Phone bill that exposed Melbourne man’s identity theft nightmare

A Melbourne man was surprised when he discovered a $700 loan he didn’t take out - but when this bill arrived, he knew something was seriously wrong.

A Melbourne man has been living a nightmare for the last three years after his identity was stolen.

The fraud has resulted in more than $7000 of debt racked up in his name, his credit rating plunging and debt collectors “harassing” him for months at a time.

Seth* moved to Hong Kong in 2018 to start a new life and a great new job.

Little did he know the damage had already been done in Australia, with scammers getting hold of crucial details like his date of birth, home address and his driver’s licence number.

He suspects mail was stolen out of his old home and his identity was farmed on the dark web.

“My pleas have fallen on deaf ears and there’s no end in sight,” Seth told news.com.au.

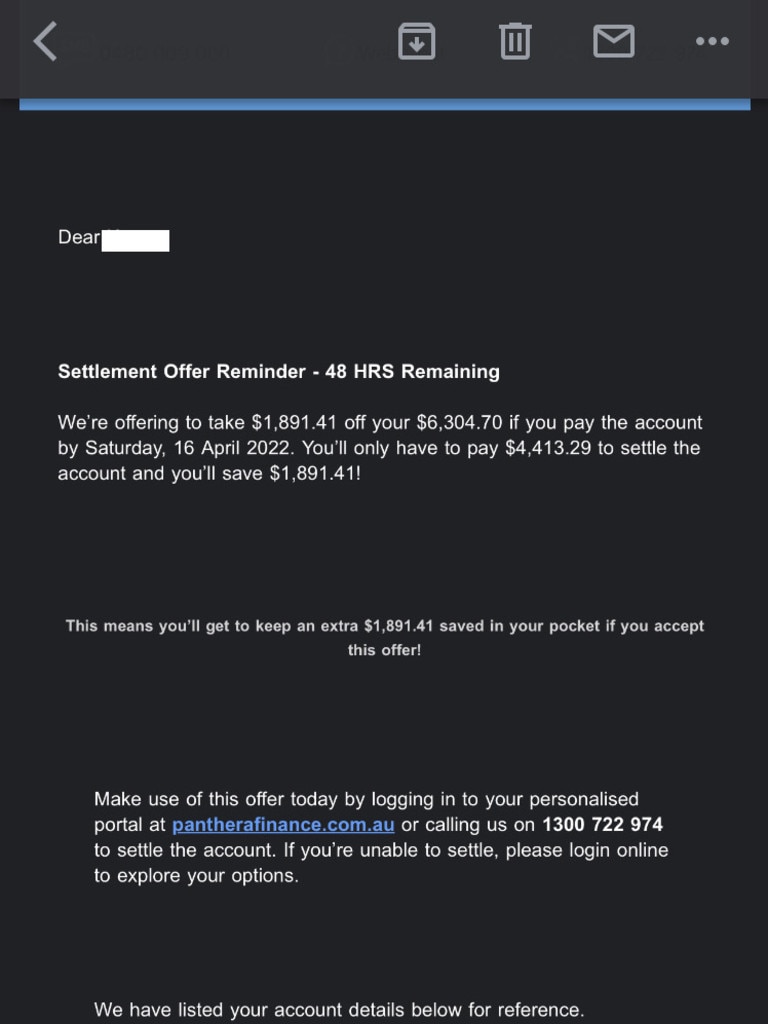

Even though he was targeted twice by scammers way back in 2019, he is still feeling the after-effects, with Australian debt collectors chasing him up as recently as earlier this month, on April 13.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Seth, in his 30s, was shocked when he was trying to buy a Melbourne property in late 2019 and his bank informed him that there was an outstanding loan of $700 to his name.

“I was getting a home loan at the time; that’s how it came to light,” he said.

A cyber criminal had taken out a $700 personal loan from Australian fintech OpenPay and now Seth was expected to pay it back.

For his home loan application, “it threw a spanner in the works,” he said.

For nearly four months, he had to fight to have his name cleared.

OpenPay eventually issued him with an apology in acknowledgment that his identity had been stolen, revoked the poor credit rating they had put on his records and lodged a police report.

The company revealed they were able to hand out the loan because Seth’s name, date of birth and address had matched up with their identification matrix.

Seth thought it was all over, changing his passwords, getting a password manager and informing all the major institutions that he was now based in Hong Kong.

But then at the end of last year, debt collectors approached him over another debt, this time for $6300.

