How to avoid paying the private health insurance price rise

Almost 14 million Aussies are about to cop a price increase that’ll set them back by hundreds and they are looking for ways to avoid it.

If you’re one of the almost 14 million Australians that hold a private health insurance policy, it’s time to dig it out and review it.

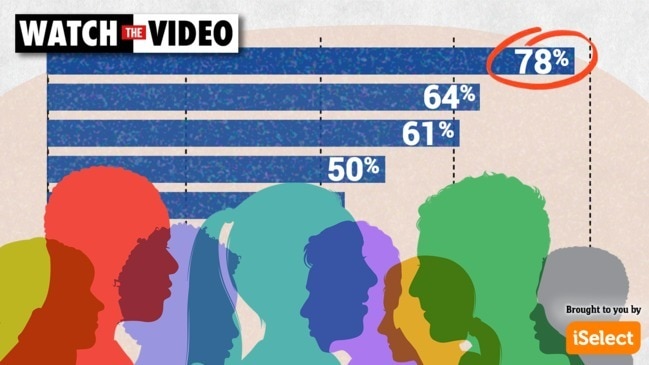

There’s a price hike coming on April 1 that will increase premiums by an average of 2.74 per cent, costing the average family $127 and individual $59 extra a year. And that’s only the average, many health funds – including the big ones – are set to charge a lot more.

Uta Mihm, health insurance expert at CHOICE, says they have received complaints from people who are seeing their premiums increase by more than 10 per cent.

“Private health insurance premiums are rising faster than wages and inflation and many people are questioning their need for expensive health insurance,” says Ms Mihm.

“Premiums have increased by 57 per cent in the last decade. The consumer price index, which is a measure of inflation, grew only 20 per cent.”

BIGGEST AND SMALLEST PRICE INCREASES

This year’s price hike is being touted as the smallest in 20 years, but it’s also the second one inside the space of six months.

In October a 2.92 per cent rise, which was delayed from April due to COVID, was also imposed on health insurance.

Some health insurance providers have already announced how much their premiums will increase by come April 1, including larger funds such as

HCF: an average increase of 2.95 per cent

Bupa: an average increase of 3.21 per cent

Medibank: an average increase of 3.25 per cent

Peoplecare: an average increase of 3.9 per cent

NIB: an average increase of 4.36 per cent

Meanwhile, smaller private health funds have announced negligible increases with St Lukes rising by 0.5 per cent, Health.com.au 0.83 per cent and HBF 0.94 per cent.

HOW TO AVOID THE PRICE HIKE

If you want to avoid paying the extra on your health insurance, you need to act before April 1.

“The easiest way to delay or avoid the premium increase is to pay your full annual premium at the old rate by March 31,” advises Ms Mihm.

“To prepay is especially important if your premium has increased by an above average rate, as you then have a full 12 months to find a better value-for-money policy.”

RELATED: Easy way to save $1,050 a year in one call

SHOP AROUND BEFORE CANCELLING

With the cost of private health increasing year on year, it’s understandable that many people will consider cancelling it altogether to save money but there are some good reasons to hold onto it.

“If you have a recurrent health condition, elective surgery like a hip or knee replacement coming up or are planning to have a baby in a private hospital you can get value from health insurance,” says Ms Mihm.

“Also, if you’re at a risk of needing elective surgery, waiting lists at public hospitals have blown out, so health insurance may currently be a good investment.”

If you do want to hold onto your insurance and paying your full annual premium upfront is out of reach at the moment, Ms Mihm advises reviewing your current policy first to check that it still fits your needs.

RELATED: Key to finding cheap hospital insurance

“What we often see is that people are paying for top cover health insurance for years or even decades without any claims, and when they actually need it they are faced with thousands of dollars in out-of-pocket costs,” she says.

“Extras policies can be bad value, on average people pay more for extras insurance than they get back in benefits.”

Once you have a clear idea of what you need, it’s a good idea to shop around for a new policy and/or provider to ensure you get the best deal possible.

“Avoid comparison sites that only cover a few providers and use pressure sales tactics,” tip Ms Mihm.

“Be aware that as long as you have served a waiting period with your current policy you won’t have to serve it again if you switch to a similar hospital insurance policy.”

“Compare your hospital and extras policy separately, in many cases you can get better value-for-money cover for your specific needs if you take hospital and extras from two different funds – instead of opting for a package policy that’s designed for the average person.”

RELATED:Tax break you need to know about