Aussie company loses $50k from single scam call

A day before a West Australian man lost $50k, the power went out. It created the perfect storm for a scam that would “cripple” him.

A Western Australian man couldn’t have known that a single phone call would spell disaster for his business for years to come.

It was past 8pm on a Friday in 2022 when one of Wade Brown’s staff rang him in a panic because they’d noticed $50,000 had left the company’s bank account.

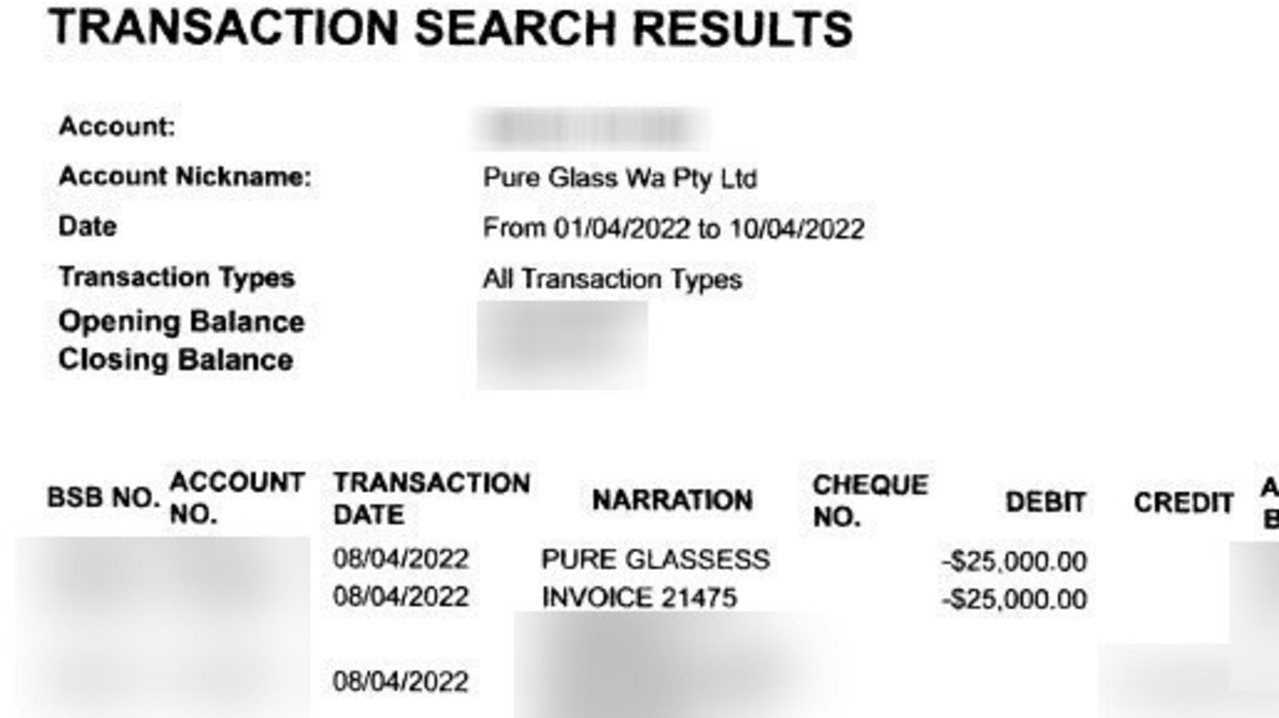

Mr Brown, from Margaret River, south of Perth, is the director of Pure Glass WA and he saw that two transfers of $25,000 each had been funnelled out earlier that afternoon without his authorisation.

The money had been sent to an AMP account with PURE GLASSESS, spelt incorrectly, and INVOICE 21745 was put down as the description for the transactions.

Mr Brown quickly alerted his bank, Bankwest, and managed to get what money remained in his accounts frozen. His bank told him they would alert AMP over the weekend.

Nervous by their response, the boss took matters into his own hands by contacting AMP himself that night and was assured the funds would be unlikely to clear until Monday.

But that didn’t end up happening – the bank did not stop the transaction going through and the scammer ended up with the sum total of their stolen proceeds.

“It almost crippled us,” Mr Brown said. “$50,000 is a lot in any small business.”

However, Bankwest claimed they alerted AMP within 35 minutes of Mr Brown speaking to the fraud team.

In the two years since the hack, Mr Brown has exhausted every avenue to get his money back and is finally turning to the media.

At the time, Bankwest declared they were not liable to pay the missing $50,000 because they said the fault was with his business.

“We are not able to reimburse you the recovered amount,” the bank wrote in a hammer blow.

So Mr Brown lodged a claim against Bankwest with the Australian Financial Complaints Authority (AFCA).

AFCA ruled in the bank’s favour, finding the fault lay with Pure Glass WA and therefore the bank should not have to reimburse the money.

Mr Brown is no longer a customer of Bankwest. “I hate banks,” he added.

He said “it could have been a lot worse” and was glad there wasn’t more money in the business accounts when the hacker gained control.

Have you been scammed? Get in touch | alex.turner-cohen@news.com.au

Mr Brown is still trying to figure out how the hack happened to cause AFCA to make a finding in Bankwest’s favour.

The day before the theft, the internet went down at Pure Glass WA. This created a perfect storm because it meant when someone called claiming to be from their internet provider, Telstra, one of Pure Glass’ employees believed it.

It’s understood this caller was actually a fraudster. But they were able to provide details of the company’s modem and said they were calling about ongoing modem issues.

The bank claims a Pure Glass employee was coaxed into downloading software that gave the scammers control of the company’s computer. However, Mr Brown said this was not the case.

But even if the scammer had infiltrated their computers, Mr Brown said it shouldn’t have been possible to drain money from the business account of Pure Glass WA.

A token code must be input into the system for any transaction and this code is generated by a dongle that is inserted into a computer’s USB port.

The dongle is kept in a separate locked room that couldn’t have been accessed by the employee who was on duty at the time.

It changes the code every minute or so, according to the business owner.

“I tried to do two transactions without a security code,” Mr Brown said. “It’s impossible.”

Yet the bank claimed that the scammer was able to obtain the funds using a token code sent to the registered mobile number.

A Bankwest spokesperson would not comment specifically on Pure Glass WA but said in a statement to news.com.au that keeping customers’ finance secure “is a priority”.

The bank added it is “accelerating investment” into technology to stop fraud and claimed it “does everything it can to prevent or recall funds lost to scams”.

An AMP spokesperson said “this does seem like a case that would benefit from further investigation” and they encouraged Mr Brown to get in touch with them.

“AMP recognises our important role in working with regulators and other banks to help protect the community from fraudulent activity, and like other organisations, we’ve uplifted and improved our own systems and practices to protect consumers.” they added.

alex.turner-cohen@news.com.au