Damning detail in what’s driving rising prices in Australia

What is actually driving inflation in Australia? New research has revealed a shocking finding.

Rising prices in Australia are actually driving corporations’ profits to record highs amid a cost-of-living crisis, damning new research has found.

The Australia Institute released the shocking findings in a report on Monday, saying that it is actually the corporate sector that needs to tighten its belt to control inflation, not workers.

“The national accounts show it is rising profits, not rising costs, that are driving Australia’s inflation,” Australia Institute chief economist Dr Richard Denniss said.

“While companies are arguing that they have ‘no choice’ but to increase their prices, the fact that they are making record and rising profits is proof of how many choices they really have,” Dr Denniss said.

“It’s a shortage of competition, not a shortage of skilled labour, that is driving up the cost of living in Australia.

“Wages made no contribution to Australian inflation in 2019-2020, or 2020-2021, and accounted for only 0.6 percentage points of the 4.1 per cent increase in prices so far this financial year.”

The country’s inflation rate is sitting just above 5 per cent, according to the Australian Bureau of Statistics. It is tipped to hit 7 per cent by end of year.

The Australia Institute copied a methodology used by the European Central Bank to analyse the role of profits in driving inflation.

German economist Isabel Schnabel, who serves as executive board member of the European Central Bank, said in a speech in May “many Euro area firms, though by no means all, have gained from the recent surge in inflation”.

“On average, profits have recently been a key contributor to total domestic inflation, above their historical contribution,” she said.

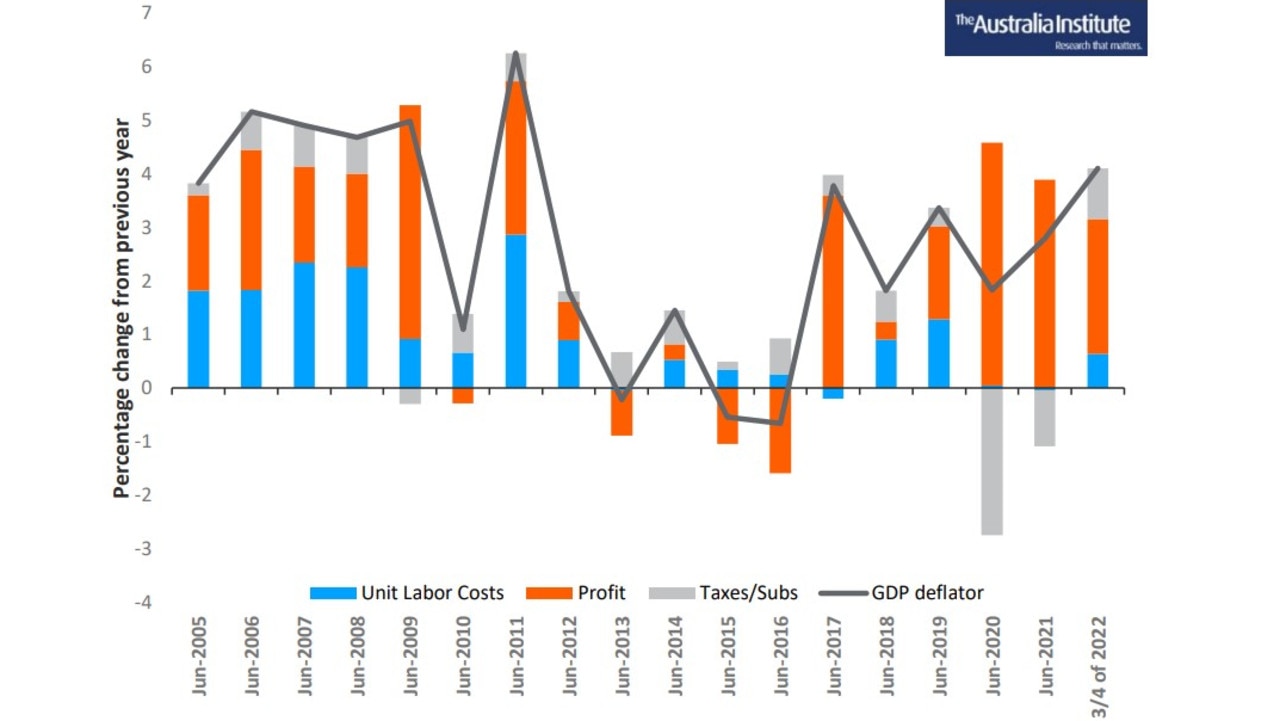

The Australia Institute applied the bank’s methodology to Australian annual data for the financial years 2005 to 2021 and quarterly data from June 2021 to March 2022, as this was the most recent data available.

The report said the Australian data “provided even more stark results” than the European Central Bank’s had.

The researchers found labour costs played an insignificant role in the recent increase in inflation, accounting for just 15 per cent of economy-wide price increases while profits played an overwhelming role, accounting for about 60 per cent of recent inflation.

In conclusion, the report said: “Wages have played a trivial role in driving inflation in Australia in the last three years. Higher profits have played the dominant role over that same period.

“The distributional consequences of record high profits and record low real wage growth have been widely discussed but the data presented above suggests that rising profits are now the major driver of inflation.”