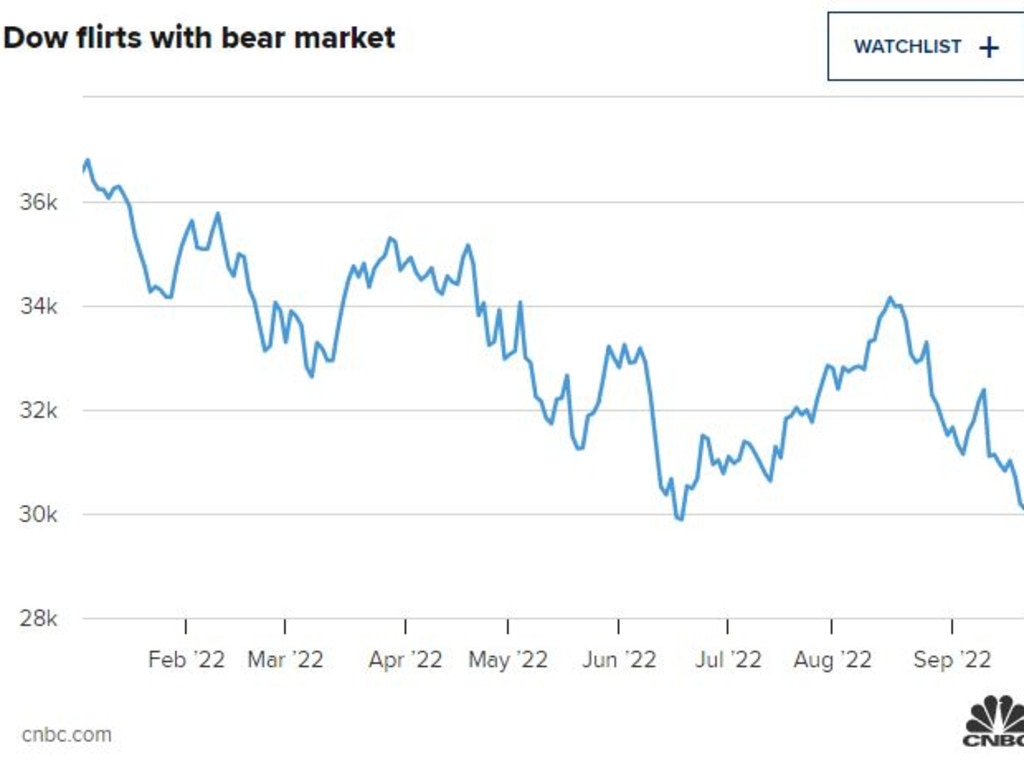

‘Scary’: Dow flirts with bear market amid fears of deeper recession

Wall Street neared bear market territory on Friday as stocks fell sharply to end the week with the Dow down more than 800 points.

Wall Street’s massive sell-off overnight had the Dow flirting with a bear market as investors appear resigned to the fact that the Fed has abandoned hopes for a “soft landing” and will continue to aggressively raise interest rates to fight inflation — even if it means a deeper recession.

The Dow Jones Industrial Average was down more than 800 points — falling into bear market territory at one point — before a late rally shaved the losses.

The index closed down 486.27 ($A744.78) to finish at 29,590.41 ($A45,321.50), its lowest level of 2022 and a shade above the 20 per cent decline from its high that define a bear market, the New York Post reports.

The S&P 500 dropped 65 points, shedding 1.7 per cent from its pre-market starting point.

The tech-dominated Nasdaq Composite plunged nearly 300 points, or 1.8 per cent.

Stay up to date with the latest market moves with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

“The current numbers are certainly scary,” Brad McMillan, chief investment officer for Waltham, Mass.-based Commonwealth Financial Network, told The Post.

“And there is, in truth, a lot to worry about.”

The markets were rattled by the Fed’s recent 75-basis-points hike as well as the precipitous decline of the British pound against the US dollar.

The United Kingdom’s new prime minister, Liz Truss, spooked global investors Friday when her chancellor of the exchequer, Kwasi Kwarteng, announced that the government would pursue tax cuts and more borrowing in an attempt to lift the British economy out of its doldrums.

The announcement sent stocks, bonds and the British pound tumbling — stoking fears of a global recession.

“The market is finally taking the Fed at their word — they are going to cause a recession in order to fight inflation,” Chris Zaccarelli, chief investment officer for Charlotte, NC-based Independent Adviser Alliance, told The Post.

“This is bad news for financial markets and worse news for workers and the economy.”

Zaccarelli said “things will get worse before they get better, but they will get better eventually.”

“Unfortunately, it is going to take time before things do improve.”

Investors ought to buckle up for a bumpy ride, McMillan said.

“The Fed has committed to raising rates until inflation is brought under control, which is what sparked the current renewed downturn and is a reason for caution,” McMillan said.

“We can expect continued market turbulence for some time.”

McMillan said the Fed is relying on a tried-and-true formula — short-term pain followed by long-term gain.

“The Fed is performing surgery right now on the economy,” he said.

“In the short run, it is painful. But in the long run?”

“It is a healing process and one that sets the stage for a healthier economy and markets.”

This article originally appeared in the New York Post and was reproduced with permission