Grim sign for world economy after US stocks suffer worst half-year plunge in 50 years

There are grim signs for the global economy as the US stock market saw its worst first half of trading in more than half a century.

There are grim signs for the global economy after the US stock market recorded its worst half-year of trading in more than half a century.

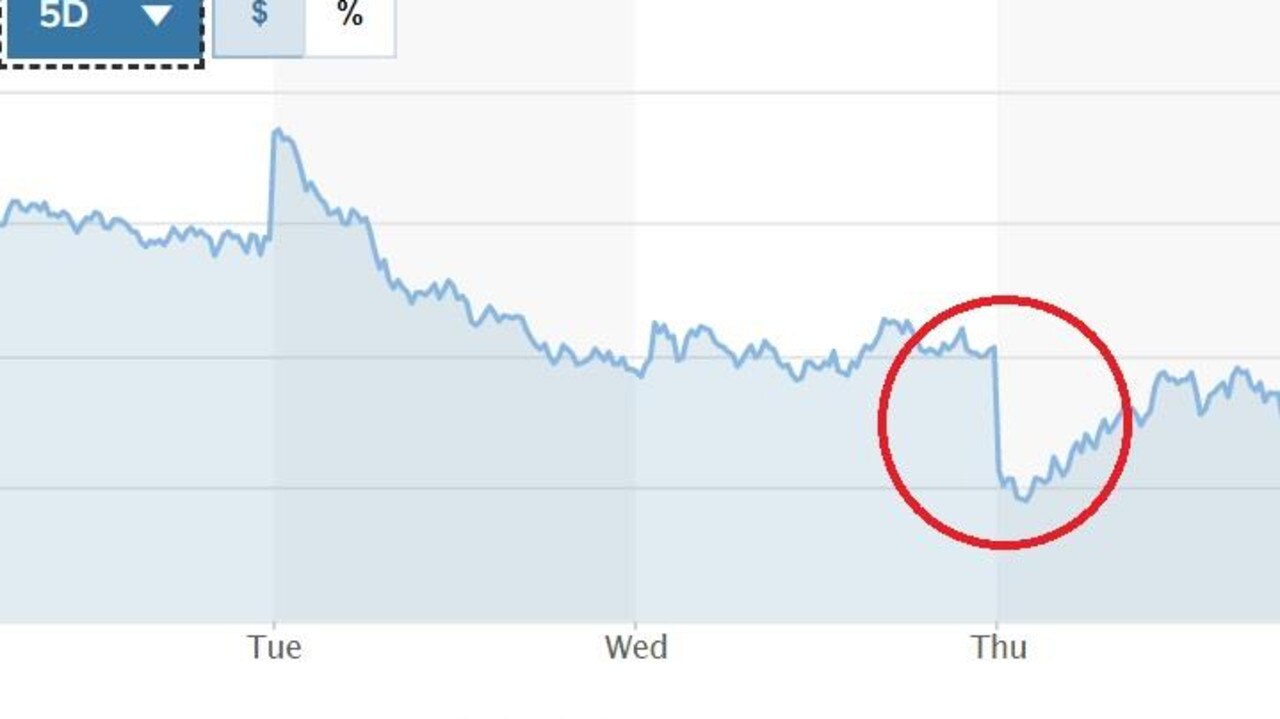

Wall Street stocks fell overnight, a fitting end to a bruising first half of 2022, finishing solidly lower after US data showed persistently high inflation pinching consumer spending.

The top 500 companies that make up the S&P 500 finished at 3,785.38, down 0.9 per cent for the day and a loss more than 16 per cent for the last six months, the worst first half of a year since 1970.

World markets also took a battering on intensifying recession fears. London ended the day down two per cent, with both Frankfurt and Paris close behind.

Despite this, Australian shares are forecast to rise very slightly today. ASX futures are up 12 points or 0.19 per cent to 6473 at 7am.

Markets in a ‘terrible mood’

The falls overnight in global markets is just continuation of a dismal year for the global economy.

“Stock markets have fallen heavily in June so it seems only fitting that they’re ending the month with big losses as reality continues to bite,” said Craig Erlam, senior market analyst at trading platform OANDA.

Stock markets are “in a terrible mood across Europe,” said AJ Bell investment director Russ Mould.

“There really is a lack of good news for investors to cling onto, and the near-term outlook looks bleak.”

The threat of an extended period of elevated inflation and painful interest rate hikes has left traders fretting over the threat of a prolonged economic downturn, while the Ukraine war continues to sow uncertainty.

The surge in inflation to multi-decade highs has forced central banks to swiftly raise interest rates, dealing a hefty blow to equities as companies faces higher borrowing costs.

Sweden’s central bank on Thursday announced its biggest hike in 22 years, raising its main rate by 50 basis points to 0.75 per cent.

Global economic turmoil

There had been hope that policymakers would ease off their hikes as economies show signs of slowing, but analysts say some officials are less concerned about a recession than letting prices run out of control.

US data released Thursday showed that a key annual inflation measure held steady at 6.3 per cent in May, but spending rose just 0.2 per cent in May, less than half the increase in April and part of a steady downward drift as consumers pull back amid surging prices.

But when inflation is taken into account, the data show a decline in real consumer spending, analysts said.

Two weeks ago, the Federal Reserve enacted a super-sized three-quarters of a point interest rate hike, the biggest increase in nearly 30 years. Markets are weighing whether to expect the same thing in July.

“Inflation came in a little bit better than expected today but probably not good enough to prevent the Federal Reserve to raise interest rates 75 basis at the next meeting,” said Tom Cahill of Ventura Wealth Management.

“At the same time we had the personal spending coming in negative for the month in real terms,” Cahill said. “People are starting to get the sense that perhaps the Federal Reserve is going to push the economy into recession.”