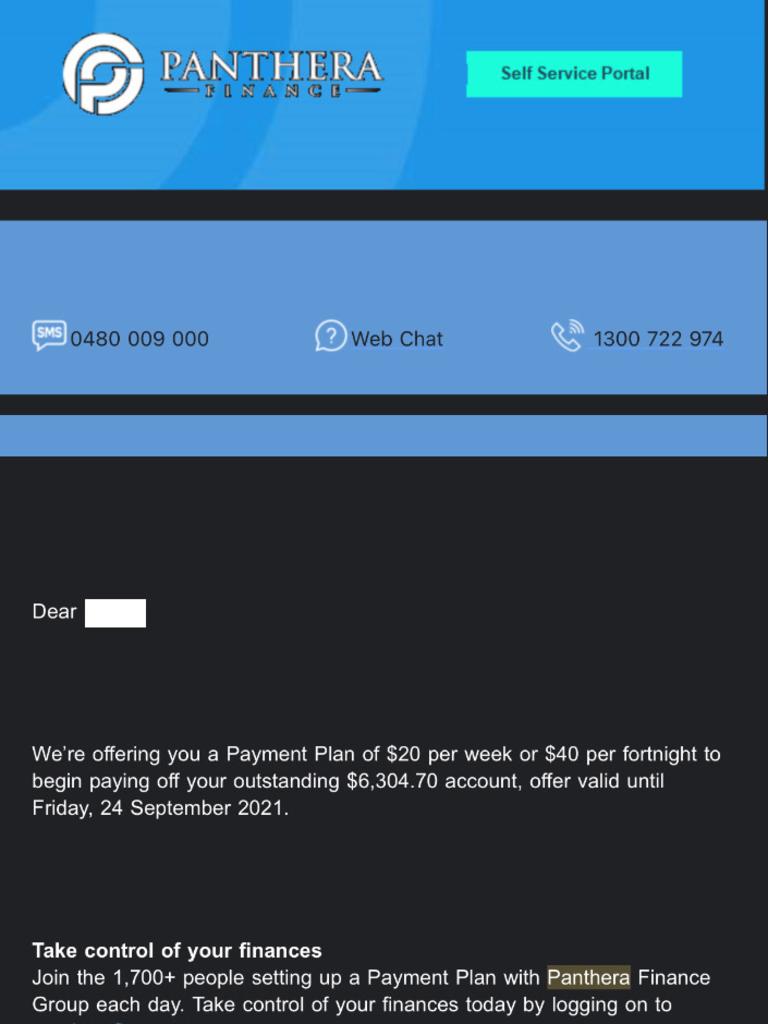

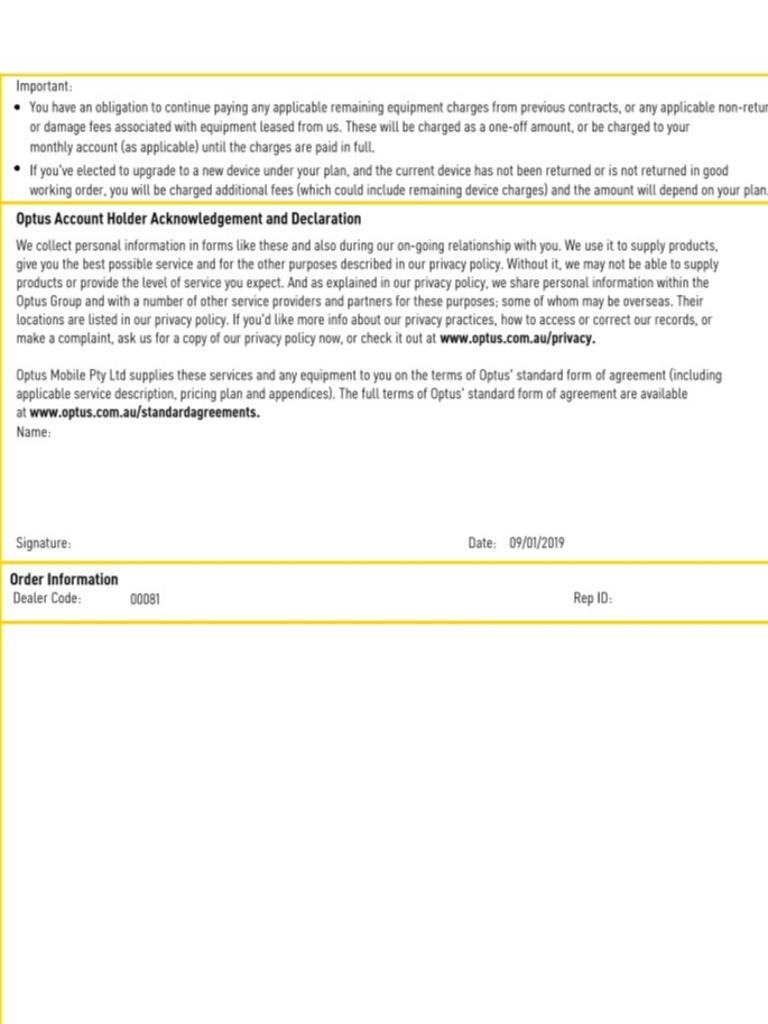

In September last year, Australian debt collection agency Panthera Finance contacted Seth demanding he pay back $6300.

