‘Out of control’: The spending habit threatening your savings

Australia is buckling under the soaring cost of living pressures – but this forgotten spending habit might be crippling your savings.

As Australia’s inflation rate is set to peak at 7.75 per cent – Australians are buckling under the soaring cost of living pressures.

And as the cost of your daily groceries and petrol prices continue to gouge your savings, new research by ANZ Plus has shown that most Aussies are losing control of their finances.

But it’s not just the rising cost of your daily necessities that are threatening your savings, said ANZ Plus team member Danielle Curry – it’s the apps on your phone.

The ‘treat yo self mindset’ and click spending

It comes to no surprise that spending habits have dramatically changed over the past decade.

Uber Eats, Afterpay services, the rise of online shopping and the ‘must-have, must-do, insta-worthy’ spending trends mean now more than ever, social media and mobile apps are driving the desire to spend money as easily as possible.

And according to the research, Australians in recent years have consistently “overspent” the most on eating out and takeaway, with 53 per cent of Aussies noting that their top expenses were food-related.

“There’s this real immediacy of spending that is becoming very normal for Australians,” Ms Curry explained.

“And especially during the pandemic, we saw a lot of restaurants convert to home delivery services so people were still ‘eating out’ but just a bit differently.”

And as lockdowns saw the nation turn to working from home, a noticeable surge in online shopping (35 per cent) and subscribing to streaming services (19 per cent) comprised the top three categories Australians were overspending on.

“And with the advent of things like buy now, pay later services it has really allowed that real immediacy of spending,” Ms Curry added.

“Twenty years ago you couldn’t order something from Amazon and have it arrive the next day … so if you’re not tracking your expenses, are you really sure exactly how much you’re spending on things like Amazon?”

Out of control

Ms Curry noted that one of the most concerning findings of the ANZ research was that a third of Australians “find it hard to stay on top of their finances” with 1.5 million of them admitting that they “don’t feel in control of their money at all”.

Despite data by Westpac suggesting that the average Australian has around $22,000 in savings to rely on – data skewed by few big savers means the more realistic amount that most people probably have saved is actually closer to $3500.

And for younger people aged 18-24 who are just entering the workforce, despite a desire to save towards home/property and maybe even travel – they have just over $5000 saved on average compared to more experienced workers aged 35-44 who will have just under $12,000 saved on average.

But it’s not the impulse buys that can leave people feeling like their money is draining away – with increasing interest and inflation rates forcing things like the electricity bill to skyrocket, it’s the cost of living that Australians are really battling against.

“Last year, you probably wouldn’t have predicted the cost of your grocery bill skyrocketing over the last six months in Australia,” Ms Curry said.

“One week it was lettuce that was expensive and then the next it was zucchini because of the floods and the impact of our supply chain.”

And the overwhelming response by the population has been to cut down on “unnecessary expenses” with many resorting to some savvy tips to save on daily expenses.

But even while most have been trying their best to make ends meet, Ms Curry said poor budgeting skills could leave many blindsided by their spending habits.

“We know that a lot of people don’t feel in control and it’s because they don’t have the knowledge about their own finances,” Ms Curry said.

“But the first thing to understand is that it’s going to be different for every single Australian … and it’s important that everyone understands their own situation.

“(It’s different) for some who might be financially struggling to make ends meet has to make choices between food and the electricity bill versus someone who is financially comfortable and is quite able to make a luxury purchase.”

Power back into your hands

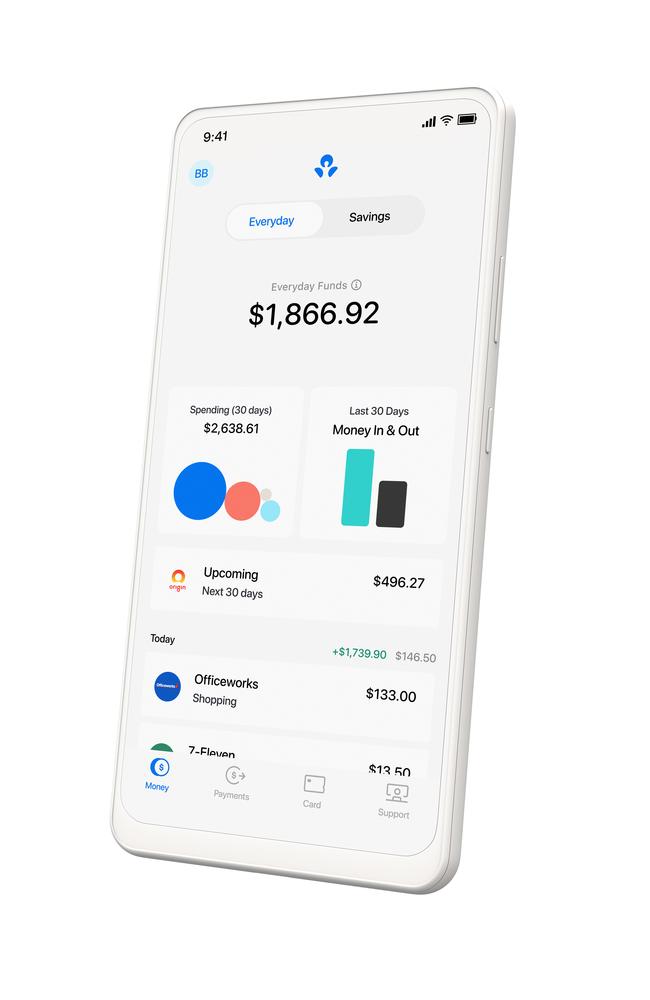

But while it may feel like rent, bills and debt are controlling you more than you are controlling them – Ms Curry said that many banks including ANZ have developed the necessary tools to help consumers get back in control of their finances.

According to ANZ Plus coach Constanza Perez, the first thing people need to know is exactly how much income they make and where that money is going.

“Historically, it might have been like a spreadsheet that you kind of have to keep track and monitor on a weekly basis or monthly basis,” Ms Perez said.

“But now (with banking apps) you have the ability to tag and categorise your spending … in order to understand your spending habits, create budgets and spending boundaries.”

After your expenses are tagged and categorised, both Ms Curry and Ms Perez said identifying “unnecessary” or passive purchases like daily coffee runs or forgotten subscriptions can be let go of or cancelled.

“Everyone is at a different stage in their lives and make custom everyday expenses,” Ms Perez said. “(But) once we can really understand what we’re doing with that money we can see if there are trade-offs … to find that extra five dollars to add towards our savings.”

Ms Curry said the next step is to design a budget based off your economic situation with a commitment to developing a “buffer”.

“We know 32 per cent of people struggle to stick to a budget, but within that you need to ask do you have a buffer savings for unexpected expenses?” Ms Curry asked.

More Coverage

“Have you set up savings goals for what’s important to you? (With these banking tools) you have the ability to track multiple credit scores, short term loans, long term loans and set up saving goals for a holiday, or a car, or towards your children.”

Ms Curry said the digital tracking tools provided in banking apps were all about “putting power back in people’s hands”.

“Using these kinds of nifty features that we’ve got around expense categorisation and setting up savings goals, really help push your finances to the next level,” she said.