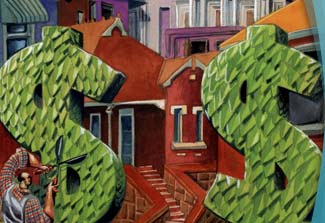

Tricky lenders fooling borrowers

POTENTIAL borrowers are being warned about tricks used by some lenders to win business after the latest interest rate hike.

Tricky lenders fooling borrowers

AFTER the latest interest rate rise, potential borrowers are being warned about some of the tricks used by some lenders to win business.

Rates Mates Mortgages co-founder Michael Lee said that some lenders regularly delayed their rate increases by a month or so, leading borrowers to think they were getting a better deal.

However, because of the time it takes to finalise a loan, by the time the loan is ready to be settled, the lender's rate had moved up.

"Even though a lender intends to increase their rate, they are not required to advertise it in the headline or comparison rate until they actually change the rate,'' Mr Lee explained.

"Borrowers usually find out too late and are locked in by heavy exit penalties.''

Mr Lee said that this was known as "holding back'' and the practice had come to the attention of the Australian Securities and Investments Commission last year.

Consequently, some lenders now reveal their intention to lift rates but usually this intention is only put in the fine print, Mr Lee said.

He said that those borrowers who intend to fix their rate should make sure it is locked or capped during their application.

Unlike variable loans, fixed rates are not subject to decisions by the Reserve Bank, and rise and fall at the whim of the lender, he said.