11 simple ways to cut your spending and survive the cost of living pinch

Tightening the belt is not something any of us really want to think about, but there are painless steps Aussies can take to hold onto more of their cash.

Cost of living is on everybody’s minds at the moment, with many Aussie families seeing their weekly spend increase and paychecks stay the same.

Despite plenty of talk throughout the election on what the next government would do to ease the pressure, economic factors like inflation and wages remain largely beyond their control – at least in the short term.

The latest ABS figures showed household spending was 8.8 per cent higher in March this year than it was for January 2020, before the pandemic hit.

While the hole in Aussie wallets could be chalked up to any number of factors, it’s worth noting the biggest increases in spending by category were health (up 24.2 per cent), clothing and footwear (up 19.5 per cent) and recreation and culture (up 15.0 per cent).

Eyes on the prize

A change of mindset can be the first step to stemming the daily bleed of cash many of us accept as a given.

Financial adviser and co-founder of Fox and Hare, Glen Hare says thinking ahead to how today’s spending affects larger, long-term goals can help put things in perspective.

“Thinking five years ahead is around what position do you want to be in five years’ time and working backwards from that,” Mr Hare said.

“So thinking how much you need to be putting aside on a monthly basis and then that kind of gives you an indication about how much you want to be spending.”

Buy Now, Pay Now

It’s easier than ever for Aussies to buy now and pay later for all of our desires – however unnecessary. Trouble is they are making it easy and alluring to spend money we don’t have.

Australians can take their pick of services to pay later on, from haircuts to movie and concert tickets.

“The argument often is ‘but I don’t pay any interest’ and that’s all well and good, but it still is debt. You’re still going to have to pay it off at some point,” Mr Hare said.

“If you can’t afford to go to that gig because you’re saving for your first property, then chances are next week you’re probably going to be in the same position.”

Unsubscribe to survive

A recent survey by comparison website Finder found it was the most annoying piece of financial advice being offered – particularly for Gen Z – but unsubscribing from streaming services and other monthly direct debits can save thousands.

Cancelling just one subscription can save close to $150 a year, and almost half of all Aussies have two or more active subscriptions.

Senior editor of money at Finder, Sarah Megginson, said it didn’t have to be a case of culling the services all together.

She recommended looking at family subscriptions which let you use multiple devices/screens and switching off services you're not currently watching.

“This is easy to do and doesn’t require you to actually delete your account,” Ms Megginson said.

“Netflix and others are cracking down on shared passwords, so that won’t work long term. Trying to hop between free accounts also doesn’t work, since most services now have shorter trials or no free trials.”

Don’t blow it at the start of the month

Like our grandparents used to keep jars of cash to help them budget, the modern Aussie now has the opportunity to keep multiple specifically designated bank accounts to help them spend less.

Mr Hare suggests transferring small amounts to a spending account on a weekly basis to smooth cash flow and remove the temptation to overspend when your paycheck arrives.

“At one of my previous jobs they had a cafe down in the foyer and we got paid monthly. At the beginning of the month, everyone would be down there buying lunch. By the end of the month it was a ghost town,” he said.

“People would get paid and then they’ve spent all their pay in the first couple of weeks. What we often talk about is having an account where your salary goes into and then allocate how much you want to spend on a weekly basis into a separate, everyday account.

“Hypothetically you pay yourself $500 a week; money goes in the same day each week and the psychology behind that is you’ve not got so much that feast or famine type mindset.”

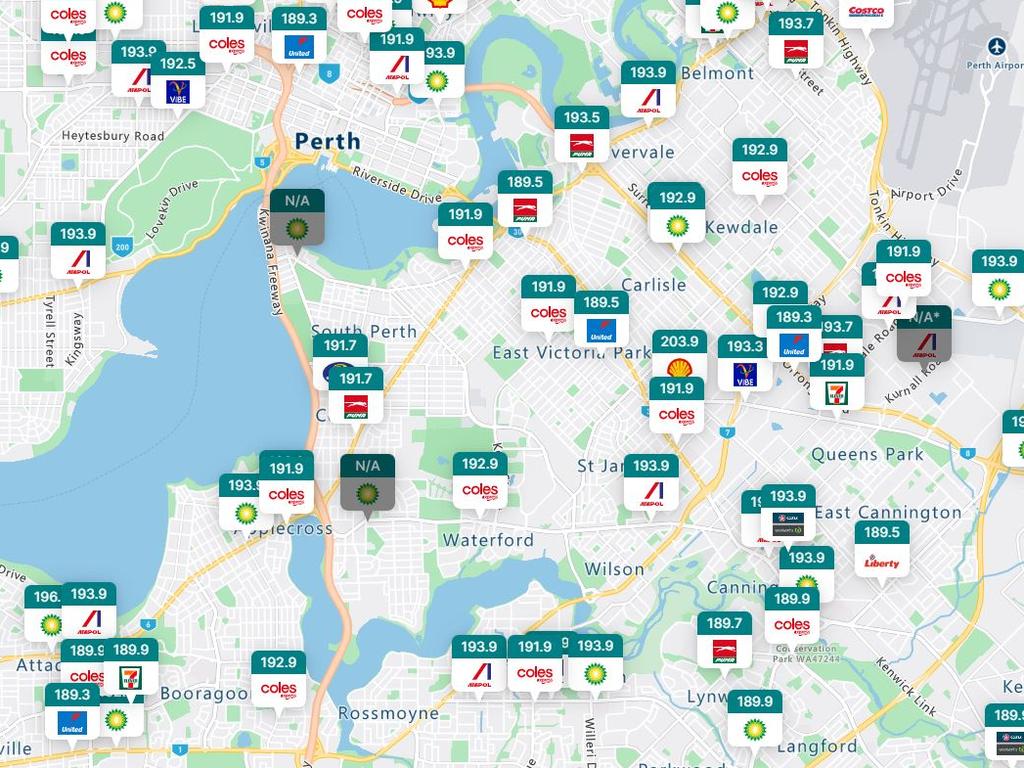

Get the cheapest petrol, every time

It’s no secret the cost of fuel is through the roof and spending money at the bowser can easily pump through a large chunk of the household budget.

