Queensland couple make horror $860,000 mistake

This Queensland family sank $860,000 into a seemingly foolproof investment – but now they are warning others about what went terribly wrong.

A family have had their $860,000 fortune stolen after being strung along for months by an elaborate syndicate of scammers.

Veronica* and her husband, in their late 30s and with three kids, owned several investment properties but were worried Australia’s property market was going to plunge this year as experts predicted.

Consequently, the pair, who live near Brisbane, sold their properties and decided to put that money into an investment opportunity where it could sit until they needed the funds later.

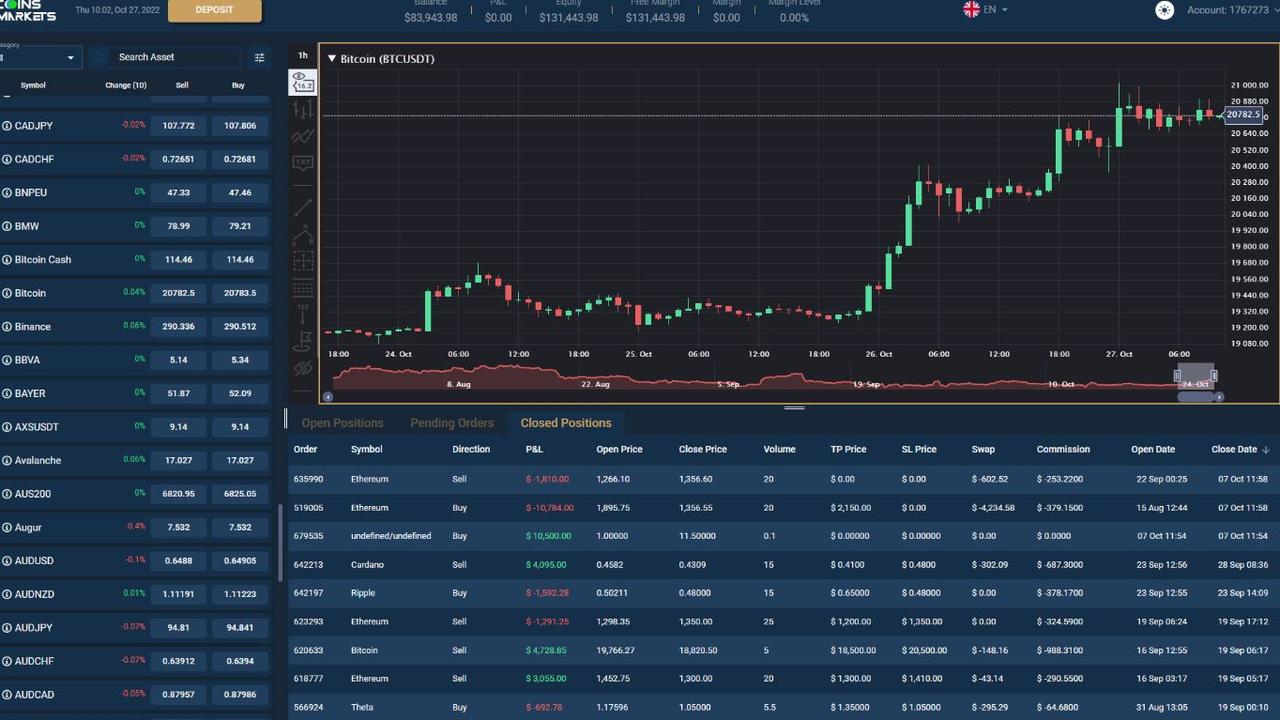

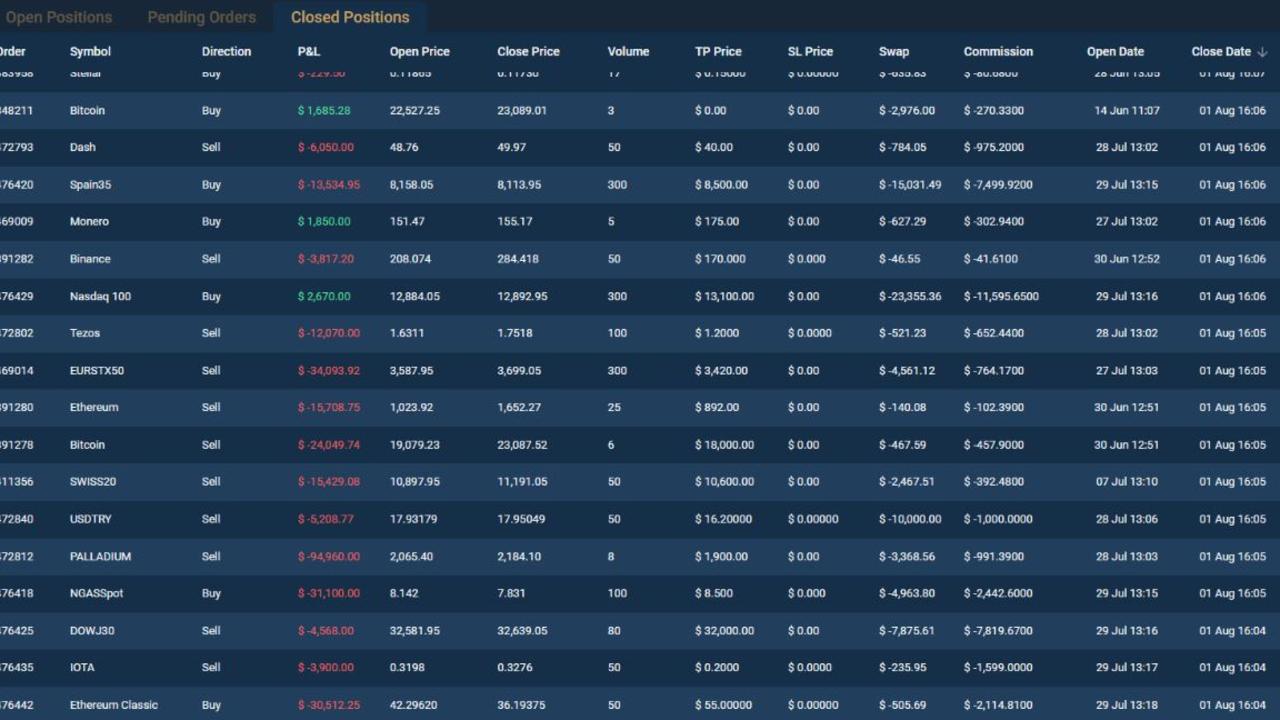

It was here they came across a trading website called Coins Markets, or Coinsmarkets.io, that taught them how to buy stocks and trade cryptocurrency and at one point their balance was sitting at US$700,000 based on the original US$575,000 (A$860,000 at the time) that they had invested.

The company had a sophisticated website complete with a complex login portal and multiple positive ratings across different review sites. Veronica claims her father’s financial broker even recommended Coinsmarkets.io to them.

Convinced, they began investing over a number of months. Everything appeared to be legitimate and they were even able to withdraw their funds when they tried to.

Staff members rang Veronica up to three times a week for half a year to keep her updated on world markets.

But now, nearly a year later, the family have realised it was a scam all along and now fear their money is lost forever.

“I don't think there’s any way of recovering any of it,” Veronica told news.com.au.

Want to stream your news? Flash lets you stream 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer available for a limited time only >

Veronica said her main point of contact were two so-called staff members named Adam Herman and David Hoffman, with European accents. They claimed they were headquartered in Switzerland.

She and her husband started investing in January this year and in total poured US$575,000 into the venture.

The couple were shown how to create a Binance account and then transfer the cryptocurrency into the Coinmarkets platform.

“It appeared to be on paper going really well, they (the trades) had made really solid profit,” she said.

“They (the staff) know everything about trading, they know all about the news, they had to appear good at their jobs so we’d keep investing.

“When you ring them there’s people talking, phones ringing in the background, market briefs, he’ll be talking to a receptionist saying ‘put this stuff on the desk’.”

