‘A better deal for consumers’: Why banks will soon be forced to say nice things about you

IF YOU’RE dealing with a bank, telco, insurance company or utility any time soon, there’s something you need to know.

IN JUST over three weeks, big changes are coming that could have serious consequences the next time you apply for a personal loan, mortgage or credit card — and most people are still completely in the dark.

From next month, comprehensive credit reporting (CCR) will become mandatory, meaning banks will be forced to share detailed positive and negative financial history with other lenders.

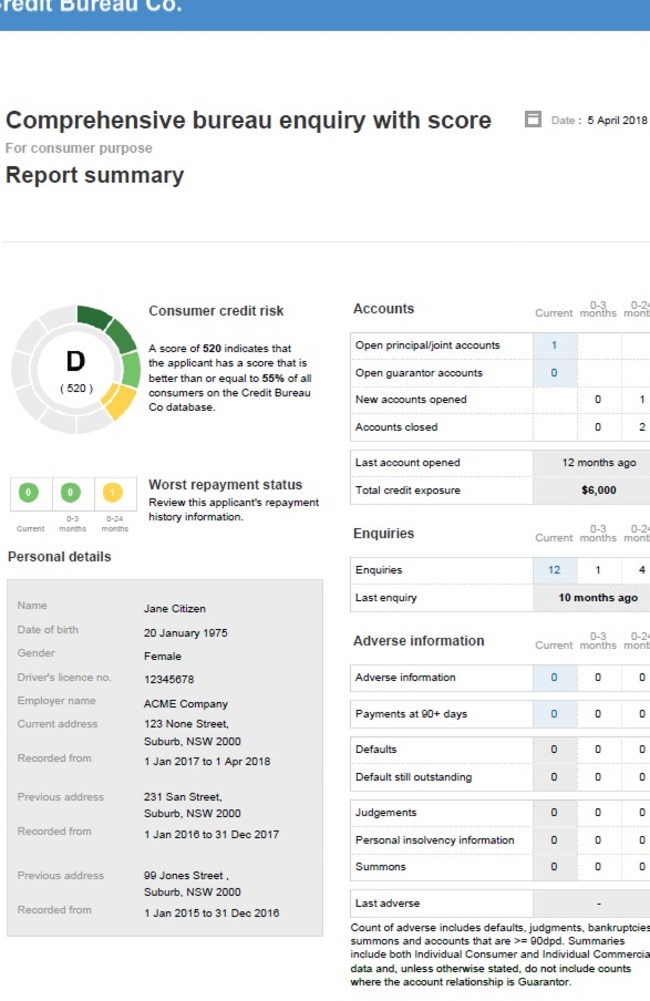

Currently, most lenders only share negative information such as credit applications, defaults, overdue payments, bankruptcy and court judgments. Under the new system, they will also have to share positive information, such as when you made all your repayments on time.

“The introduction of mandatory positive information means a history of making regular payments, repaying a loan early or closing unused accounts, can help a borrower demonstrate their creditworthiness and ultimately be rewarded with a better deal from lenders,” said Daniel Foggo, chief executive of peer-to-peer lender RateSetter.

Technically CCR has been around since 2014, but with the Big Four largely refusing to take part, Treasurer Scott Morrison was forced to step in to make CCR mandatory from July 1, 2018.

Mr Foggo said the new laws would likely result in most borrowers seeing their credit scores increase due to the extra information shared by financial institutions with the three credit reporting agencies, Dun & Bradstreet, Veda and Experian.