Fuel price apps can locate the cheapest fuel in your area and most are free to use, with some using government data and others relying on users to submit prices.

New South Wales, Queensland, Western Australia and Northern Territory governments maintain mandatory fuel price databases, with servos uploading their prices.

The WA government website FuelWatch provides an up to date view of fuel prices and can be used on mobile browsers, however as yet does not have an app.

New South Wales is the only state with a fuel price app created and operated by a state government.

Lift your pre-game

“I have a bit of a joke with our members in their 20s – bring back pre-drinking,” Mr Hare said.

“You go to a restaurant, you spend $100 on a bottle of wine, whereas you can buy that same bottle of wine down at the bottlo for about $20.”

Going out to a restaurant can easily double or triple in price once you add the cost of alcohol to the bill, with two cocktails easily costing $50, plus wine making it more than the meal itself.

Picnics are another low-tech, high reward way to get your drinking done somewhere it won’t cost you an arm and a leg.

Call your energy company

Energy bills are also on the rise and heading into winter could see Aussies paying record amounts just to keep their homes warm.

There are several steps to reducing energy bills, starting with calling your provider to ask them if you are on the best deal – which they legally have to tell you – before shopping around to see if another company can service your needs even cheaper.

“Nearly half of Australians (44 per cent) are paying the lazy tax on their electricity bills, meaning they don’t think they are getting good value for money, but haven’t switched providers within the past six months,” Sarah Megginson from Finder said.

“When you’re ready to make the switch, contact your new provider – they will usually take care of the switch for you.”

Once you know you are getting the best price for energy, reducing consumption can be another simple way to slash bills.

Wearing warmer clothes can cut heating bills and turning appliances and lights off when not in use can both save considerable amounts from bloated energy bills.

Park’n’ride

Even better than finding cheap fuel is not driving at all and with free park’n’ride facilities across the country, incorporating public transport into your commute doesn’t have to be a hassle.

Transperth offers 24-hour parking at its stations for just $2 on weekdays and for free on weekends and public holidays.

Elsewhere in the country, park’n’ride services are completely free and include government websites to help locate a carpark near you and plan your trip.

The Transperth app also offers free service information from any stop, station or jetty, meaning you’ll never have to wait around wondering when the next bus or train is.

Plan meals in advance

It’s an easy predicament to find yourself getting to 7pm on a weekday with an empty fridge and seemingly no option but to order in.

Planning meals in advance and doing a weekly shop not only helps you buy in bulk, but reduces overspending by reducing waste and encouraging you to cook meals from scratch.

“There are so many ways to lower the cost of your weekly shop,” Ms Megginson said.

“Try looking online before you head to the supermarket to find out what produce is in season and what products are on special, then plan your meals accordingly.”

Having a plan also takes the stress out of mornings and evenings, when you’re too tired to think – especially if you’ve got plenty of leftovers to dig into.

Hassle your bank

Bullying your bank for a better home loan deal could prove game-changing with interest rates climbing.

Loyal customers never get the best deals on home loans – there is no incentive for banks to table better offers to borrowers they know will stick with them anyway – so it mightn’t hurt to shop around and let your lender know you’re thinking about pursuing a better offer.

A couple who recently wrote into the Barefoot Investor to recount their bank-bullying magic even received a $2000 cash reward in addition to lower rates after entertaining rival offers.

“Our friends from the CBA (Commonwealth Bank) were in contact asking why we wanted to discharge our loan,” borrowers John and Suzie wrote.

“I politely indicated we made them aware of this before deciding to pursue the better offer.

“The CBA has now offered to reduce our rate below the rival rate and thrown in $2,000 in cash to reward us for being a loyal customer.”

Buy Nothing New

Fast fashion and other readily disposable goods are not only bad for the planet, they’re bad for our wallets. Buying second hand can put thousands of dollars a year back into your pocket and reduce waste at the same time.

Founder of Buy Nothing New Month and The New Joneses’, Tamara DiMattina, says she hasn’t bought anything new for the past 10 years.

She challenged Aussies to try her way of life for a month and reassess what they actually need to buy that can’t be found second hand.

“Look at all the beautiful alternatives – everything I need, everything in this home – everything has been bought second hand,” Ms DiMattina said.

She added it’s not about going overboard, like ditching deodorant because you can’t find an alternative, but challenging yourself to reassess what you really need to buy and what can be repaired, op-shopped or swapped.

“Everything you need you can get second hand on eBay, Facebook Marketplace, there are swap groups, people are giving their stuff away, we’ve got so much stuff,” she said.

“What I love about Buy Nothing New Month and thoughtful consumption is it’s better for our people, it’s better for our planet, it’s better for our pockets.”