Research reveals 2.7 million Australians hide their spending from partners

Millions of loved-up Australians are sneaking around behind their partners’ backs — and they could “end up paying for it some day”.

Australians in committed relationships are forking out a collective $1.6 billion a year on sneaky purchases — and hiding our guilty habit from our partners.

According to a new analysis by comparison site finder.com.au, a whopping 2.7 million of us are spending behind our significant other’s back.

It found the average Aussie forks out a staggering $588 per month on purchases their partner knows absolutely nothing about.

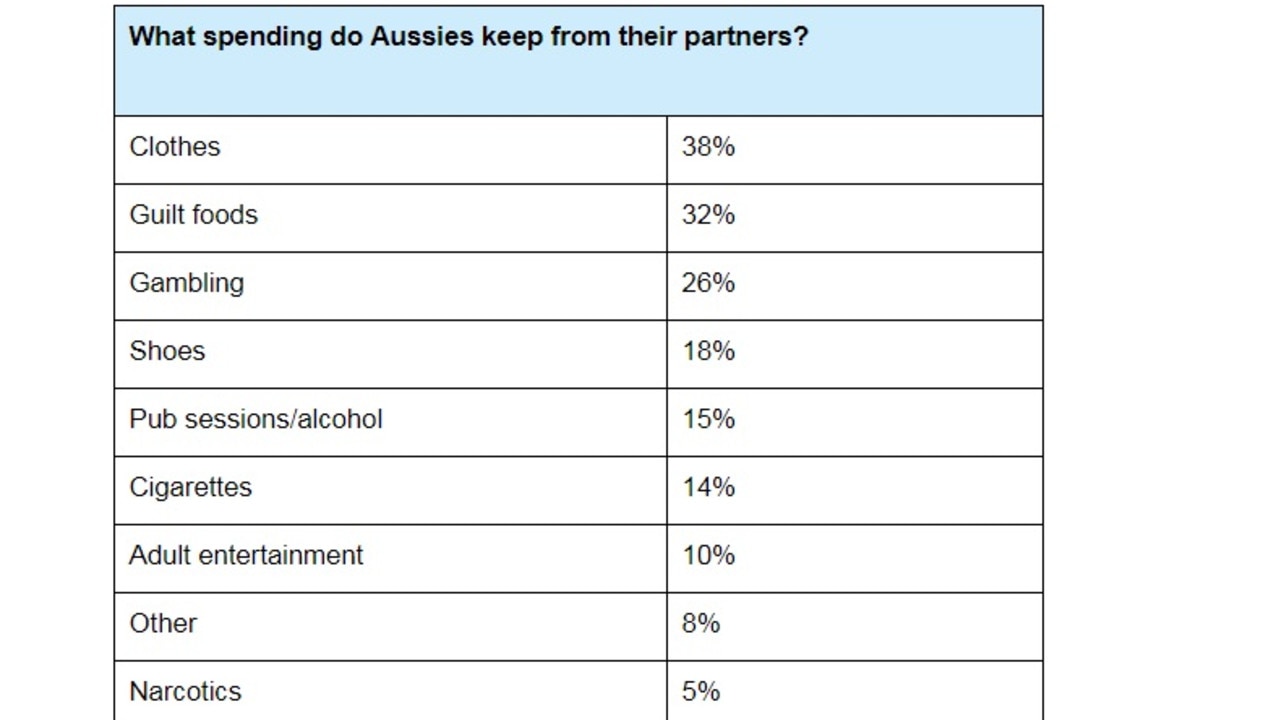

While the majority of those splurges are on seemingly innocent items like clothing, shoes and snack food, others like gambling, alcohol, cigarettes, adult entertainment — or narcotics — could indicate a more serious problem.

And when it comes to X-rated secrets, men are the biggest culprits, with males more likely to cover up spending on “adult entertainment” while women were most likely to conceal clothing purchases.

The research found 60 per cent of us carry out covert spending with cash instead of plastic, while a further 26 per cent pay for secret purchases on debit, 24 per cent use a credit card and 17 per cent admit to using a buy-now, pay-later platform.

The research revealed the average covert monthly spend for men was $807, compared to just $366 for women.

Gen Y is the generation most likely to hide purchases from their partner, while baby boomers are the least likely.

According to Dan Auerbach, a psychotherapist with Associated Counsellors & Psychologists Sydney, it’s important to understand the seriousness of financial infidelity.

“Money is really central to people’s sense of safety, and when we’re in a partnership and we act deceptively about how we spend the family finances, it can really shatter our partner’s sense of security,” he told news.com.au.

“People can dig themselves into a deeper and deeper hole that can escalate over time — the deceit can get bigger and bigger to the point where the person feels it’s too late to reveal.

“When their spending is finally revealed it can come as a huge shock with regards to the relationship — some people might be splurging in order to bolster their mood, to feel better or to keep up with people, while others might do it to maintain an addiction to gambling, sex or drugs.”

Mr Auerbach said financial infidelity was “secretive and addictive” by nature, but that is was also often done subconsciously or without full understanding of the consequences.

But he said when it was finally revealed, the habit can cause the guilty party’s world to come “crashing down” as they experience “deep regret”.

He said most couples needed to negotiate and find a balance between one person’s need for freedom and the other’s need for security, which can be achieved by setting a limit or budget for each partner’s expenditure.

“For some people, spending is part of their freedom and a way of getting enjoyment out of life while for other people, it affects their sense of security,” he said.

Finder.com.au money expert Bessie Hassan said there was a difference between the odd harmless purchase — and a regular habit.

“The fact some are using cash suggests they’re going the extra length to conceal their guilty pleasures. But if you’ll be going the distance with your significant other, they’re bound to discover these purchases eventually,” she said.

“Financial infidelity can certainly damage a relationship especially if it leads to hidden debt which can quickly spiral out of control.

“Couples who live together should be honest about their necessary and discretionary spending and even share credit scores, especially if you plan buying a home together.”

She said people who had “no idea” about their significant other’s spending habits could “end up paying for it some day”.

Continue the conversation @carey_alexis | alexis.carey@news.com.au