EOFY 2020: Why your tax refund will be bigger this year

Feeling the pinch? There could be some good news in sight, with the tax office set to be more generous this tax time for three reasons.

If the coronavirus crisis has put the squeeze on your household budget lately, you’re not alone.

But there could be a bit of good news in store for scores of Aussie taxpayers in the months ahead.

That’s because the Australian Taxation Office will likely be issuing larger tax refunds than usual for many of us this time around.

news.com.au has launched the Money Project to help Australians deal with the financial impact of the coronavirus.

H&R Block director of tax communications Mark Chapman said there were several reasons why many of us can expect a slightly fatter refund this year.

Here’s what you need to know before you lodge your return.

SCOMO’S $1080

First of all, the Government’s $1080 tax offset is here again, which will give a helping hand to thousands of eligible taxpayers.

But remember, it doesn’t mean you’ll get the cash as a lump sum.

That’s because it’s a tax offset which reduces your overall tax bill, which means you will either get a bigger refund than you normally would, or alternatively, you might end up having to pay less if you receive a tax bill.

It’s worth anywhere from $255 to the full $1080, depending on how much you’re earning – and those who make more than $126,000 won’t get anything at all.

And Mr Chapman said that, just like last year, you “don’t have to do anything” to receive the benefit – it will automatically be calculated when you lodge your tax return.

“That will be an incentive for people to lodge early because some will be desperate to get their hands on their refund,” Mr Chapman said.

JOB LOSSES

The COVID-19 pandemic has decimated our economy and caused countless workers to be stood down or dismissed.

But while it has been devastating for affected employees, there could be a small silver lining come tax time.

“A lot of people who have lost their job over the course of the year and who have experienced financial stress will be really keen to get their tax refund ASAP,” Mr Chapman said.

“And they may well get a bigger that refund than usual.

“It may well be that their employer over-deducted tax – the way it works is that the employer deducts tax assuming you’ll be in the job for the whole 12 months or 52 weeks, so if you lose your job nine or 10 months through the year, it’s very likely they’ve taken out too much tax during those months which could lead to a bigger refund.”

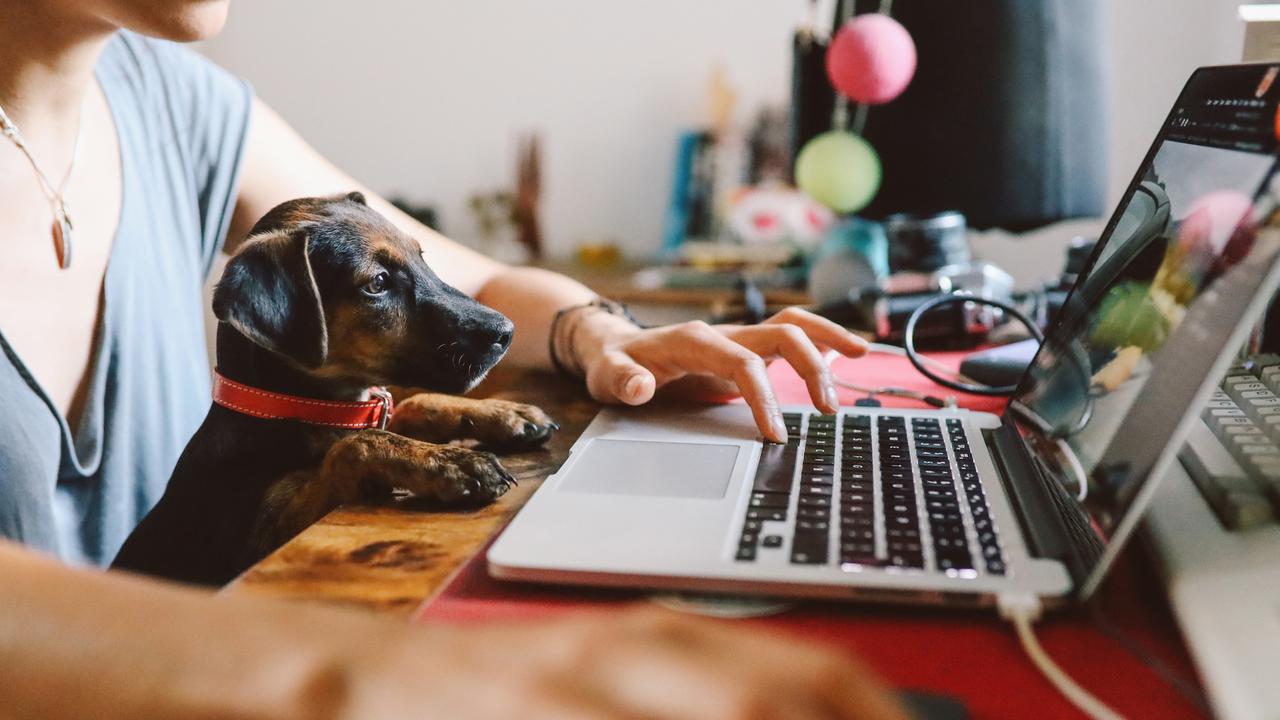

WFH DEDUCTIONS

Finally, with hundreds of thousands of Australians working from home during the coronavirus lockdown, there will likely be a surge in certain tax deductions – leading to a larger refund for many.

“We’re likely to see some deductions in what people claim this year spike in terms of working from home expenses compared to previous years,” Mr Chapman said.

“A lot of us have been working from home full-time so there’s bound to be a bit of a spike in those claims.”

Just last month, the ATO revealed it was rolling out a new working from home shortcut to make it easier for people to claim deductions.

The special new arrangement will allow people to claim a rate of 80 cents per hour for all their running expenses, instead of calculating costs for specific running expenses as taxpayers would under normal circumstances.

Multiple people living in the same house can claim this new rate individually, and it is no longer a requirement to have a dedicated work from home area in order to claim.

The change means taxpayers will be now able to choose one of three ways to calculate their additional running expenses for the period of March 1 to June 30.

They include claiming that rate of 80 cents per work hour for all additional running expenses, claiming a rate of 52 cents per work hour for heating, cooling, lighting, cleaning and the decline in value of office furniture, plus calculating the work-related portion of your phone and internet expenses, computer consumables, stationery and the decline in value of a computer, laptop or similar device, or claiming the actual work-related portion of all your running expenses, which you need to calculate on a reasonable basis.

Mr Chapman said it was “worthwhile having a conversation with a tax agent” to find out which of the three options would be best for you.