Finance news you need to know today

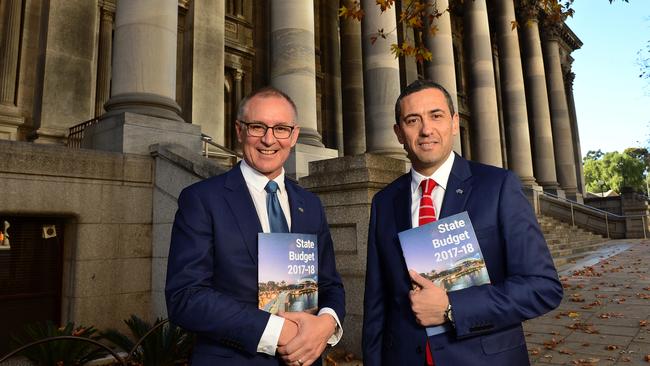

THE banking lobby has slammed a surprise bank levy announced by the South Australian government, labelling it an “outrageous cash grab”.

THE Australian market looks set to open modestly higher after all three of Wall Street’s key indexes settled hardly changed. At 0700 AEST on Friday, the share price futures index was up seven points, or 0.12 per cent, at 5,650.

Meanwhile, the Australian dollar has slipped further against its US counterpart which has remained fairly stable in the overnight session. The local currency was trading at 75.41 US cents at 0700 AEST on Friday, from 75.54 on Thursday.

WORLD FINANCE UPDATE:

BRUSSELS — British Prime Minister Theresa May has set out what she calls a “fair deal” for EU citizens living in Britain, saying in her first test of negotiating strength she did not want anyone to have to leave because of Brexit or to split up families.

BRUSSELS — European Union leaders have agreed to extend sanctions imposed on Russia for its intervention in Ukraine by another six months, European Council President Donald Tusk says.

WASHINGTON DC — US Senate leaders have unveiled a draft of legislation to replace Obamacare, proposing to kill a tax on the wealthy that pays for it and reduce aid to the poor to cut costs.

THURSDAY HIGHLIGHTS:

CIMIC — Work is set to commence on the first rail tunnel under Sydney Harbour after the NSW government awarded a $2.81 billion contract for its construction to a consortium led by CIMIC Group and John Holland.

BANK LEVY — The banking lobby has slammed a surprise bank levy announced by the South Australian government, labelling it an “outrageous cash grab” and demanding other states and territories promise they will not copy the move.

MURRAY GOULBURN — Murray Goulburn has raised its opening farmgate milk price by about 10 per cent and lifted the top end of its full-year target range following what it says was a review of its budget assumptions.

MEDIBANK — Dental services worth more than half a billion dollars account for almost half of the extras claims made by customers of private health insurance giant Medibank, latest figures show.

FAIRFAX — Fairfax Media investor Alex Waislitz has “strongly encouraged” the publisher to press ahead with the spin-off of its lucrative Domain property classifieds business despite it being in takeover talks with potential buyers.

ILUKA — Iluka Resources plans to put its Hamilton mineral separation plant in Victoria on care and maintenance status resulting in an $150 million pre-tax impairment charge in its half-year accounts.

CALTEX — Caltex Australia has forecast an increase in first-half replacement cost operating profit on the back of a jump in earnings from its Lytton refinery in Brisbane.

OLIVERS — Shares in Oliver’s Real Foods have continued to surge a day after the healthy fast food chain’s ASX listing with heavy trading lifting the stock’s value by around a quarter.

HILLS — Technology firm Hills says it will make another loss this financial year, due to the costs of a restructure and its scrapped plans to demerge its health technology business.

CABCHARGE — The consumer watchdog will not stand in the way of taxi payment service Cabcharge Australia buying Yellow Cabs in Queensland.

CROWDFUINDING — The corporate watchdog has banned start-up companies from making multiple crowd- source funding offers to raise money to expand their businesses.