Silver shares: GameStop investor army on Reddit turns to new target

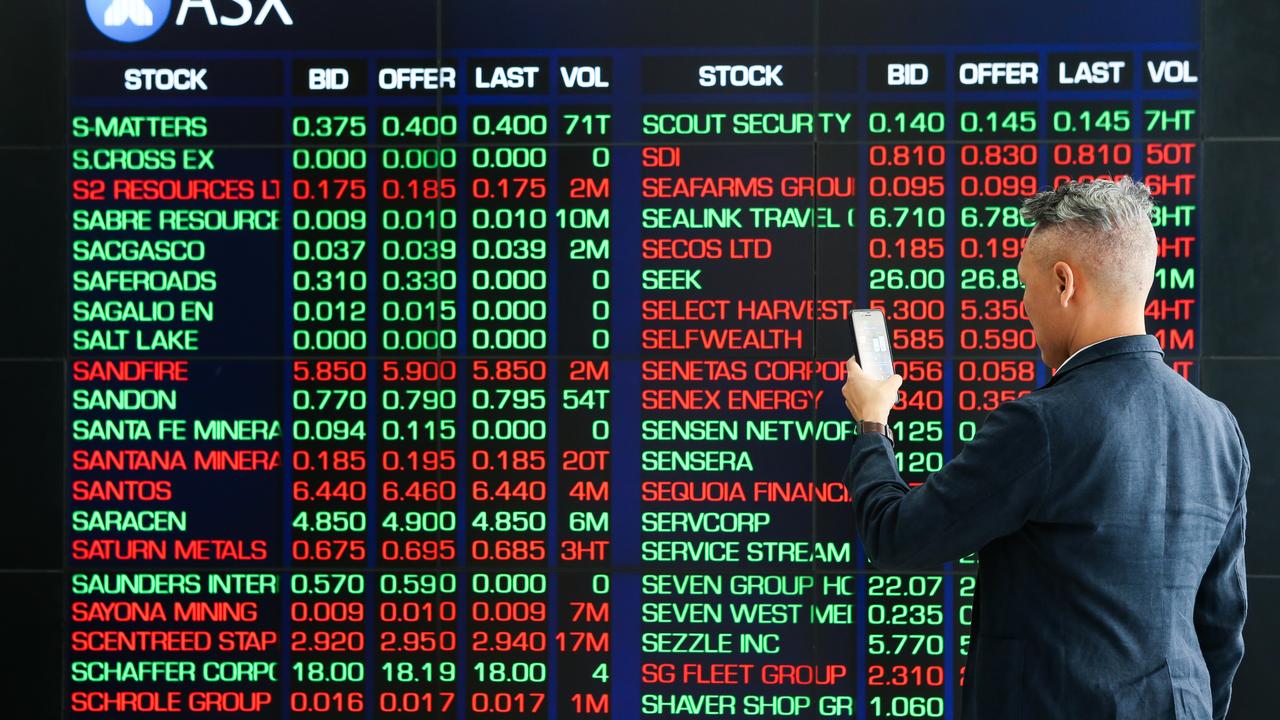

After causing chaos on the stock market with their investments in GameStop, an army of social media renegades is turning to a new target.

They’ve been buying up shares in struggling video game store GameStop and causing chaos on the stock market. Now an army of social media investors has shifted to silver as their target – pushing its price up to the highest level in eight years.

The price of the metal skyrocketed to $30.10 per ounce in overnight deals – that’s the first time it’s been that valuable since 2013. It has now soared by more than 16 per cent since Thursday.

Financial experts are linking the surge in its value to a series of big market moves sparked by day traders swapping tips on social media sites like Reddit.

The so-called army of mostly inexperienced investors have been causing shockwaves across the stock market, with some making huge profits by scooping up assets big fund managers usually bet against.

The movement is being driven by the WallStreetBets Reddit subgroup which has millions of members.

RELATED: Robinhood app’s stunning GameStop backflip

Some are doing it to stick it to the big investors, and their efforts paid off last week when their investments in GameStop, a US bricks-and-mortar video retailer that’s been struggling to compete with the shift to online shopping during the pandemic, saw a massive rise in its value.

By the end of January, the store’s shares were up a staggering 1700 per cent since the start of the year.

Now the investor army has set its sights on silver, and it is already having a big knock-on effect with precious-metal miners standing to profit from higher prices.

The Wall Street Journalreports that Fresnillo PLC, listed in London and with mines dotted around Mexico, gained 12 per cent, while Canadian miner First Majestic Silver Corp jumped 24 per cent and Pan American Silver Corp rose 16 per cent.

Markets.com analyst Neil Wilson said investors are taking note of the trend.

“Silver prices jumped … as investor interest turned on the metal due to expectations Reddit traders will attempt to squeeze prices higher,” he said.

“Retail traders are herding into silver in the same way they have driven the likes of GameStop over the last week.”

The social media army is targeting shares of companies that have been “short-sold” by hedge funds in a bet that the prices would fall.

Shares in GameStop, a company that has been financially ailing, soared during the Reddit group’s massive buying initiative – mounted in protest against hedge fund bets on GameStop’s demise.

To cover their losses, the hedge funds have to buy back, at higher prices, shares they had sold – meaning some of the Reddit army members made big profits while causing disruption to the stock market.

RELATED: Boy, 10, makes huge amount on GameStop shares

RELATED: GameStop investors troll hedge fund billionaires

However, with silver the situation is slightly different, because commodity had been ticking along fairly well over the past few years.

In this case, it is banks that are being hurt rather than hedge funds.

Hussein Sayed, chief market strategist at FXTM, said that “influencing the price of silver will not be as easy” as it was with GameStop owing to the metal’s total market value of around $US1.5 trillion ($A2 trillion).

At its high last week, GameStop was worth $US22.8 billion ($A29.9 billion). And, despite moves to stop the surge in investments – such as restrictions in trading apps like Robinhood – members of the Reddit group said they have not given up on the video game store.

Mr Sayed said the tactic of pushing up silver prices could work should investors succeed in tightening the physical market for the metal.

“In the medium term, any excessive price rise is harmful for silver because it irrevocably destroys part of the physical demand,” said Commerzbank analyst Eugen Weinberg.

Swissquote Bank analyst Ipek Ozkardeskaya cautioned meanwhile: “In this game … if you lose full support, and momentum, it’s over.

“This is why, the speculative rush is a prosperous, but a dangerous game.”

Patrick J. O’Hare at Briefing.com called the jump in silver prices “the latest sign of the times”.

“We’re talking silver futures, people – or perhaps they would be referred to better today as silly futures,” he said.