Bingo Saving Challenge: How to save $1000 by Christmas

Savers around Australia are joining in a new challenge to stash away cash and the best bit is, it’s as easy as playing a game.

Whether you’re saving for something big like a house deposit, building a nest egg or just want to get ahead for Christmas (it’s 30 weeks away), a clever savings trick could get you to your goal quicker.

And if you start now you could save just over $1,000 by the end of the year or $5,000 by this time next year.

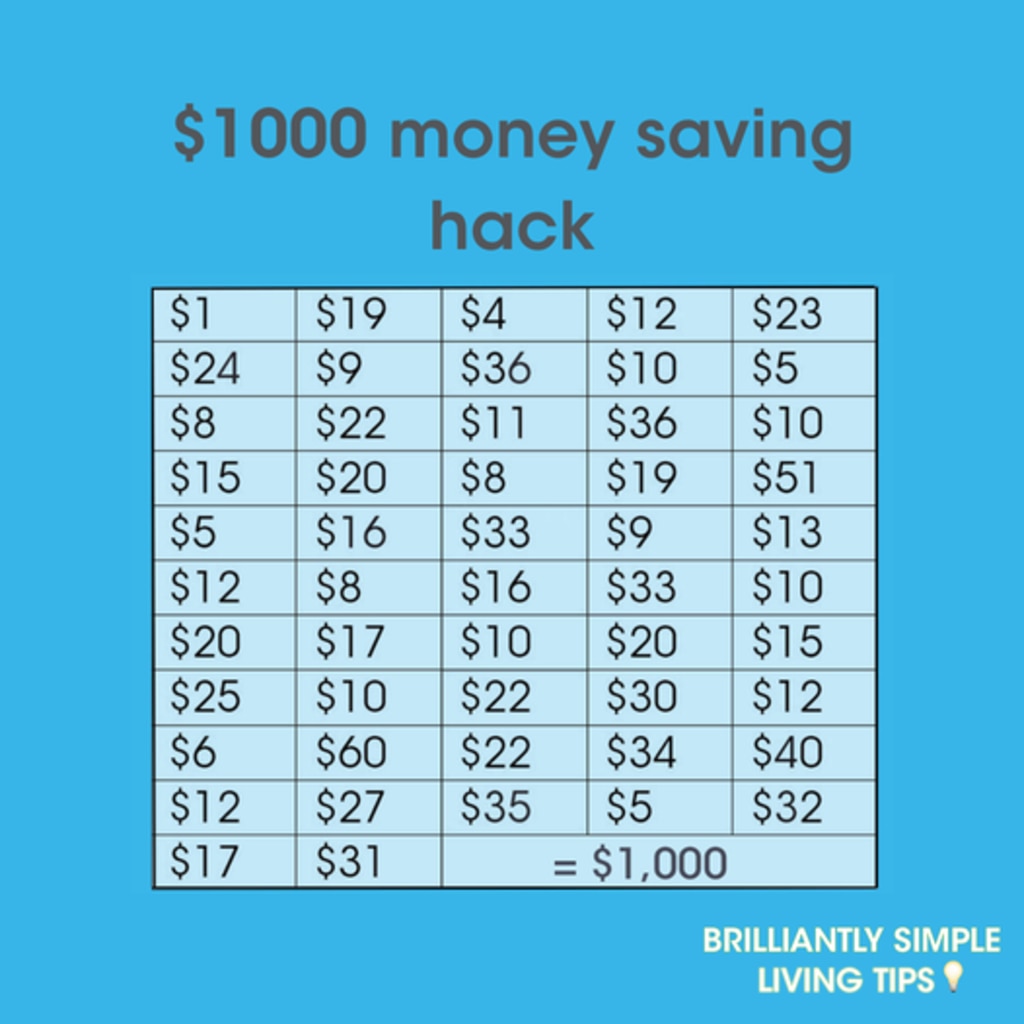

The Bingo Saving Challenge has taken off on social media, with fans saying it’s the easiest way to save big bucks.

