Experts warn of ‘red zone’ insurance risk as severe weather spreads

Australians have been battered by bushfires, floods and severe storms all in a matter of months – but now there’s a new danger looming.

Australia is still reeling from a series of extreme weather catastrophes – but experts warn there’s even more pain on the horizon.

As this summer’s bushfire crisis recovery continues along with the mammoth clean-up after a series of severe storms and flooding across the country, homeowners are now facing a fresh risk – that of insurance “red zones”.

A red zone exists when a property is deemed uninsurable due to a perceived threat, either by being denied cover altogether or if annual premiums are above 1 per cent of the property’s value, which would be $10,000 a year for a $1 million home.

And as the world is increasingly impacted by climate change, the number of red zones is expected to rise, leaving more and more Aussie households facing a potential financial nightmare.

Leading climate risk analyst Karl Mallon, director of science and systems at Climate Risk, told news.com.au the logic behind insurance was simple – it’s a method of spreading risk, with a high number of people putting some money into a collective pool which can then be drawn on in the unlikely event of a loss.

But as more extreme weather events occur, the cost of premiums for people in at-risk locations will also rise, meaning some might not be able to afford cover at all.

It also makes homes in those areas far tougher to sell, and risks leaving some homeowners “stranded”.

“A flooding event might have happened only once in 100 years, but with climate change that might become every 50 years, which means there’s a good chance it could happen during the life of your mortgage,” Dr Mallon said.

“Insurance is not designed for something that is going to happen, it’s designed for something that’s not going to happen most of the time.”

He said his firm expected the number of properties in red zones to “at least double” based on an increase in “extreme precipitation events causing flooding” as well as the “relatively new phenomenon of coastal inundation”.

That’s when sea water rises high enough that it floods infrastructure and buildings or puts people’s safety at risk.

It's a phenomenon seen recently at Stockton in Newcastle in NSW, with erosion already claiming a kindergarten and a beachside cafe and leaving other properties under threat.

