China’s filthy rich lose $72 billion in a day

There’s never been a worse 24-hour period to be a Chinese billionaire. as these men discovered the hard way.

The wealthiest 78 people in China have suffered a huge hit to their finances after a horror day on the stock market.

On Monday, China’s filthy rich saw their shares tank, with $72 billion collectively wiped from their fortunes, according to analysis from Bloomberg’s Billionaire Index.

These staggering losses have largely been attributed to Russia’s invasion of Ukraine.

Although stock markets around the world have been affected by the global conflict, Chinese businessmen and women have been hit particularly hard because of their government’s perceived sympathy towards the Russian cause.

On Monday those suspicions were exacerbated when US officials said Russia had asked Beijing to help with their war campaign against Ukraine.

This prompted concerns that there would be backlash against Chinese companies such as boycotts and potentially even sanctions, which have crippled the Russian economy.

Hong Kong’s stock market plummeted by the most since November 2008 during the Global Financial Crisis while the Hang Sang Tech Index tumbled 11 per cent, the most it has ever fallen in history.

As a result, Chinese businessman endured massive repercussions, with the country’s richest man losing as much as $7 billion.

Stay up to date with the latest market moves with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Zhong Shanshan is currently the richest billionaire in China – and 18th richest person in the world – from his bottled water empire, Nongfu Spring Co.

The company dropped 10 per cent in a day, which is the most it has slumped in 18 months.

An eye-watering $6.9 billion was lost in the process.

Mr Zhong still remains incredibly wealthy though, worth $83.7 billion at time of writing.

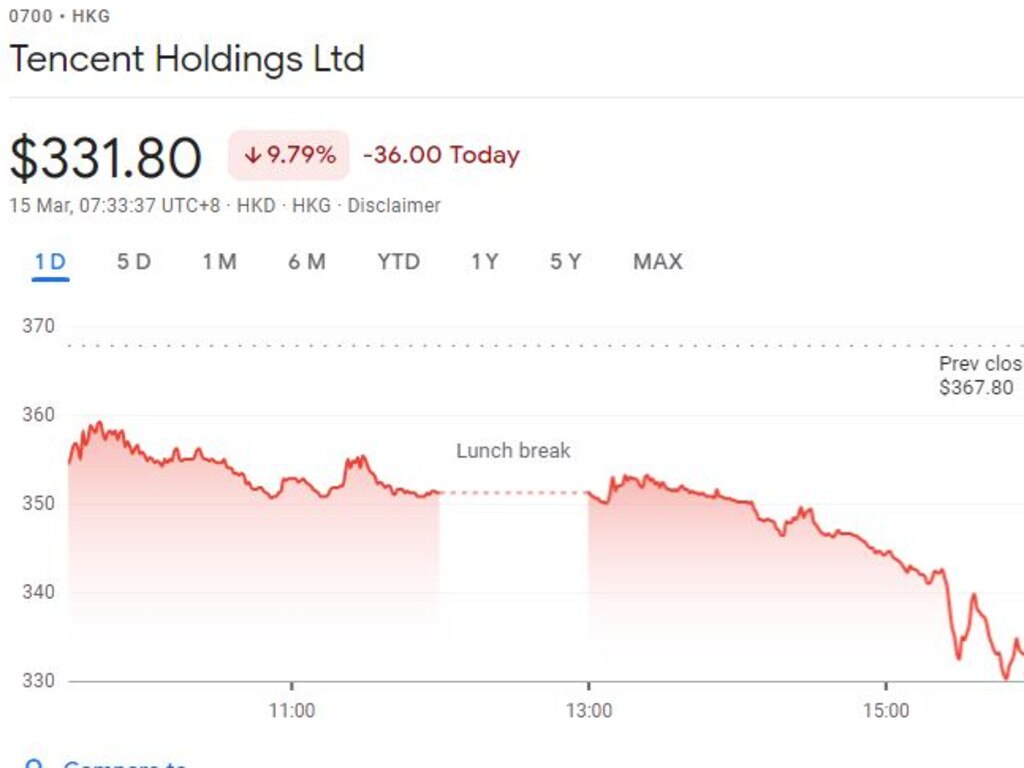

Hot on his heels was the third highest net worth individual in China, Pony Ma of Tencent Holding Ltd, which oversees popular Chinese social platform WeChat.

Tencent fell by a staggering 9.8 per cent, the most it has dropped in a decade.

Mr Ma of Tencent shed $4.6 billion of his personal fortune in 24 hours, according to Bloomberg.

This major price plunge wasn’t entirely because of concerns sparked from the Russia-Ukraine conflict; Tencent has recently found itself in the crosshairs of the Chinese Communist Party.

The tech company allegedly breached money laundering laws because of its WeChat pay feature, which was found to have allowed money transfers for funds through illicit purposes such as gambling.

The firm is facing a “record fine” but the exact number – including how many zeros – has not yet been revealed.

And last Friday, Asian rideshare company Didi Global Inc lost a record 44 per cent after its founders delayed listing on Hong Kong’s share market.

Consequently, Didi’s founder Cheng Wei lost his billionaire status.

Other well-known Chinese-owned companies have also suffered, including Alibaba, JD.com and Baidu, plummeting by more than 10, 10, and 8 per cent respectively.

Alibaba was down 12 per cent last week and is on a downward spiral of 34 per cent so far this year.

Baidu has plunged 27 per cent since 2021.

JPMorgan Chase analysts gave an unflattering label to JD.com, Alibaba and Pinduoduo, calling them “underweight” on Monday because of the panicked sell-off.

“Due to rising geopolitical and macro risks, we believe a large number of global investors are in the process of reducing exposure to the China internet sector, leading to significant fund outflows from the sector,” the analysts wrote.

“We believe Alibaba, as one of the most widely owned stocks within the China internet sector, will continue to face stock selling pressure in the near term.”

Jack Ma is the owner of Alibaba — pegged as China’s version of eBay, Amazon and PayPal all rolled into one — who was once considered the wealthiest man in China.

However, he is now fourth on the national rich list, after he angered the Chinese Communist Party over comments he made that were perceived as critical towards them.