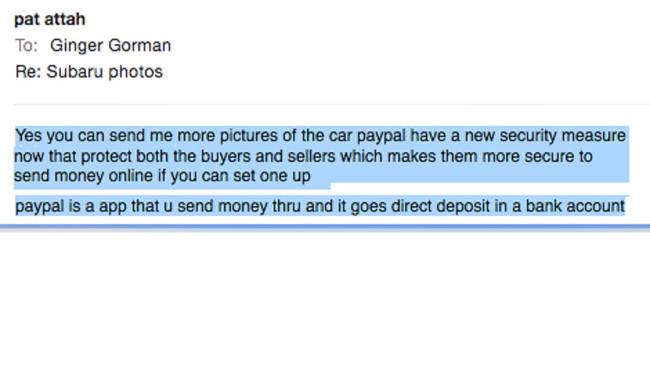

Andrick isn’t alone in trying to scam me. I’m trying to sell our old car on Gumtree. “Pat Attah” wants me to email photos through. So far so good. But things start to smell fishy fairly fast. Or perhaps I should say “phishy”.

Pat won’t come and actually see the car and just keeps asking for more information from me and more photos too. Unprompted, he starts to go on about how secure PayPal’s new security measures are. This sets alarm bells off.

Despite PayPal’s best efforts, there are loads of different PayPal scams — often involving refunds.

“You’ll need to come and see the car before we talk further,” I write back to Pat Attah, “At the moment I’m pretty confident you’re a Nigerian scammer.”

Unsurprisingly, I never hear from Pat again. (He doesn’t respond to my request to be interviewed for this story, either).

SCAMS ARE COSTING AUSTRALIANS A BOMB

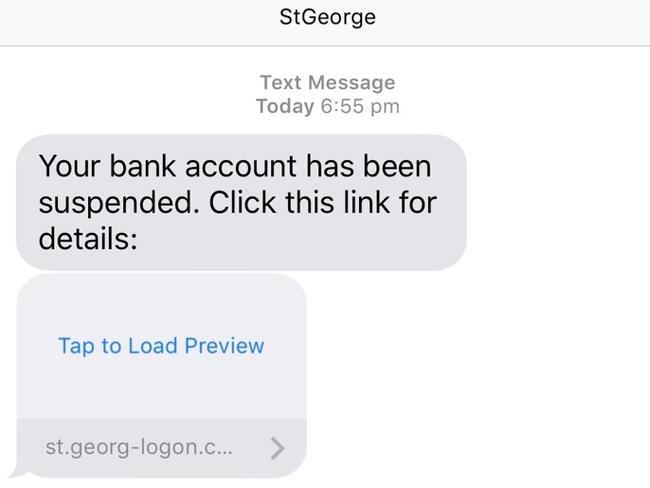

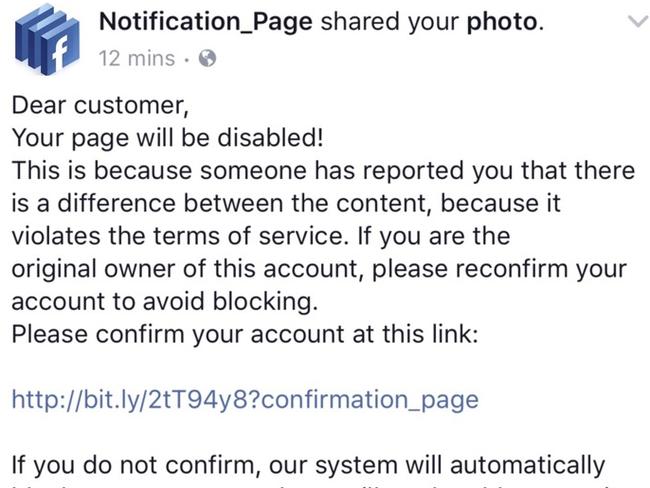

Then there’s the text message supposedly from St George Bank — who I don’t have an account with — telling me my account has been suspended. Click on this link. The bank confirms it’s bogus.

Similar messages stream in on Facebook and email: Your Squarespace account has been suspended. Your Apple account has been suspended. Click the link. Click the link. CLICK THE LINK.

