Mining sell-off pulls down Aussie shares

Mining stocks have weighed down the sharemarket again this week, with the benchmark ASX200 dipping into the red on Wednesday.

Mining stocks have weighed down the sharemarket again this week, with the benchmark ASX200 dipping into the red on Wednesday.

The sharemarket has started the week on a low note after a retreat in iron ore and oil prices over the weekend.

The Australian share market drifted lower in quiet trading on Friday as investors stepped cautiously before Wall St’s big Friday.

A fire at a major coalmine has caused hundreds of workers to be sent home and their futures are uncertain.

One company’s epic fall from grace has sparked fears that a major market correction is on the way.

The Australian sharemarket tumbled on Wednesday after a shock inflation print sparked fears of a possible rate hike.

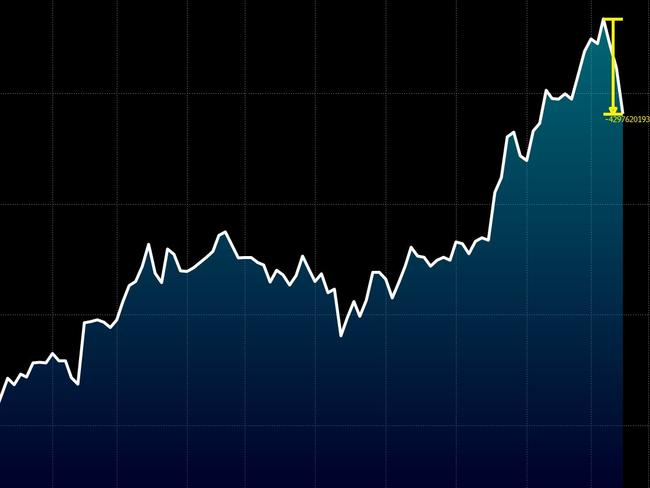

The Australian sharemarket notched a powerful rebound rally on Tuesday on the back of iron ore and oil price rises and a surge in banking behemoth Commonwealth Bank.

Just days after becoming the darling of the entire world, it’s turned into a bloodbath for one company.

The Australian sharemarket fell sharply in a ‘punchy session’ to start the week, dragged down by a selloff in the energy and materials sectors.

Australian equities rose modestly on Friday to cap off a positive week buoyed by Wall St gains.

In the biggest float in three years, the burrito merchant had a stunning performance on its first day on the ASX.

Ever wanted to own a Mexican fast food business? Well now you can, with burrito giant Guzman y Gomez going public today in a bid to take on kingpin McDonald’s.

Hawkish remarks from the Reserve Bank haven’t rattled investors, with Wednesday recording a quiet day of trading following Tuesday’s strong advance.

Wall St hit fresh highs overnight but it wasn’t enough to lift Aussie equities, with the ASX200 drifting lower on extended weakness in China.

Australian investors have reacted positively to better-than-expected US inflation data, with new hopes the Federal Reserve could cut rates soon.

The share market shedded 1.3 per cent as investors awaited the Federal Reserve’s much anticipated meeting on Thursday for a signal on its interest rate path.

After a tech-propelled rally on Wall Street overnight, the Australian share market followed suit.

Following a two-session rally, shares on the Australian stock market slipped as iron ore and oil prices tumbled.

Aussie shares shrugged off a grim night on Wall St to end a three-day losing streak and finish the week with a broadbased rebound.

The Australian sharemarket fell for its third straight session on Thursday, dragged down by Wall St, inflation fears and a tumble at BHP.

Australian shares slumped on Wednesday after hotter-than-expected CPI numbers renewed inflation fears and narrowed the likelihood of rate cuts this year.

The Australian sharemarket fell lower on Tuesday after weak retail sales data hit discretionary stocks.

Ten of 11 industry sectors ended in the green on Monday in a rebound ahead of crucial retail and inflation data.

Booking a four-day losing streak, the sharemarket fell to close out the week after investors were rattled by hotter-than-expected services and manufacturing data.

With Federal Reserve officials indicating interest rates will likely remain higher for longer, investors took profits in commodities on Thursday.

Paring back its early gains, the sharemarket inched lower to finish in the red for a second consecutive session.

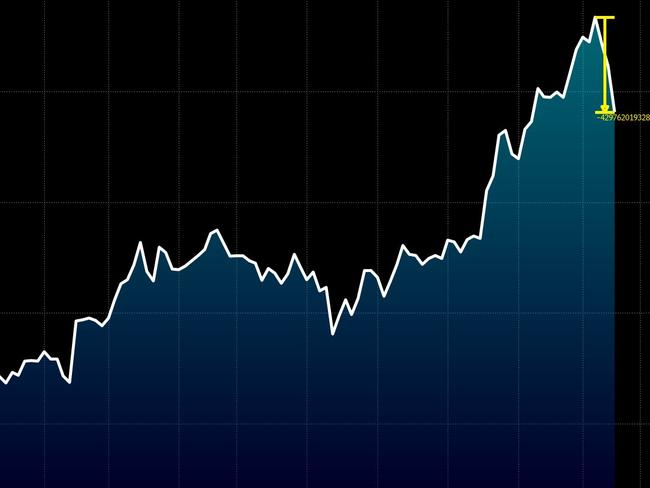

A rally in prices for key commodities including oil, iron ore, nickel, gold and copper sent the benchmark within 33 points of its record high.

The Aussie sharemarket has fallen one day after it was a “smidgen away” from record highs at the close.

One of Australia’s energy titans will cut 200 jobs, blaming a delay in ‘growth activities’ for the cull.

Aussie stocks lifted on Wednesday on the back of a mining rally fuelled by bourse heavyweight BHP.

Original URL: https://www.news.com.au/finance/markets/world-markets/page/8