Nurofen maker accused of making $365 million of tax ‘disappear’

THE company behind Nurofen, Dettol and Clearasil has defended a global restructure that allowed it to avoid paying a huge amount of tax.

AS DONALD Trump so aptly put it, minimising your tax bill is the “smart” thing to do in business.

But his views are not shared by Oxfam, which is campaigning to close loopholes that allow global conglomerates to shift their cash offshore, thus reducing the amount of net tax paid on earnings — in some cases, to zero.

The charity has taken aim at Reckitt Benckiser, the company behind Nurofen, Dettol and Clearasil, which it accuses of a $365 million tax minimisation scheme that robs countries including Australia of much-needed dollars for public health and education.

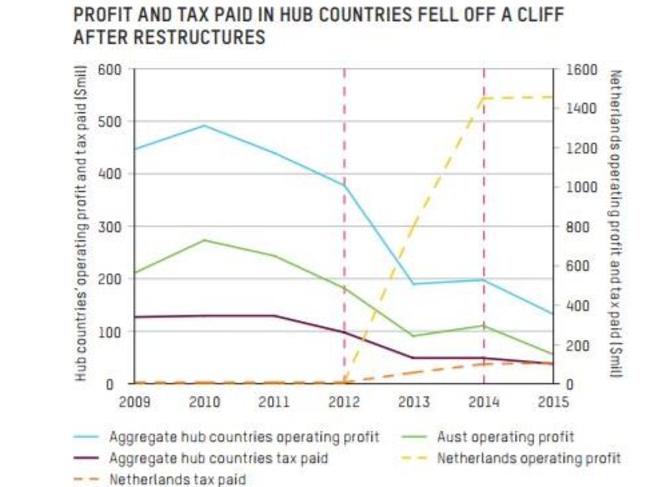

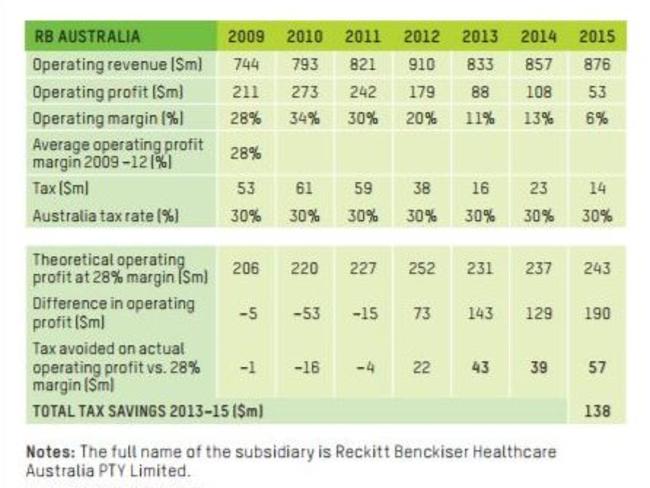

In a report released on Thursday, Oxfam claims that Reckitt Benckiser “manipulated the price of transactions between subsidiaries in order to avoid tax” by “funnelling intracompany transactions through the Netherlands, Dubai and Singapore”.

AUSTRALIA ‘LOST OUT BY $138 MILLION’

After analysing the company’s books, the charity concluded it had restructured the business so that more profit accumulated in these low-tax jurisdictions, rather than in the countries where its core business activity took place – and where tax rates are higher — such as Australia.

“Oxfam is not suggesting that RB has done anything illegal in reducing its tax bills and does not consider RB to be the worst offender, but the impact of the shortfall in tax revenues means less

money is available for essential public services needed to tackle poverty, particularly in developing countries,” the report said.

It also noted the company was “highly successful” and generated $18 billion in revenue from its popular household products last year.

Reckitt Benckiser responded by welcoming the Oxfam campaign against tax avoidance, while insisting it was not doing so and noting that the charity had recognised its approach was “totally legal and the norm for the majority of global businesses”.

“Oxfam is calling for an end to practices that see money funnelled out of both poor and rich

countries alike,” the charity said, estimating that Reckitt Benckiser’s restructure had cost the Australian public $138 million between 2013 and 2015.

$138 m could pay for more than 144,000 emergency ward admissions in our hospitals; or https://t.co/ygf2T2iafk #MakeTaxFair

— Joy Kyriacou (@joykyriacou) July 13, 2017

But the impact was felt more acutely in developing nations like Bangladesh, the report said, where citizens were more reliant on corporate taxes to fund essential services as their domestic economies were simply not up to the task.

The report comes as the ATO cracks down on multinational companies like Google, Apple and Microsoft, slugged with a combined $2.9 billion worth of tax liabilities earlier this year.

New laws passed in March could levy a 40 per cent tax penalty on those who break the rules.

Oxfam Australia chief executive Helen Szoke said the investigation underscored the need for tougher tax laws and greater transparency to tackle “rampant” tax avoidance.

“The case study highlights the widespread problems with a tax system that is robbing Australia of revenue that could be used for healthcare, education and jobs – as well as depriving poor countries of money that could be used to tackle poverty and inequality,” Dr Szoke said.

In Australia, she said, the estimated tax loss could pay for more than 144,000 emergency ward admissions in our hospitals, while in rural Pakistan it could fund a $110 million sewage treatment plant to service more than half a million people.

‘WE ARE NOT AVOIDING TAX’

Reckitt Benckiser denied organising its affairs to avoid paying tax, saying in a statement on Thursday: “We strongly refute the assertion made by Oxfam that RB’s decision made in 2012 to locate its regional ‘business headquarters’ in the Netherlands, Dubai and Singapore was driven principally by tax avoidance.

“Rather, this restructuring was motivated by our desire to ensure that our business was organised to be close to our customers and consumers.”

It said the head office was Europe and North America was combined in the Netherlands, while Russia, the Middle East and Africa were serviced out of Dubai and the Asia Pacific from Singapore.

“We share Oxfam’s belief that it is important for governments, particularly the poorest nations, to have access to sufficient tax receipts to be able to invest in the provision of adequate public services and infrastructure,” the statement said.

“RB has had longstanding partnerships on the ground in developing countries to promote improvements in child and infant mortality, health and hygiene. This is core to the purpose of many of our brands like Dettol, Lysol, Harpic and Durex ... None of our business operations are in any way linked to tax avoidance in developing countries.”

The company said it paid “the right amount of tax in each country where we do business around the world” and that its effective tax rate of 23 per cent was higher than comparable British companies.