Sydney marketing manager Queenie Tan shares how she built $350,000 net worth

She’s only in her 20s but this Sydney woman has built up a sizeable sum of money in just five years. She shares how to save your hard earned cash.

Sydney woman Queenie Tan, who has accumulated a net worth of $347,000 in five years, is sharing her biggest financial mistakes to help out others.

The 24-year-old is part of a new generation of FinTok influencers offering financial advice to the younger generation.

She started her YouTube channel in March 2020 and joined TikTok in June last year sharing personal finance tips, tricks and wins, and her losses, including a dud crypto trade over four years ago.

The marketing manager, who purchased her first property in 2019 for $500,000 and lives with her boyfriend, has recently shared the biggest money mistakes she has cut out of her life.

1. Buying cheap quality technology and appliances

Most of what Ms Tan bought for her apartment was really good quality like her oven, dishwasher and coffee machine, but one of the cheapest things was the kitchen rangehood, which acts as an exhaust fan.

“I really regret it as we probably saved $100 not getting an expensive one or not getting a better quality one but we will probably end up having to replace this one day as it really doesn’t do this job,” she said.

“Sometimes, it is a better financial decision to spend a little bit more on something that will last you a longer amount of time.”

Her first vacuum cleaner cost $100 and it never really worked properly even when it was brand new. So she said it’s better to spend a few extra hundred of dollars to get a really good quality of piece that can last many years, rather than having to replace something three or four times.

RELATED: Model’s baby plans not ‘financially viable’

2. Difference between being frugal and cheap

There’s nothing wrong with trying to get the best deals and reducing your electricity, internet and phone bills, but when it comes to her friends and family she isn’t cheap, she said.

“I do like to spend money on people who are important to me. I like to shout my friends and my family lunch and coffee and things like that, I like to go on holiday and spend money on things like that because those are the things that are really important to me,” she said.

“I think that being cheap is more like being stingy, not spending money on yourself or your friends or your family, because you are always thinking about money and I don’t think that being frugal is cheap.”

Being frugal is about looking for value for money and time, she added. She said her dad is an extremely frugal person but has good values when it comes to money and relationships and friendships.

When she was a child, he would buy her a box of ice cream from the supermarket, rather than going to the corner store and spending loads of money – but when it came to a big family dinner in a restaurant he would sneak off to the bathroom and pay the bill, which could be around $600 to $1000

“Sometimes going to a bit more effort to get something for a cheaper price and get more value for money is definitely worth it but when it comes to friends and family it’s important to spend a bit more money,” she said.

RELATED: Millennials better savers than Boomers

3. Invest in items that will grow in value

Ms Tan admits she’s a big Facebook Marketplace user, because furniture depreciates really rapidly and can sell for 50 per cent less than the retail price. She brought an Ikea ladder for $15 off marketplace, rather than spending the full price of $30.

“The reason why they didn’t want it anymore is it literally didn’t fit into their apartment so I got a 50 per cent discount and already had everything built for just by shopping on Facebook Marketplace,” she said.

Second hand cars are also a good investment, rather than picking up something up brand new, she added.

This strategy can also apply to clothes and good quality technology too.

She advises people to invest money into the stock market and property to deliver a passive income in the future, which would allow them make money while they sleep and potentially retire early.

“Some assets that I like to buy quite regularly are ETFs,’ she said.

An exchange-traded fund is a type of investment fund and exchange-traded product.

ETFs give you a way to buy and sell a basket of assets without having to buy all the components individually, and they often have lower fees than other types of funds.

4. Live below your means

Don’t splash the cash if you get a pay rise, she advised.

“I know it can be really tempting to go out there and treat yourself as soon as you start earning extra money, but I think it’s important to avoid increasing your lifestyle all that much when you get a raise,” she said.

“It’s important to try not to increase your lifestyle that much so you can save and invest a lot more money for your future and retire early and have a lot more financial independence.”

Choose the Toyota Camry and not the Tesla, she added.

Ms Tan, who listened to audiobooks to educate herself on financial matters, also encourages other people in their 20s to lock in a full time job, set up a side hustle and start saving before jumping into investments.

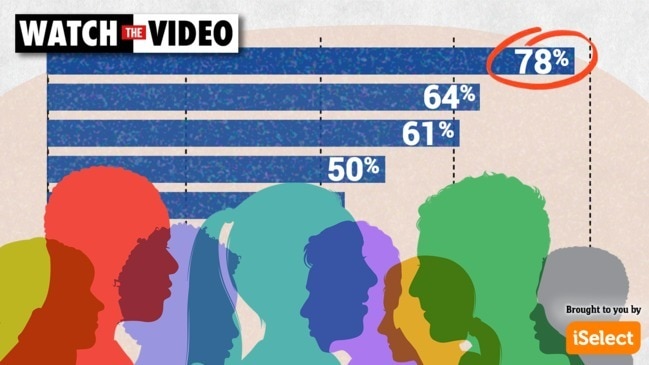

She is popular among Millennials with 90 per cent of her audience under 35 watching the content she shoots out of the second bedroom in her Sydney apartment.

Stock, cryptocurrency, an offset account, savings and superannuation make up some of Ms Tan’s wealth, while she makes also money from YouTube ads and affiliate links with organisations like Up Bank, Cashrewards and trading platform Stake deliver her extra money through her social media channels.

She revealed that she uses $5000 from six sources of income as well as equity from her apartment to make investments each month.