How the 2021 Bingo Saving Challenge works

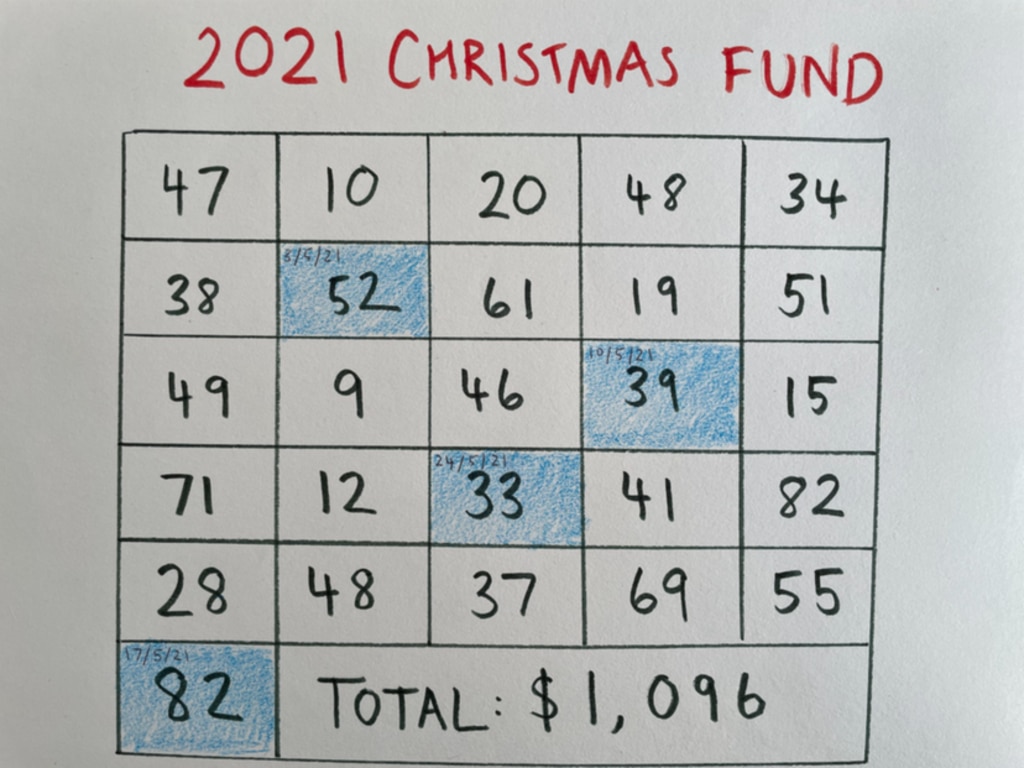

To take part in the 2021 Bingo Saving Challenge, all you have to do is create a 26 box grid with a number in each, like in the image below, print it out and put it somewhere prominent to remind you.

Each box represents the remaining weeks until Christmas 2021 because who wants to be saving during Christmas week?

Once you’ve finished a box, you colour it in and write the date in it to keep track of your saving, then repeat until your card is full.

Every amount is under $100, ranging from $9 up to $82, so should be achievable for most people who, if they stick with it, will have $1,096 saved by Christmas.

The Bingo Challenge is proving to be a big hit on social media with many sharing their success and banks and energy companies as well as money, finance and mums groups are creating their bingo board templates for people to print off and play along.

RELATED: Savings tactic we need to stop

“I have done this before and I barely missed the money,” said one Facebook user.

“It’s saving and it’s fun,” said another.

While another added, “This is definitely the easiest way to save money and it’s a bit of fun.”

Even experts are into the challenge, “I love this idea!” says financial coach Jane Walters.

“It’s essentially gamification of savings, which is a great way to make savings fun and help motivate you to keep going.”

Although she does urge those taking part to stick with it, “My concern would be that some people would lose interest before you actually reach Christmas which is why I like automating finances more, but doing it online and with other people could help start a good habit and keep the momentum going.

“I’m all for finding fun new ways to get people interested in their money.”

RELATED: Secret to avoiding winter bill shock

What to do with the money you save in the 2021 Bingo Saving Challenge

Once you’ve started saving, what should you do with the money? Those who’re already on the challenge have shared that they’re doing everything from stuffing it into an envelope to paying it into a bank account.

Ms Walters recommends doing whatever feels right for you, “In an ideal world, and one where interest rates were higher, an online savings account is best. But I always say the best solution is the one that makes it easy and that you’re most likely to stick to,” she says.

If you’d prefer paying your savings into a bank account she recommends thinking through what you need before opening a new one.

“For a basic savings account, you want to aim for the highest interest rate, no fees and, if you struggle to save, make sure there is a separation between your new savings account and your day-to-day spending account.

“Some banks motivate you to save regularly by providing bonus interest. Make sure you know the ‘rules’ of these accounts before deciding if that works for your cash flow and personality type.”

RELATED: Hidden cost of green home energy