$2 trillion tech stock drop shows smart investing is needed

The stock market has been particularly volatile lately and shows no sign of abating. One type of stock in particular been wiped of $2 trillion.

The share market has been on a wild ride over the past month and investors have taken a bit of a beating.

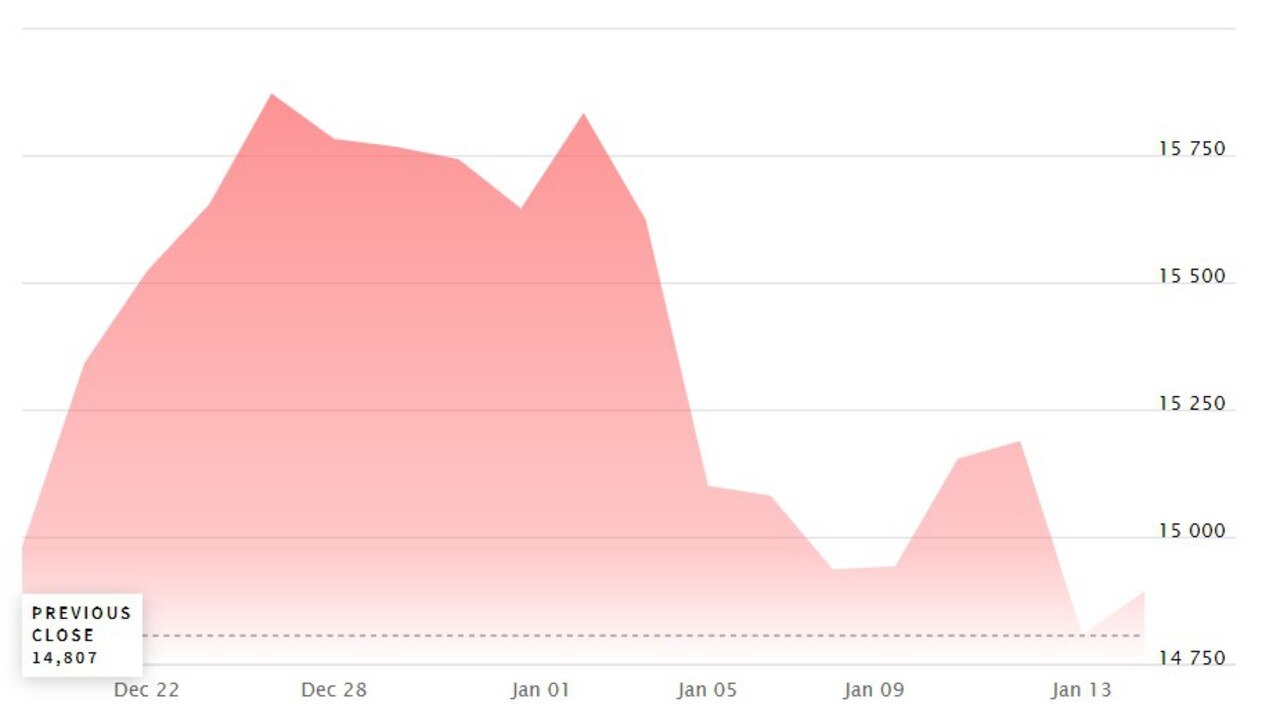

A big driver of market movements has been US technology stocks, with a decline of 9.13 per cent in the last month alone, wiping close to $US2 trillion ($A2.77 trillion) off the value of the Nasdaq index (measure of the largest technology companies globally).

These declines come with opportunity, but with so much activity many investors are questioning where markets are going from here and what 2022 has in store. I wanted to unpack the key things you should be across to invest the smart way when the market is crashing.

Avoid herd mentality

There is so much psychology that impacts how we invest. FOMO is a huge one that’s hard to escape, where you see markets moving and don’t want to be left behind – sometimes leading you to make decisions you regret in hindsight.

Stream more finance news live & on demand with Flash. Australia’s biggest news streaming service. New to Flash? Try 14 days free now >

We all know you should apply logic and strategy when investing, but in the heat of the moment it’s often hard to resist the voice of your inner investor that doesn’t want you to be the one who misses out on making all that money.

But especially when the share market is experiencing a lot of volatility, keeping a cool head will serve you well.

Get clear on your timeline

Your investment timeline should be one of the biggest drivers of when, how and how much you invest. Investments, like shares, have a suggested investment time frame of seven to 10 years or more. The reason this timeline is suggested is because of the potential for the sharemarket to have long periods of time where the markets are down.

