A third of Aussies believe they will always be in debt

Thousands of Australians caught up in turmoil over debt and the rising cost of living say they fear there’s no way out and will carry it forever.

Australia might be termed the Lucky Country but with a third of Aussies saying they believe they will always be in debt, maybe it’s only lucky for some.

Almost 30 per cent of respondents to the latest news.com.au Cost of Living survey say they are struggling with debt to such an extent that they believe they’ll be carrying it for the rest of their lives.

The detailed survey, which ran in February, asked readers to share the major household money challenges they were facing. The results are now in and news.com.au has kicked off The Money Project, revealing the financial hardships and tests Australians are facing as well as offering practical advice on how to get your money shipshape in 2021.

More than 10,000 people responded to the survey, with 91 per cent saying they carry credit card debt, almost half of which totals more than $5,000. Conversely, only 38 per cent of respondents have more than $5,000 in savings.

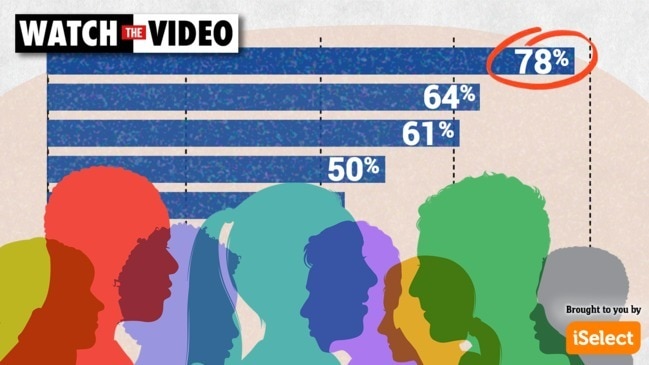

As part of the survey, respondents were asked if they felt they were on ‘Struggle Street’, ‘Barely Coping’, ‘Doing OK’ or on ‘Easy Street’ based on how they felt they were faring financially – and the impact of bills came up again and again for readers.

Those on ‘Struggle Street’ and ‘Barely Coping’ are 41 per cent and 121 per cent respectively more likely to believe they will always be in debt.

Australia has world’s second highest level of debt

If this is you or you’re in a similar situation, you’re definitely not alone, says Fiona Guthrie CEO National Debt Helpline, a not-for-profit service that helps people tackle their debt problems.

“We see around 100,000 clients face-to-face each year,” she explains. “Australia has the second largest ratio of household debt to income in the world and there’s about two million Australians living in households of high financial stress, this is a big problem that’s very hidden.”

“People can feel so overwhelmed when they’re in debt that they can feel like there’s no light at the end of the tunnel. But they do have options and they have more options than they realise.”

The latest figures from The Organisation for Economic Co-operation and Development (OECD), show the ratio of Australian household debt to net disposable income stands at 217 per cent – meaning the average household owes twice what it makes in a year. The Bank of International Settlements puts Australian household debt at 119 per cent – second only to the Swiss.

RELATED: Hidden detail costing Aussies billions

Getting out of debt

If you are struggling with debt Ms Guthrie suggests speaking to your creditors in the first instance, then contacting the National Debt Helpline for further assistance.

“Sometimes when people are struggling with debt, they go out and get more debt. When you’re overwhelmed, you don’t always make good financial decisions. The other warning is not to go and pay for-profit providers to help you get out of debt or fix credit records, talk to a financial counsellor, we can put your mind at rest,” she says.

“We can tell you about your rights, tell you what bankruptcy means, tell you how to negotiate repayment arrangements, talk to you about whatever your situation is.”

Of course, opening up about your debt can be easier said than done, especially because talking about money is still a taboo in our culture.

“I often say we are more likely to talk about our sex lives than we are to talk about our financial lives,” says Ms Guthrie.

“That’s part of the problem, people can feel as if it’s a personal failure but we are in a society that encourages over commitment and makes it too easy to become overcomitted. Credit is a really complex product and it’s miss-sold.”

The complexity comes from the lack of consistent regulation around different credit products. Buy now pay later, payday loans, credit cards, personal loans and peer-to-peer lending all have different rules and, if you hold several of these products, you could be subject to due dates scattered throughout the month, making money management at best difficult.

That said, not all debt is to be avoided. Money saving guru Belinda Hogan, who is chief financial officer of smartbank 86 400, says it’s important to understand the distinction between ‘good’ and ‘bad’ debt.

“Good debt is debt that is helping you in the long term. For example, a mortgage to buy a house that rises in value will help you grow your wealth over time. It also might include debt to fund education, such as through HECS-HELP loans, as it enables you to increase your future earning potential,” she explains.

“Bad debt is generally debt to buy depreciating assets — these are things that may help you now (like a car or a holiday) but don’t provide a long term financial benefit. Sometimes this can be a bit grey, for example, if you need a work ute for a new job but don’t have the cash right now. Always consider whether there’s a cheaper alternative that does the job and requires a smaller loan or no loan at all, even if it doesn’t quite have all the bells and whistles.”

This will be music to the ears of the 16 per cent of respondents to the Cost of Living survey that said HECS debt was their most intimidating future cost.

RELATED: Woman reveals big budgeting myth

A spending versus saving culture

A greater understanding of credit and a shift in attitude towards saving is what both Ms Guthrie and Ms Hogan believe we need to redress the balance of personal debt in Australia.

“We’ve moved away from having a savings culture to a spending culture and we need to rebalance that,” states Ms Guthrie.

“When you go and apply for a loan at a bank, they ask you to fill out an expenditure and income statement, but none of them have line items for saving. Having a little bit of money set aside and being able to save is one of the most important things that we know helps financial wellbeing.”

RELATED: Combining energy bills could save hundreds

How to build strong money management skills

For those wanting to improve their money management skills, Ms Hogan shared the following tips.

– To take control of your money, review all of your expenses and work out what can be removed or reduced. Start from the biggest to smallest, and then call and ask for a better deal on the bigger expenses, like electricity, insurance, phone and internet. For the others, work out if there’s anything you can go without, such as multiple streaming services, gyms, or frequent takeaway.

– Your mortgage shouldn’t be set and forget, keep an eye on your interest rate and shop around for the best deal.

– Set up separate accounts for groceries, bills, emergency funds, and whatever your saving goals are, like a new car, holiday, or renovation. Decide how much of your pay will go into each account and set it up automatically either through your payroll or bank.

– Be realistic about what you can afford and the lifestyle you can enjoy. Understanding your money story and values, and that of your partner, is really important to making sure you feel in control of your finances. What’s a splurge for one person is a non-negotiable for another.

– Be consistent. Small changes and good savings habits will add up over the long term, but don’t get frustrated or stop if you’re not seeing immediate changes.

– Give yourself a guilt-free splurge budget and use it to save up for the purchases you really want but aren’t big enough for a dedicated savings account. If you feel guilty about buying that new pair of jeans, you’re more likely to spend more to feel better. This way it might mean waiting a week or two but feels so much better when you reach the goal.

If you’re struggling with debt reach out to the National Debt Helpline for free financial counselling and advice.

Read more stories about the Cost of Living here.