Do you have a similar story? Get in touch | alex.turner-cohen@news.com.au

The two staff members even showed her how to withdraw her funds, and she took out $2000. Satisfied that she knew how to withdraw her money, she didn’t have the need to try again until she started to notice some red flags in August.

‘Things were going along well until they got us to place aggressive trades that subsequently went bad really quickly,” Veronica said.

“They called to say we had a margin call and we have until the end of today to advise if we will give them another US$115,000 or our account will be closed.”

In hindsight, Veronica says it was obvious it was a “con”.

She thinks the scammers deliberately made her trades go badly on the weekend hoping she wouldn’t be checking her account.

“As fast as we could close the trades the money was disappearing,” she said.

The couple turned down the suggestion of paying a further US$115,000 to keep their trading account online.

Veronica went to a cyber security expert, Nick Savvides, chief technology officer APAC at cyber security company Forcepoint, where her worst fears were confirmed.

He found a number of suspicious activities, such as no phone numbers or physical addresses appearing on the Coins Markets site and a private domain registration that was under the jurisdiction of Seychelles, a country in East Africa. However, the company was not listed under the remit of the Seychelles Financial Services Authority, indicating it was not a legitimate business.

“When I attempt to sign up it says ‘We cannot register you at this time’,” Mr Savvides observed. “This is common with scam sites, they often only want to sign up people who they’ve already got on the hook.

“I wish I had better news but I fear the chances of recovery are extremely low,” he told the devastated couple.

For the last two months, Veronica has been trying to socially engineer the scammers into releasing her funds, but has got nowhere.

She is going public with her story now that she believes there is no chance of recovering her lost fortune.

Since then, more reviews have emerged where others have shared their own experiences with scammers.

Veronica is in touch with a French man who had a similar experience to her and who also lost a whopping amount of money.

“These people are absolute scum,” the unnamed man told news.com.au.

Cyber expert Mr Savvides previously told news.com.au these particular types of scams are “sophisticated” and “well-resourced”.

The money has probably ended up overseas and could be part of an organised crime gang, he said.

*Name withheld over privacy concerns

alex.turner-cohen@news.com.au