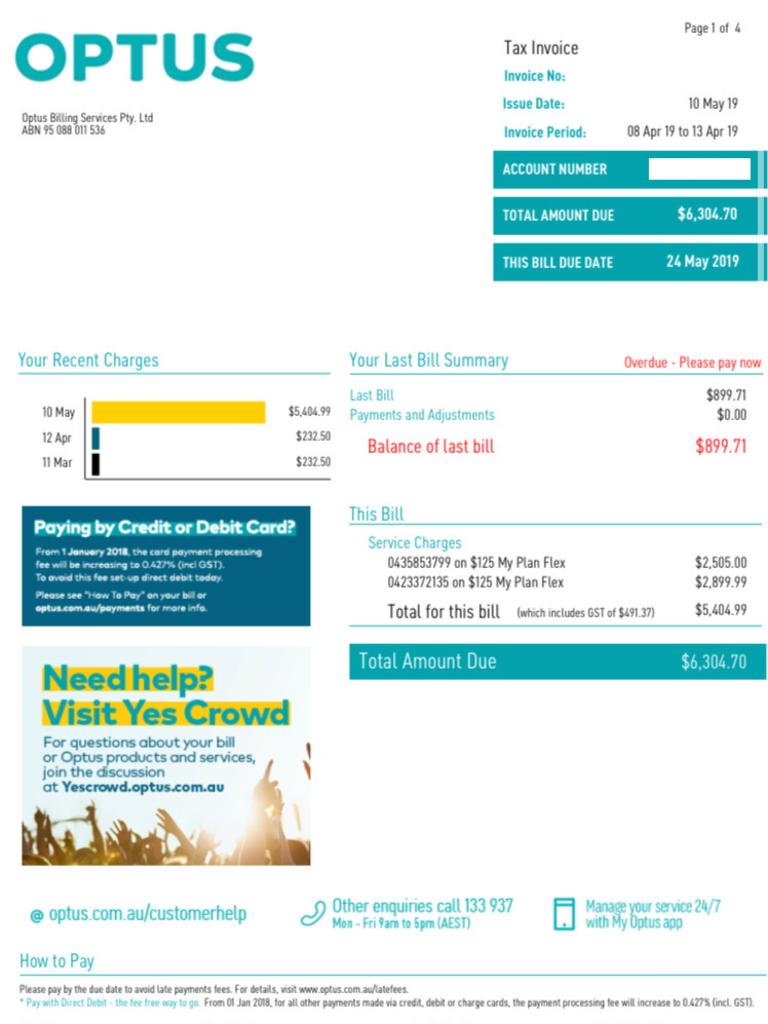

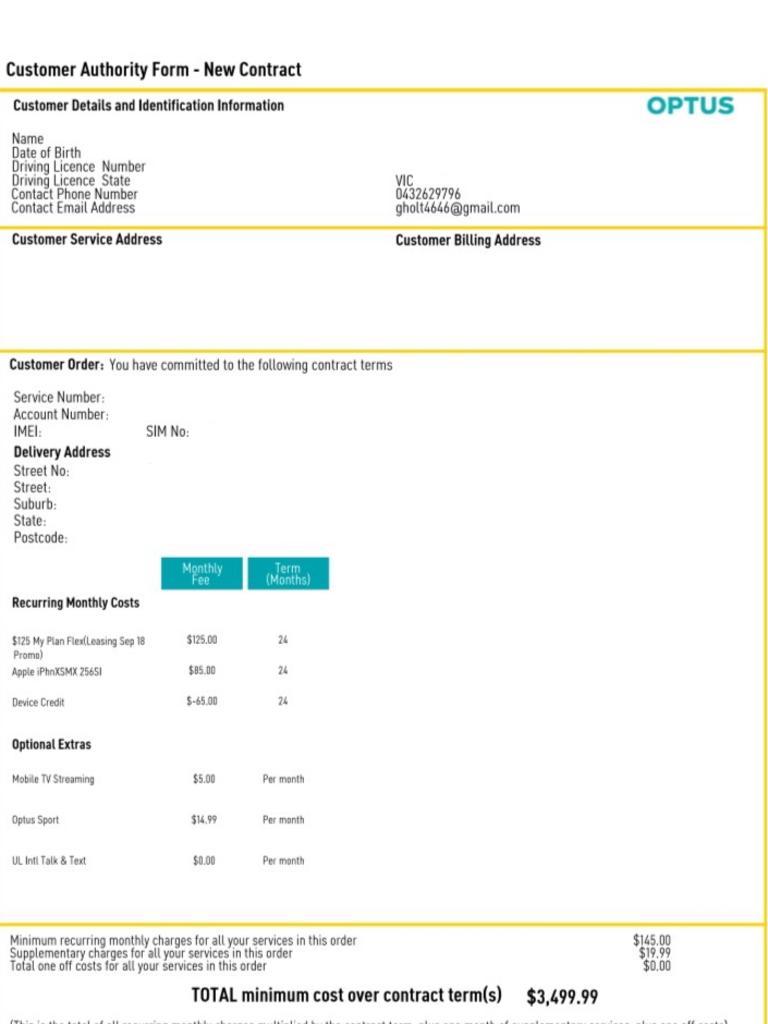

It turned out a scammer had opened an Optus account pretending to be Seth in January 2019 and bought a brand new iPhone X on a 24-month plan.

The fraudster had used Seth’s full name, date of birth, address and driver’s licence number to open the account. They also provided an Australian mobile number and a dummy email address.

Interestingly, the phone was delivered to another address in Melbourne, not to the one where Seth was supposedly residing.

