How to avoid the next ‘Hawk Tuah’ crypto investment disaster

With Bitcoin trading above $160,000 and interest in crypto soaring, experts have issued an urgent warning to Aussie investors.

Hailey Welch, aka “Hawk Tuah”, probably won’t be the last celebrity to back a failed crypto project.

With Bitcoin now trading above $US100,000 ($A160,690) and pro-crypto Donald Trump set to regain the US presidency next year, expect plenty more celebs to jump on the crypto bandwagon in 2025.

It’s crypto, so most Aussies are still scratching their heads – what actually caused Welch’s crypto token HAWK to crash? And was Welch even in control?

Welch speaks out after crypto flop

Welch spoke out on social media on Saturday after her crypto token, HAWK, plummeted over 90 per cent just hours after its launch on December 4 (US time).

The 22-year-old said she was co-operating with lawyers to “help uncover the truth, hold the responsible parties accountable, and resolve this matter”.

The token, which she had been actively promoting, reached a total market value of $US490 ($A786) million soon after launch, but a major sell off saw that drop to $US26.4 ($A42.37) million.

I hate to break it to you, but if your favourite celebrity crush is promoting a crypto meme coin, there’s a good chance they know very little about the project’s tokenomics – the economic model behind the cryptocurrency.

Despite how involved they appear, they’re probably just the face of the campaign, in exchange for a pay cheque.

Possible foul play

While Welch has denied that the HAWK project was dirty, the data paints a grim picture of what actually went on behind the scenes, regardless of whether she was aware of it.

The token was launched on Meteora, a decentralised crypto exchange. These exchanges are like the wild west of crypto, unlike centralised exchanges like Binance or Coinbase, where research teams typically conduct thorough due diligence before listing a token.

In fact, 96 per cent of HAWK’s total supply was connected to 10 crypto wallets before the launch, according to blockchain data firm BubbleMaps.

This is one of the biggest red flags to watch out for with any crypto token – the uneven distribution means that a sale at any time will drastically impact the price, as it all comes down to the balance of supply and demand.

It’s like if 10 people owned 96 per cent of the housing market in Australia. If they all decided to sell, the value would plummet because the market would be flooded with supply.

Shortly after the launch, data reveals that there was a major sell off within the first hour and insiders of the project made roughly $US3 million in profit.

Due diligence required

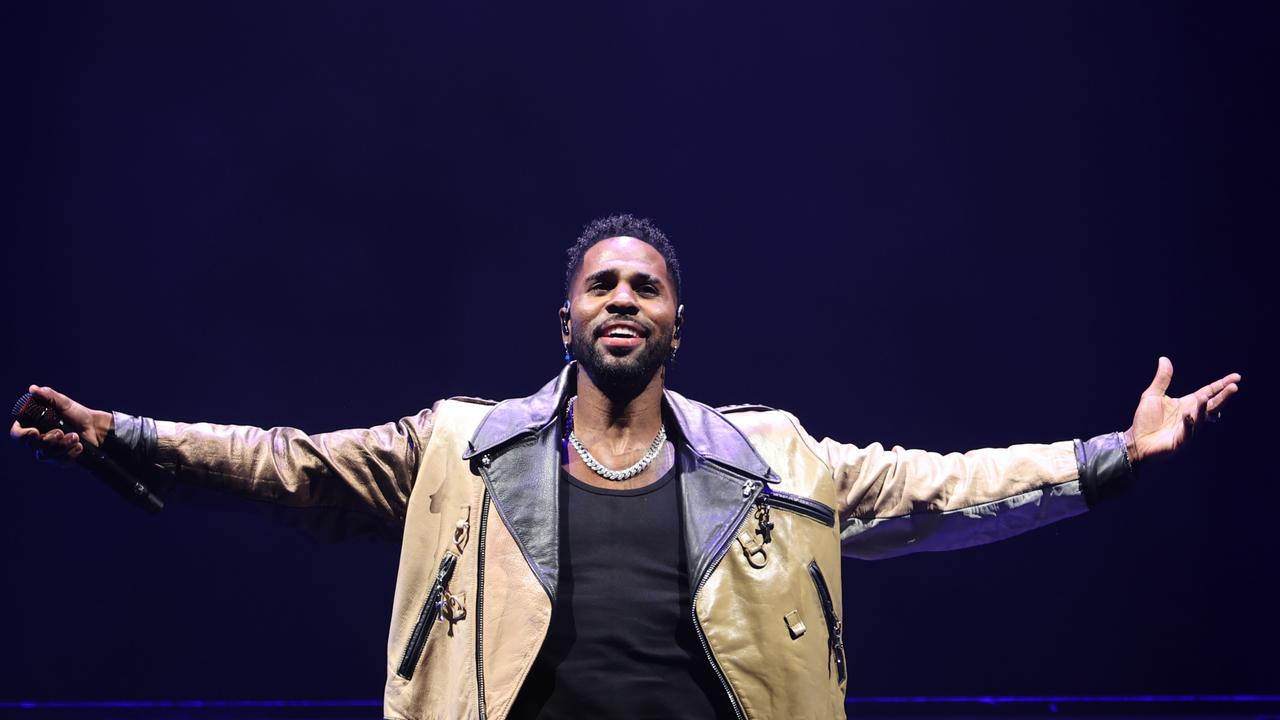

Celebrities like former Olympian Caitlyn Jenner, singer Jason Derulo, rapper Rich the Kid and singer David Adedeji Adeleke Oon have all launched crypto tokens this year, and none of them have performed well.

Media personality Hasbulla promoted a token in memory of his late cat, Barsik, on November 16. It peaked at $US274.12 million, but just a month later, its value dropped to $US18.26 million.

I don’t usually go near celebrity tokens, but as an experiment, I put money into Barsik and saw my investment multiply sevenfold in just eight hours.

While it eventually flopped, it had a solid run-up. Unlike HAWK, though, the distribution of holders was much more balanced, even if there were profit-takers along the way.

I sold most of it, but if I hadn’t, it would now be worth just pennies.

So, while you might get lucky on a celebrity crypto token that isn’t a “rug pull” and manage to sell quickly, it’s probably not worth getting involved with them.

Beware of celeb-backed crypto

Collective Shift founder Ben Simpson believes it’s highly unlikely that any celebrity crypto token will have lasting success.

“Never buy any celebrity coins, we would never ever look at these celebrity coins, 99 per cent of them are going to go to zero,” Simpson said.

“The reality is the blockchain is a visible ledger that anyone can see who does what, and it was tracked back to see that insiders got insider allocation.

“Maybe she had good intentions but I think she was advised pretty poorly.”

Tax implications for Aussies

Crypto tax platform Koinly CEO Robin Singh warns that Aussie investors who’ve seen their HAWK crypto investment drop to zero can’t just claim a capital tax loss – they must actually sell the asset before June 30, 2025.

“To claim a capital loss, the ATO requires a clear disposal event – simply holding a devalued token isn’t sufficient,” Singh said.

“Investors should consider selling, swapping, or burning the asset to crystallise the loss, which can then offset capital gains from other investments, such as shares or property, thereby reducing overall tax liability.

“Look beyond celebrity endorsements to assess the project’s real-world application, the transparency of the team, and the clarity of the road map.”

Disclaimer: The content provided is for informational purposes only. Please refrain from considering any of the above information as investment, financial, or other advice. It’s essential to conduct your own research before making any investment decisions.

Ciaran Lyons is a cryptocurrency market analyst, journalist and avid investor, with a background as a national radio presenter. He regularly contributes to global cryptocurrency publications and was one of the five Australians on the latest SBS series Filthy Rich and Homeless.