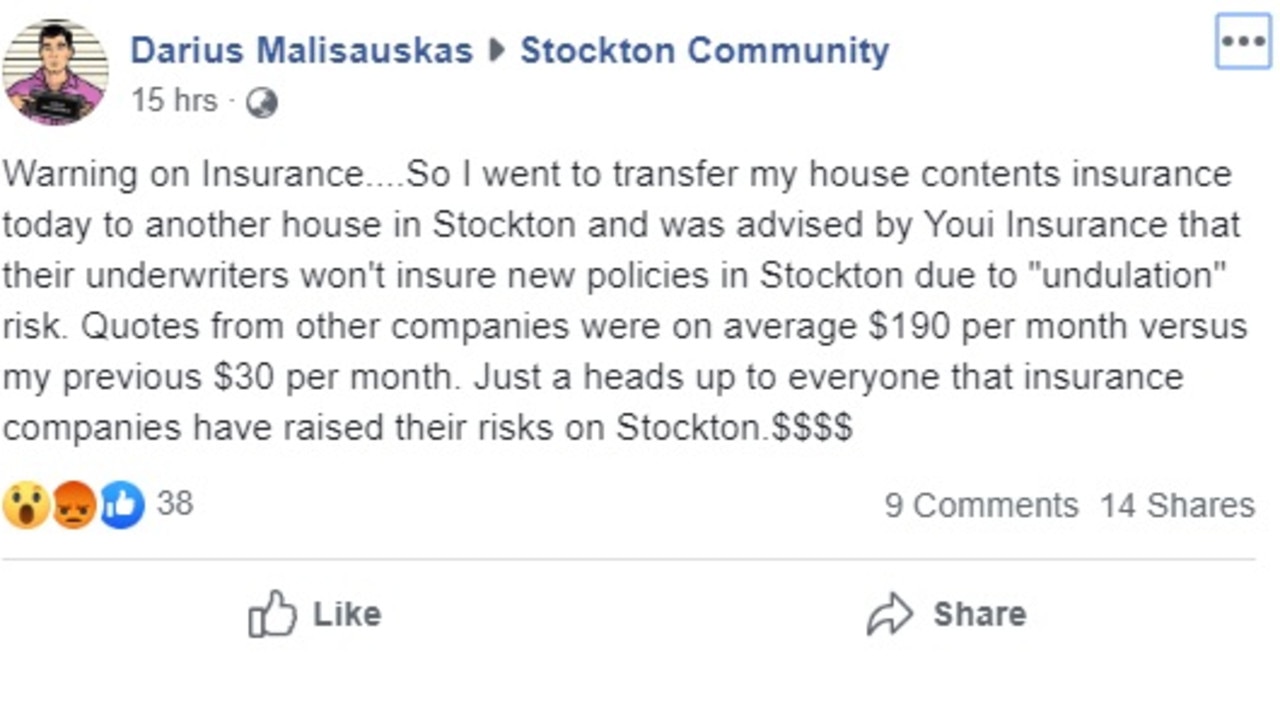

And it seems that local crisis is already costing locals, with one Facebook user taking to a private community group to claim his insurance had spiked.

“Warning on Insurance … So I went to transfer my house contents insurance today to another house in Stockton and was advised by Youi Insurance that their underwriters won’t insure new policies in Stockton … Quotes from other companies were on average $190 per month versus my previous $30 per month. Just a heads up to everyone …”

Others reported similar insurance problems, with some companies apparently considering the area at high risk of inundation and flood.

Dr Mallon said it appeared Stockton had now been pushed into a red zone, but said the red zone threat could be lessened by addressing climate change and also overhauling building standards, increasing emergency management systems, investing in things like fire fighting equipment and flood management systems and relocating infrastructure out of harm’s way.

“Let’s not dress this up – this is about much more than insurance – if red zones expand, then the number of people in area where they can’t afford flood cover will increase,” he said.

“Once that happens … more people will not have the resources to rebuild.”