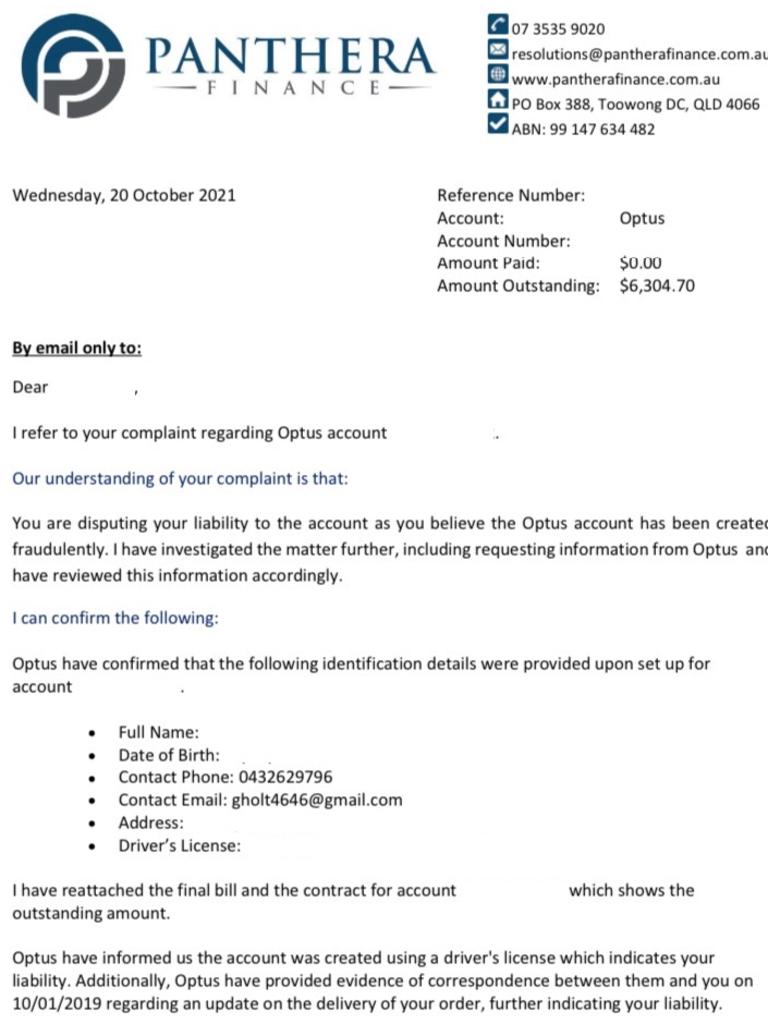

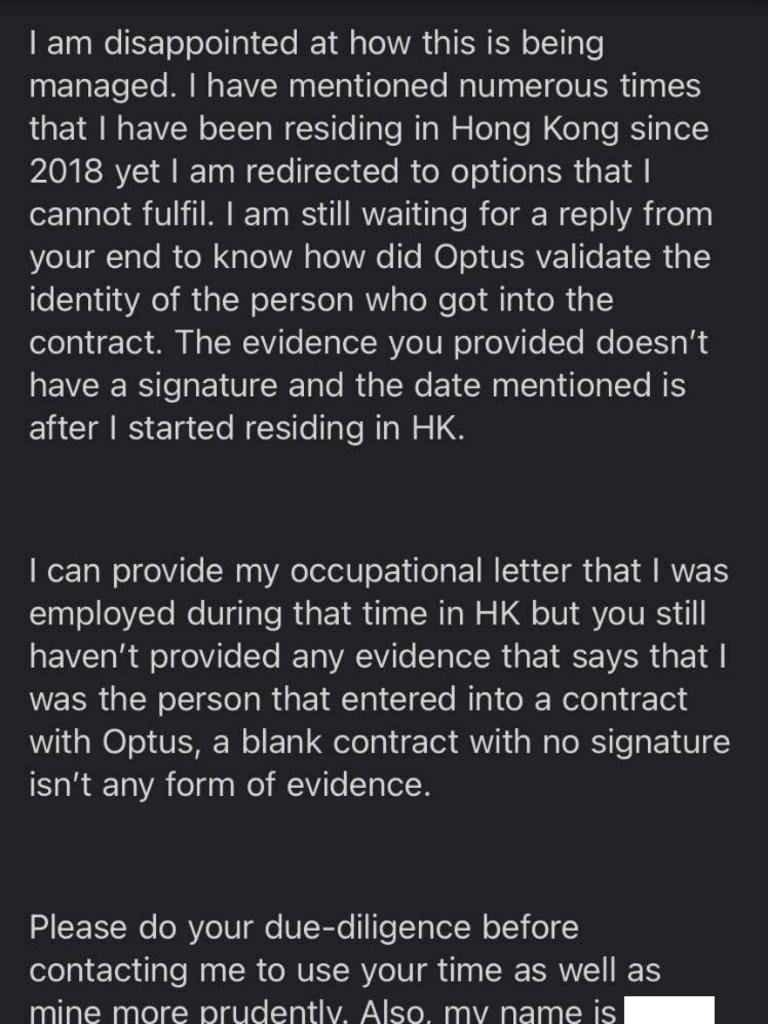

However, Seth has never been an Optus customer in his life and pointed out he had been living in Hong Kong for the whole time.

His Victorian driver’s licence had also expired by then, and he still has the old licence in his possession, making him wonder how Optus allowed the purchase and delivery to go through in the first place.

The total cost of the phone was $3499 but then interest on the debt ballooned out to be $6300.

Optus then got fed up chasing him on the missing payments so sold the debt on to Panthera Finance, a third party debt purchaser.

In September last year, Panthera contacted him about the debt – which was the first time he’d heard of it. Every month since then, they have been asking him to pay back the money and it’s taking a toll.

“The stress and harassment is the most annoying part,” he said. “They haven’t touched my credit rating but I do imagine if they don’t stop, it’s eventually going to go to my credit rating.”

Panthera emphasised that Seth was never put into a credit default listing.

Seth disputed the debt and was supplied with a copy of the contract he had supposedly signed with Optus, but it had no signature.

This makes him suspect that the scammer had his licence number but not a photo of his actual licence, which had stopped them from forging his signature.

Optus honoured the unsigned contract and still delivered the state-of-the art iPhone.

