Aussie mum exposes the hidden cost of using a bank card

A viral Facebook post has revealed the reason Australians should start paying with cash instead of cards.

An Aussie mum has revealed the reason people should be paying with cash instead of cards.

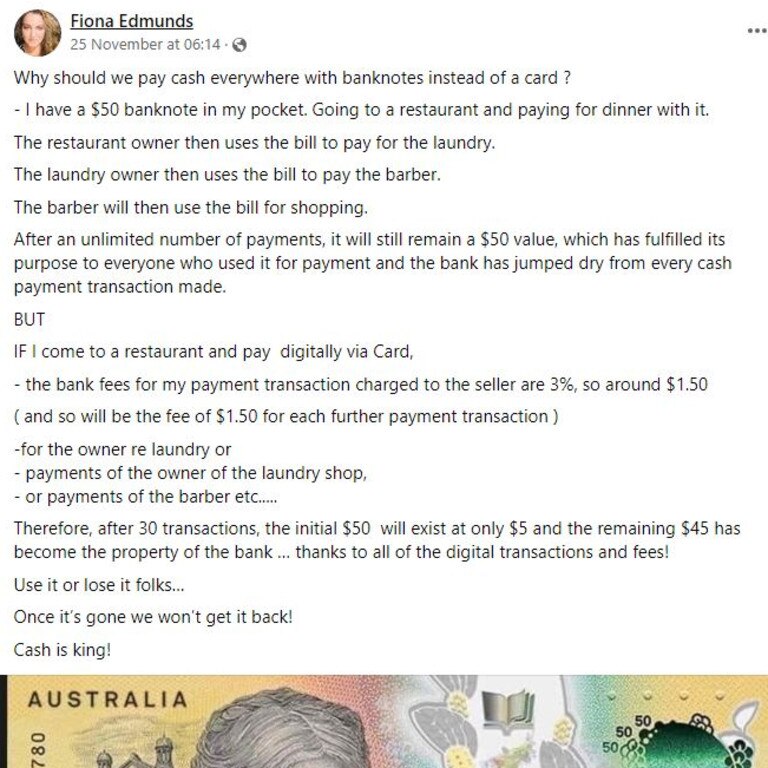

Fiona Edmunds, from Brisbane, took to Facebook to explain how physical money will retain its value regardless of how many times it is used.

However if you were to pay with a card, bank fees are applied and the store owners would be forced to pay surcharges.

“I have a $50 banknote in my pocket and I go to a restaurant and pay for dinner with it,” Ms Edmunds wrote.

“The restaurant owner then uses the bill to pay for their laundry. The laundry owner then uses the bill to pay the barber.

“After an unlimited number of payments it will still remain a $50 value which has fulfilled its purpose to everyone who used it for payment.

“BUT if I come to a restaurant and pay digitally via card, the bank fees for my payment charged to the seller could be up to 3 per cent or $1.50.”

Read Compare Money's guide to common credit card mistakes and how to avoid them >

The mother-of-three pointed out that a similar figure would be charged on every other transaction using that original $50 if the card holder pays via tap-and-go.

“Payments made by the laundry shop owner, the barber and so on,” Ms Edmunds continued.

“Therefore after 30 transactions the initial $50 will exist at only $5 and the remaining $45 has become property of the bank.”

With every purchase, banks and credit card companies take a small percentage of the original $50 until with enough transactions, it becomes theirs.

“Use it or lose it folks … cash is king,” Ms Edmunds said.

The Facebook post has gone viral with 19,000 people sharing the social platform.

According to the Reserve Bank of Australia, the surcharges businesses pay banks or credit card companies to use their payment services — known as merchant fees -have declined over recent years.

“However, consumers are making more payments with cards than ever before, which is raising total payment costs for merchants,” the RBA said.

“Smaller merchants also face notably higher card payment costs per transaction than larger merchants.”

It means a local cafe is paying more of their earnings in fees than a large department store which turns over a lot more money and can get fee reductions.

Businesses are allowed to pass on surcharges to customers to cover merchant fees but the amount cannot exceed the fee amount.