Chinese investment in Australia falls to lowest level since 2007, report says

Australia’s biggest trading partner has dramatically scaled back investment Down Under, in another painful blow for the economy.

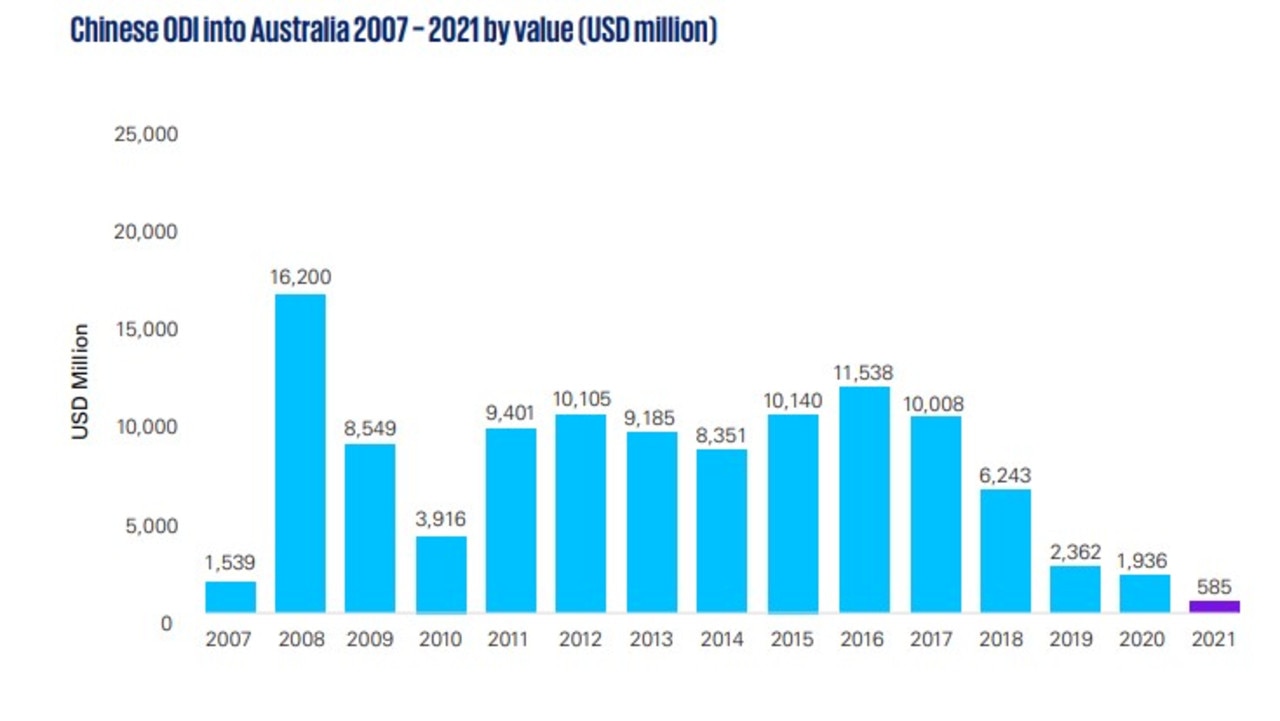

Chinese investment in the Australian economy fell a staggering 69 per cent in the last financial year, according to new data from KPMG and the University of Sydney Business School.

Over $1 billion in Chinese investment was wiped from Australia in 2021, with Chinese Outbound Direct Investment (ODI) falling to its lowest level since 2007.

