Loan sharks cop caning

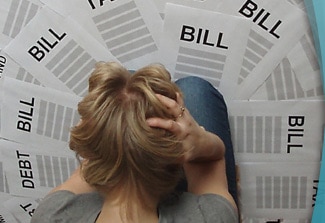

GREEDY finance brokers are hitting vulnerable households with massive fees and charges more than 20 times the industry standard.

Loan sharks cop caning

GREEDY finance brokers are hitting vulnerable households with massive fees and charges more than 20 times the industry standard.

Some deals are stripping up to 30 per cent of built-up equity away from the homeowners, as well as fees of more than $20,000.

The findings came yesterday in a report released by the investment watchdog, the Australian Securities and Investments Commission.

The report analysed refinancing deals and the operations of fringe brokers. It was done to help state governments prepare uniform broking laws across the country.

The report highlights the risks some homeowners take to save their home from being repossessed and to get relief from mortgage stress.

However, the ASIC report found the refinancing deals often made their financial position worse by stripping away their equity, as well as losing tens of thousands of dollars in total costs.

"These borrowers were intent on saving their family home which placed them in a vulnerable position where they were prepared to accept almost any solution,'' ASIC consumer protection director Delia Rickard said.

The report found:

TWO brokers charged fees of more than 20 per cent of the existing equity in the family's home.

ONE broker charged fees of more than $24,000.

DESPITE the huge fees, brokers refinanced people into interest-only loans that lasted just one or two years.

IN SOME cases borrowers could not afford the new repayments.

SOME brokers set up a cycle of unaffordable loans and each time the household defaulted they were refinanced into yet another loan until there was no equity or money left to pay any more fees.

The report concentrated on the activity of fringe brokers, which primarily do not belong to any association and often use lenders such as privately raised fund or solicitor mortgage schemes.

ASIC said up to 188,000 Australian households were considered to be under severe mortgage stress and at high risk of defaulting.