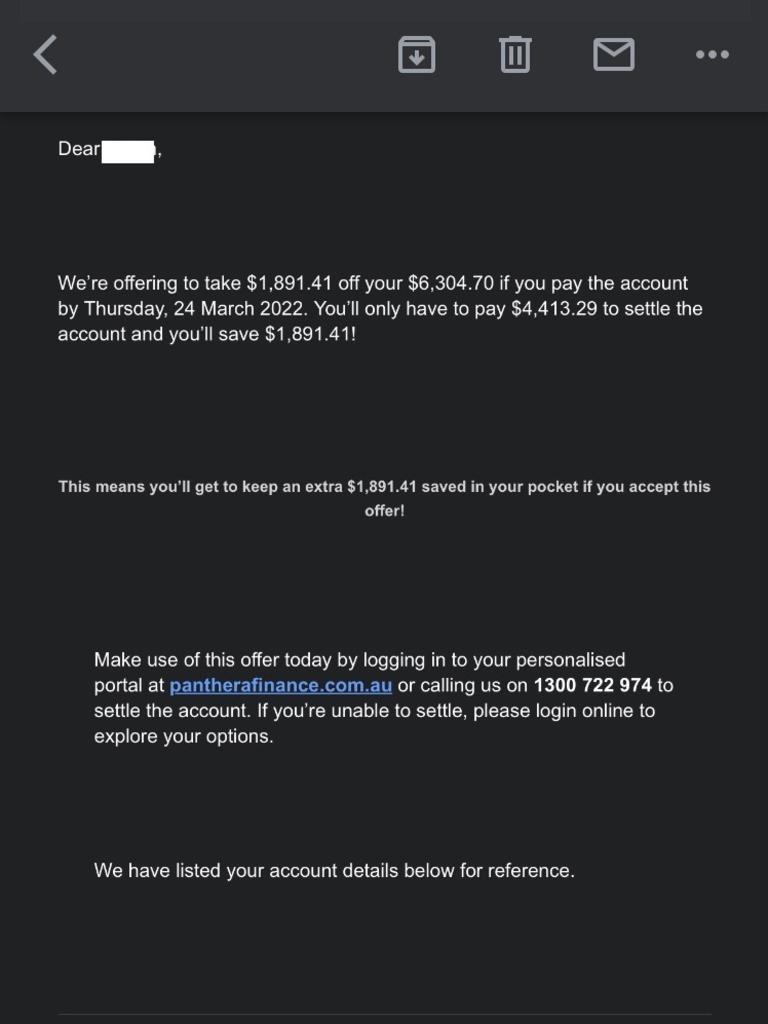

Despite pointing this out, as well as supplying proof he had been in Hong Kong when the iPhone delivery was made and also explaining how his identity had been compromised in the past, Panthera were adamant that Seth pay back the money.

“Optus have informed us the account was created using a driver‘s license which indicates your liability,” the debt agency said in an email exchange supplied to news.com.au.

“Additionally, Optus have provided evidence of correspondence between them and you on 10/01/2019 regarding an update on the delivery of your order, further indicating your liability.

“Based on the information and documentation currently available to Panthera Finance, our investigation to date indicates it is more likely than not that you are liable … As such, the total balance of $6304.70 remains outstanding.”

Seth was told he needed to submit a police report or a statutory declaration for them to open a fraud investigation.

He couldn’t complete a police report as he was based in Hong Kong and said when he looked into a statutory declaration to be used in Australia it was going to cost him more than $1000 which was “unfair” considering this wasn’t his debt to bear.

A Panthera spokesperson said a statutory declaration was usually free of costs and that they were unable to progress with his case until he provided them with more documentation.

“It’s like I’ve been proven guilty and have to prove my innocence even though they don’t have a signed copy of a contract as evidence,” Seth said.

But after being contacted by news.com.au, Panthera Finance waived the debt, letting Seth off the hook.

“Panthera Finance can confirm that no payments will be required in relation to the outstanding account, following a review by our head of compliance and customer advocacy,” a spokesperson said.

At the end of 2020, the Federal Court fined Panthera Finance a whopping $500,000 “for unduly harassing three consumers over debts they did not owe and for misleading one of the three consumers”, according to the Australian Competition and Consumer Commission (ACCC).

ACCC commissioner Sarah Court said: “Consumers were subjected to repeated and intrusive calls from Panthera, and had to take multiple steps to prove they did not owe the alleged debt.”

Authorities received around 100 complaints about Panthera’s debt collection activities in the two years leading up to the case.

That said, the Federal Court and the ACCC concluded that the conduct against the three customers was “limited in scope” and an isolated incident.

The ACCC also noted: “Panthera is a debt collection company which collects debts, on behalf of other businesses and by purchasing non-performing debt for significantly less than its face value and then attempting to recover the full amount.”

Panthera confirmed to news.com.au that they would be wearing the cost of Seth’s $6300 debt.

The company’s head of compliance invited Seth to talk to him if he was unhappy with how they had handled his situation.

Optus wouldn’t comment on Seth’s individual case but said: “Optus, along with the wider telco industry, is working to enhance existing protocols and controls to prevent unauthorised access to customers’ accounts and services.”

*Last name withheld for privacy reasons.

Have a similar story? Continue the conversation | alex.turner-cohen@news.com.au