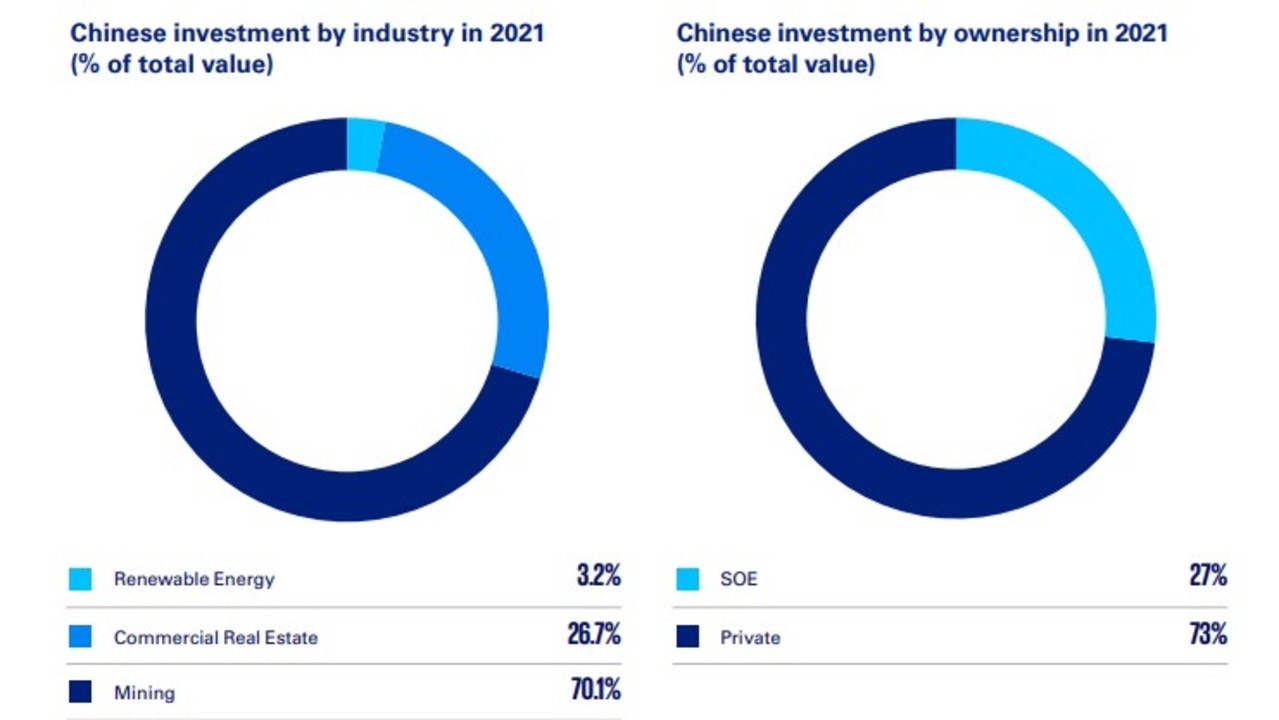

While copping a significant loss of international cash flow, Australian mining remained the number one recipient of Chinese investment, with the sector collecting over 70 per cent of the spoils.

Commercial real estate followed with 26.7 per cent, while renewable energy – consistently flouted as the new frontier for the global economy – saw an investment of just 3.2 per cent.

The number of transactions between the two nations also dropped dramatically, almost halving from 20 in 2020 to 11 in 2021.

Australia has long been – and still remains – the second-largest recipient of Chinese investment, with the US sitting firmly on top of the pile.

However, Washington also saw a 34 per cent drop in Chinese ODI in 2021, while Europe received a 25 per cent increase of investment from Beijing.

The figures are emblematic of a rapidly changing geopolitical financial landscape for China, with the forthcoming BRICS summit between China, Russia, Brazil, South Africa and India – the world’s leading emerging economies – set to lean heavily on discourse surrounding economic decoupling from Western markets.

Ahead of the virtual summit, due to begin today, Chinese state media praised the BRICS nations for showcasing “multilateral co-operation with non-Western styles, forms and principles,” and chastised the US for pushing Western nations to “rebel against globalisation”.

However, with UN data showing Foreign Direct Investment (FDI) rising back to pre-pandemic levels, the swing towards European markets by Chinese investors shows rapid diversification by Beijing, which has become increasingly isolated from the West in recent years.

More Coverage

“In terms of the issue area that’s most important for Beijing right now, I think it is about global economic recovery and keeping markets open,” Stephen Nagy, an Indo-Pacific specialist and senior fellow at the MacDonald-Laurier Institute in Ottawa, Canada, told Al Jazeera.

“What we’re seeing is states consciously diversify their supply chains away from China and form new standards-setting agreements such as the Indo-Pacific Economic Framework, or proactively create coalitions that are trading with each other,” Dr Nagy said.

“Beijing wants to stop this and I think any kind of momentum toward reversing China’s isolation from the global economy is a net plus from their point of view.”