In a typical share market downturn, the value of stocks can be down by 40 to 50 per cent, and in some cases it can take years for values to recover. If you’re forced to sell your investments when the markets are down, you’ll crystallise a loss and you’ll have to go back to the starting line.

If you map out your investment timeline and have confidence you can leave your investments to bubble away for years, you should be confident you can ride out any periods of market decline, ultimately giving your investments the time they need to do what good investments do over the long term – make you money.

Get Cashed Up

Created by financial adviser Ben Nash, Cashed Up is news.com.au’s free six-week course to help Aussies get their finances in check. Those who sign up to the budget bootcamp get weekly, step-by-step challenges to improve their financial fitness.

By the end of the six weeks, participants will have set a budget, created a savings plan, learned how to invest, and sorted their superannuation. The interactive course can be started at any time and aims to empower participants to make more informed financial decisions.

Choose your investment approach

Another important element of your investment strategy is deciding on your investment approach, and what I mean on this is active vs. passive investing.

Active investing means, as the name suggests, your investments are managed actively. What this really means is that you’re choosing investments you think will do better than all the other options available to you.

Passive investing in contrast involves just investing into the overall sharemarket, and the return on your investment tracks the average sharemarket return.

Both styles of investing have their advantages and disadvantages, but the statistics show that the majority of active investment managers (over 70 per cent) fail to outperform the overall market over the medium to long-term (i.e. more than five years), mainly driven by higher fees and the fact nobody can predict the future.

This choice is an important one, particularly in a market that’s moving – so take the time to understand your options and make the right choice to get the outcomes you want from your investment.

Choose your investment product and platform

Once you’ve decided on an investment approach, you’ll need to select the products to use to actually invest. The main types of share investments are direct shares, managed funds and exchange traded funds (ETFs).

Here you also need to decide on your preferred investment ‘platform’, which is the actual account you use to buy investments. Shares and ETFs can be accessed on a direct brokerage account like CommSec or SelfWealth, managed funds can be accessed directly through the provider or your bank, or you might want to look at a micro-investing app like Raiz or Stake.

Each type of investment product and platform have their own benefits and nuances, different tax considerations, fee structures and considerations. But, if you’re early on and just starting out on your investment journey, and in particular if you’re not investing six-figure sums of money, the returns on these different investment products are likely to be fairly similar.

I’ve unfortunately seen many would-be investors get trapped in analysis paralysis and ultimately miss out on the opportunity to start building their investment momentum – don’t make this mistake.

You’ll have a bigger impact if you make a choice then back it up with prompt action, to get your investments in place and put your money to work. Know that you can adjust and refine your approach as you learn more; you’re not setting your strategy today in stone.

The important thing when you’re getting started is creating some traction to keep you motivated as you move forward on your investor journey. Focus on using investment products that are easy to understand and easy to access – this way you’ll make it easier to take the action needed to start turning your investment plans into investment results.

Be smart with tax

Tax has a huge impact on how your investment portfolio will grow over time, so being smart here will accelerate your investment growth and asset building.

You want to be smart with where you invest. Do you invest in your personal name? For couples, you might want to be strategic and invest in the name of the partner with a lower tax rate, then you can invest through superannuation, or even use tax structures like family trusts.

Each of these options come with advantages and disadvantages, and they all have different outcomes on how much tax you pay. The rules get pretty complicated pretty quickly, so take the time to do your research and think about getting some good help so you make the right decision.

The wrap

When you put in solid work around planning your investments you get a heap of benefits. Confidence to pull the trigger sooner, clarity and motivation on what you’re working towards, and better risk management. You’ll also go a long way to avoiding herd mentality and the psychological biases that can push you to make poor investment choices.

Take the time to lay out all the things that are going to impact your planning and strategy, how you expect your income and spending to change over time, explore your options, choose your preferred pathway forward, then put it all together into a crystal clear action plan. This way you’ll know exactly what you need to do to turn your investment plans into dollars in your bank account.

Ben Nash is a finance expert commentator, podcaster, financial adviser and founder of Pivot Wealth, and Author of the Amazon Best Selling Book ‘Get Unstuck: Your guide to creating a life not limited by money’.

Ben is putting on a series of free money education events in 2022 to help you get on the front financial foot. You can check out all the details and book your place here.

Disclaimer: The information contained in this article is general in nature and does not take into account your personal objectives, financial situation or needs. Therefore, you should consider whether the information is appropriate to your circumstances before acting on it, and where appropriate, seek professional advice from a finance professional.