SHIB coin: Why Shiba Inu price is surging

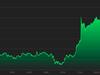

The price of “meme” crypto Shiba Inu has surged, with some crediting Tesla CEO Elon Musk for the unexpected rise.

The price of Shiba Inu has surged 216 per cent – with some crediting billionaire Elon Musk for the rise.

Shiba, created in 2020 by the mysterious “Ryoshi”, was originally a joke crypto based on the Doge meme.

The coin was pumped this week, at one point pushing it to the 13th most valued cryptocurrency by market capitalisation, according to CoinGecko.

Shiba first saw a major price spike in May this year, hitting $A0.00004938, before dropping again sharply.

It spiked again this month, hitting a high of $A0.00003893, although it has since fallen slightly.

A tweet by Tesla CEO Elon Musk was widely credited for the surge.

Myron Jobson, personal finance campaigner at interactive investor, said: “It’s a case of déjà vu as a tweet from Elon Musk has once again helped propel the price of Shibu Inu – albeit unwittingly.

“Elon Musk has amassed a sizeable fanbase who hang on his every word when it comes to his views of cryptocurrency – and often fuels an already high level of volatility in the crypto market.

“Here, a picture of Musk’s very own Shina Inu pup was enough to generate hype around the coin.”

Floki Frunkpuppy pic.twitter.com/xAr8T0Jfdf

— Elon Musk (@elonmusk) October 4, 2021

But according to Coin Desk, SHIB’s rise could be due the crypto market’s overall growth.

“I would say it’s just crypto being crypto,” Delphi Digital’s Ashwath Balakrishnan said.

“When markets go risk-on, the meme coins tend to benefit.”

Shiba Inu is the most traded cryptocurrency behind only Tether, bitcoin and ethereum over the last 24 hours, according to coinmarketcap.

What are the risks of investing in crypto?

Below we round up five risks of investing in cryptocurrencies.

Consumer protection: Some investments advertising high returns based on cryptoassets may not be subject to regulation beyond anti-money laundering requirements.

Price volatility: Significant price volatility in cryptoassets, combined with the inherent difficulties of valuing cryptoassets reliably, places consumers at a high risk of losses.

Product complexity: The complexity of some products and services relating to cryptoassets can make it hard for consumers to understand the risks. There is no guarantee that cryptoassets can be converted back into cash. Converting a cryptoasset back to cash depends on demand and supply existing in the market.

Charges and fees: Consumers should consider the impact of fees and charges on their investment which may be more than those for regulated investment products.

Marketing materials: Firms may overstate the returns of products or understate the risks involved.

– With The Sun