The Federal Government’s Scamwatch notes that Australians lost more than $300 million to scams in 2016 — up from $229 million the year before. That’s a 31 per cent increase.

According to the Scamwatch website, the most losses were racked up through investment scams, closely followed by romance scams. A huge portion of people reporting scams (45 per cent) were Australians over the age of 55.

Cyber safety consultant Leonie Smith — dubbed “the Cyber Safety Lady” — says scammers “will go for people that are over 60 because they think those people are more vulnerable. They haven’t been on the internet as long, they’re not digital natives.”

In fact, my friend Oliver tells me an anecdote that fits this exact scenario: “My elderly dad is really interested in astronomy and downloaded astronomy software that had a Trojan attached to it.

“He then rang the fake Microsoft number that popped up on his on screen and they tried to scam him for a lot of money. He refused to pay and they kept ringing back harassing and bullying him for cash,” Oliver says, adding that he believes “there’s a huge need for community education” among retirees.

WE ARE LEAVING OUR DOORS UNLOCKED

Back with Cyber Safety Lady Leonie Smith, many of her clients “are really quite shocked” when they learn how open they’ve made themselves to online scamming.

While most of us have grown up being security conscious of physical property — like our houses or cars — Ms Smith says “the internet is a whole new city” and “the proliferation [of scamming] is because people are just leaving the doors unlocked.”

She points to the colossal amount of information people freely give away online about themselves and says having your friends lists, photos and interests publicly accessible on Facebook is all valuable information for scammers.

“Social media is designed for sharing,” Ms Smith continues, and “the onus of the user to learn how to use it and learn what they can do with it and how to protect their privacy.”

But usually, she says, users simply don’t take the time to educate themselves: “Human nature is that you won’t do anything about your personal safety or insurance or anything else until something happens.”

To add insult to injury, Ms Smith also says scammers “are coming up with more and more sophisticated ways of getting money.”

SCAMMERS DON’T SEE IT AS STEALING — BUT IT IS

As a rule, scammers are not that keen to have a chat about their crooked ways. However one person who has interviewed and indeed spent time with Nigerian scammers is Brooklyn-based journalist Erika Eichelberger.

Back in 2014, Ms Eichelberger was in Nigeria for another assignment when she managed to convince a couple of scammers to chat to her by paying them $130 USD.

“My fixer knew some scammers so I decided to interview them,” she tells news.com.au via email, “What surprised me most was that they were open to talking with me.”

In the article Ms Eichelberger wrote for the US publication Mother Jones, she outlines how the scammers make “friends” with their victims and slowly find out everything about their lives — including how much money they have in their bank accounts, where they are working and even their relationship status. And then the money extraction begins.

“They insist that tricking people is not the same as stealing,” Ms Eichelberger writes, and goes on to say her interviewees “make a tidy living” from scamming.

DON’T GET SCAMMED! HOW TO HOLD ONTO YOUR CASH

Keen to make sure you don’t fall for Andrick’s rugged good looks and terrible grammar? Leonie Smith, the Cyber Safety Lady, has these top tips to avoid scammers:

1. The number one security tip for Facebook is to hide that friend’s list. As soon as you do, you’re going to reduce your risk of being targeted scammers.

2. Look for the privacy and security settings on everything that you use, including apps and social media. Set them to a security level that you’re happy with. Turn off location services (because, for example, if you have it on and send a Tweet while you are at home with an app like Tweetbot, it will allow other people to pinpoint your house on a map.)

3. Hide your birth date and your phone numbers and all of your personal data online, including your address. If you have to enter your birth date, put in a fake one. Personal data is extremely useful to scammers. Lock your physical mailbox.

4. Never click on a link in any email or SMS that has been sent to you. Go to your account the normal way that you would and resolve any issues that way. The only reason to click a link in an email is if you are verifying your email address.

5. Flooded with spam and scam emails? Google your email address and your phone number and see if they’re written up online. If you’re having a problem with them, you might want to take them off the internet altogether and consider using a contact form online.

Educate yourself further by downloading the ACC’s free “The Little Black Book of Scams.” I swear on my life. It’s a genuine link. You can click on it.

Ginger Gorman is an award-winning print and radio journalist. Follow her on Twitter @GingerGorman or support her work on Patreon.