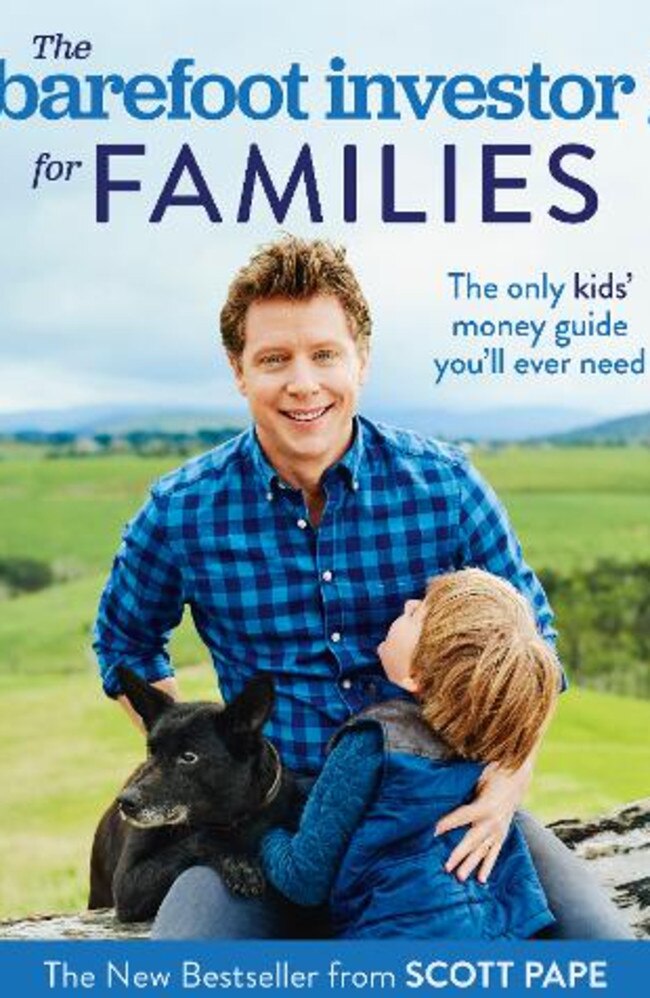

Barefoot Investor warns parents to watch their spending on children this Christmas

Cash-strapped Australians should adopt these Barefoot Investor strategies to avoid a Christmas spending blowout. TAKE THE CHRISTMAS SPENDING SURVEY.

Parents should think twice before blowing a fortune on their kids this Christmas, because often they end up giving them expensive presents they “don’t remember anyway”.

Barefoot Investor Scott Pape has warned families: “It’s not worth it, if it ruins or stresses you out right up to Christmas and after Christmas.

“Kids have inflated expectations about what they expect from Santa and that leads into tough conversations.

MORE: Bitcoin is still a big gamble

MORE: Don't feed super the super fat cats

“Christmas morning is just one morning that you have got your kids all excited about unwrapping presents.”

Pape said December and January always caused heightened financial pressures.

He urged shoppers to steer clear of credit and limit how much cash they splashed.

BAREFOOT INVESTOR’S XMAS TIPS

1. Focus on experiences rather than physical gifts.

2. For adults send an email telling them you are doing Secret Santa to save money.

3. Leave your credit card at home.

4. Go all out on the wrapping and be tight on the gifts; younger kids won’t notice anyway.

5. Buy, swap and sell your rejected presents (you know you’re going to get them).

The nation’s ballooning credit card bill crept up to $52.9 billion in December last year and already sits at a whopping $51.9 billion, latest Reserve Bank of Australia figures show.

“For many Australians the next 60 days are the most stressful days of the year because you

have Christmas, Christmas presents, then you have school fees,” Pape said.

“If you haven’t been planning for it you can get yourselves in a lot of trouble.”

Just over three weeks remains until Christmas and already shoppers have been swamped by massive sales including for Black Friday and Cyber Monday — traditionally monstrous shopping days in the US that have now become big Down Under.

TAKE THE BAREFOOT CHRISTMAS SPENDING SURVEY

Despite record-low interest rates which is assisting borrowers paying off mortgages, those with cash savings have continued to receive dismal rates.

Pape said many Australians often leave it too late to plan financially before Christmas, so for these people they should try and cut their spending.

Paying with debit instead of credit is important and sticking to a shopping list is also key to avoiding a financial blowout.

Buy now, pay later schemes have also soared in popularity including Afterpay, Zippay and Openpay.

New figures released by the Australian Securities and Investments Commission this week found the number of users of these schemes soared from 400,000 in the 2015/16 financial year to more than 2 million in the 2017/18 financial year.

But consumers have been warned to think twice before signing up to these schemes which allow customers to buy items and pay them off later in instalments.

Customers are hit with fees if they fail to meet the strict repayment criteria but do not pay interest.