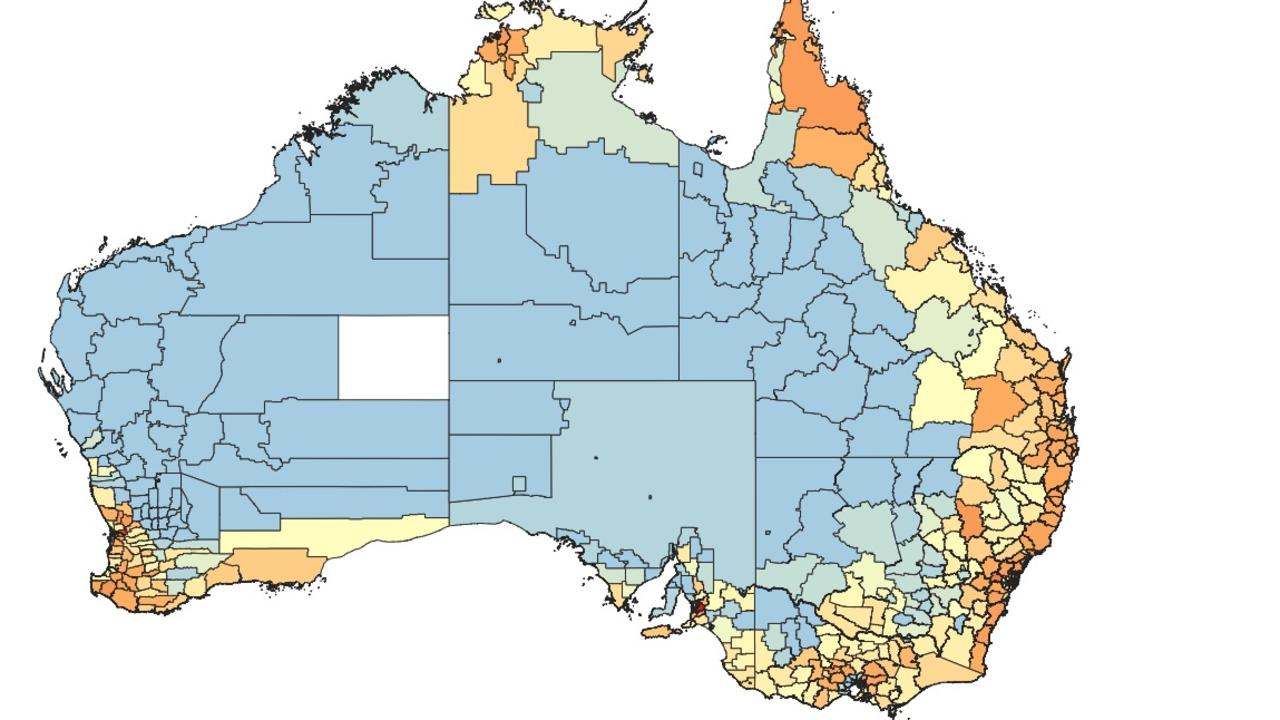

According to a national risk report by Climate Risk’s sister company XDI, the top 10 local government areas at risk from all hazards include the Gold Coast, Brisbane, Sunshine Coast, Fraser Coast, Moreton Bay and Mackay in Queensland, Greater Shepparton and Wangaratta in Victoria and the Tweed and Central Coast regions in NSW.

Dr Mallon said banks could also start factoring in the cost of high premiums in certain areas when assessing mortgage serviceability and refuse home loans, which will in turn leave existing owners “stranded” if they decided to sell.

2000 HOMES RAZED

It’s a concern echoed by real estate expert and Starr Partners chief executive Doug Driscoll, who told news.com.au that with more than 2000 homes razed in the NSW bushfires since August, the economic survival of these communities was at risk if red zones spread as a result.

He said figures released by the Insurance Council of Australia last month showed claims from Australia’s bushfire crisis have exceeded $700 million, although that could easily top $1 billion.

“We only have to look at the insurance cost of the Townsville flood devastation, which peaked at $1.24 billion, to know that both insurers and banks are jittery about insuring or lending on a property that is at risk of flood or fire,” he said.

“We may choose a property, but until we pay down the loan in full, the bank ultimately owns it, so they are right to be nervous.”

He called on federal, state and local governments to introduce a “robust prevention plan”.

“We need to make sure we protect these rural communities, because if the powers that be don’t step up now, they may change beyond recognition and some may be lost altogether,” he said.

“That might seem extreme, but we are already seeing a general pattern of migration from rural areas into metro regions.”

He said while it was wrong to blame insurers for raising premiums based on risk, the government needed to put pressure on insurers to regulate against sharp premium increases in home insurance policies., as well as devise a plan to give banks the confidence to continue making loans readily available for people in fire or flood-ravaged areas.

PROTECT YOURSELF

Sophie Walsh, insurance specialist at Finder, told news.com.au insurance premiums were based on risk, and that insurers regularly review and reassess how new risks will impact a specific area.

“If more break-ins happen in a suburb, for example, home and contents insurance premiums could increase because there’s an increased likelihood of a claim being made,” she explained.

“It remains to be seen whether the recent catastrophic weather events will lead to an expansion of the ‘red zone’, although some research suggests this is likely.

“Usually, if there is an increase in risk, premiums will rise.”

Ms Walsh said shopping around could save you up to $1335 a year, but that it was “vital” the policy covered key threats to your local area.

“Recent bushfires and floods serve as a timely reminder to compare your options to maximise your protection,” she said.

Ms Walsh said red zones were typically uninsurable areas or addresses as deemed by insurers, and that a home was deemed uninsurable not just if a person is refused cover, but also if the annual premiums were over 1 per cent of the property’s value.

“What this means is that the cost to insure properties in these areas would outweigh the cost of replacing the property,” she explained.

“Therefore it is often not financially viable to insure homes in these areas.”