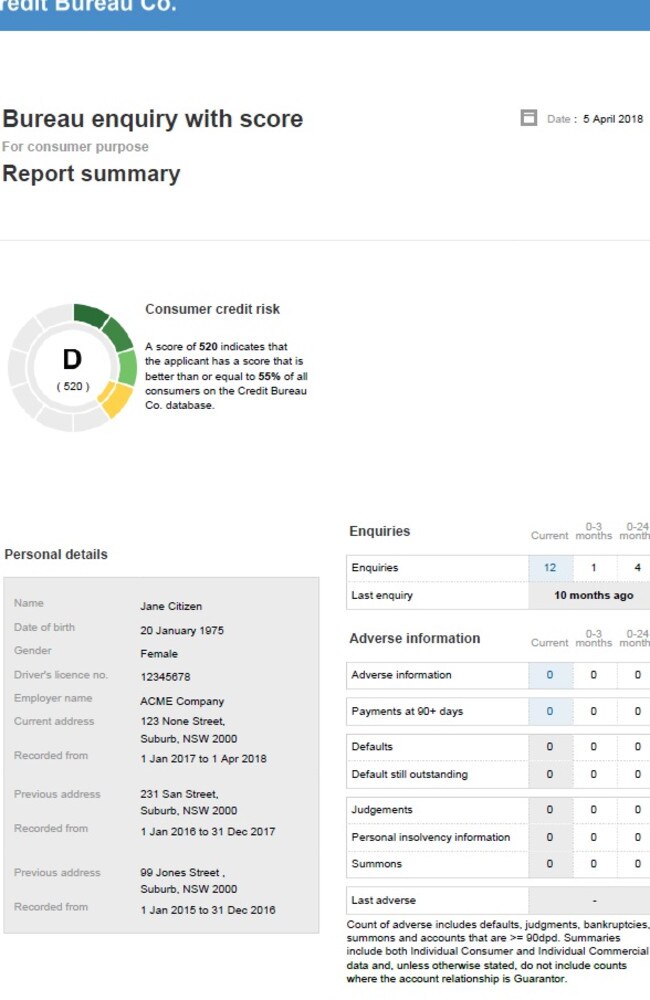

Most credit scores sit between 300 and 750, and a higher score is better. It gives you more leverage to negotiate a better deal from banks, telcos, insurance companies and utilities. Consumers with a low score may find it harder to obtain credit, or they may be charged a higher interest rate.

“Following the rollout of comprehensive data, we would expect that most people will actually see their credit score increase,” Mr Foggo said.

“Currently credit files are paper thin, and this means that scores generally inflate risk because there’s not much information to use. If we use early anecdotal evidence here in Australia and experience of lenders in the UK as an indication, we could expect most people to increase their credit score.”

The lender, which has already implemented CCR, estimates that the difference between a credit score of 500 and 800 could be as much as 5 per cent a year on an unsecured loan.

Sydney woman Gaynor McTaggert, 31, said she saved around $2500 on a car loan because she managed to get a lower interest rate due to her clean history. “I initially took out a $10,000 personal loan and was able to pay it off fairly quickly,” she said.

“Then I took out another $15,000 personal loan to buy a car, and the interest rate was extremely low due to the fact that I had a proven credit history. I was able to take a larger loan and pay it off over a shorter period.”

The most important thing people can do to make the most of the CCR system is to pay their bills on time. But according to research commissioned by RateSetter, two thirds of people are unaware of the coming changes.

Awareness was significantly lower among women, with only 25 per cent aware of the changes compared with 40 per cent of men.

The 30 per cent of people who were aware of the changes, however, said it would positively change the way they managed their finances and they would be more likely to pay bills on time and repay loans promptly.

Ms McTaggert said she wasn’t aware of the benefits of positive credit reporting until she applied for her current loan. “People generally aren’t aware [that they can] get access to lower rates,” she said.

“I think it’s a really positive initiative which will ensure banks’ accountability and it will reward those with good credit ratings with more options and lower rates.”

Mr Foggo said CCR had the potential to significantly increase competition in the market and meant a better deal for consumers on loans. He said RateSetter had been “eagerly waiting for the banks to share their data so we can reward borrowers who have already proven they can manage their finances”.

Not everyone is happy about the changes, however, with consumer advocates warning the risk of Australians’ data falling into the wrong hands will increase.

The Consumer Action Law Centre pointed to the embarrassing revelation that Commonwealth Bank lost the personal financial histories of 20 million customers stored on tape drives.

“Credit reporting is already a mess of bad data, confusing processes and poor oversight,” Consumer Action chief executive Gerard Brody said last month.

“We’re about to see a major expansion in the collection and sharing of data that will have serious impacts on people’s lives.

“More time is needed before we can be confident in the growth of data sharing by big banks. Regulators need to be better resourced, and have the power to ensure accountability.

“Robust systems must be in place to ensure people are not disadvantaged by data sharing. Treasurer Scott Morrison has the power to stop the data disaster and make sure banks get it right.”