China bans bitcoin in order to make its own cryptocurrency

China’s cracking down on cryptocurrency. But it’s not because it doesn’t like the idea of an all-digital economy.

China’s cracking down on cryptocurrency. But it’s not because it doesn’t like the idea of an all-digital economy.

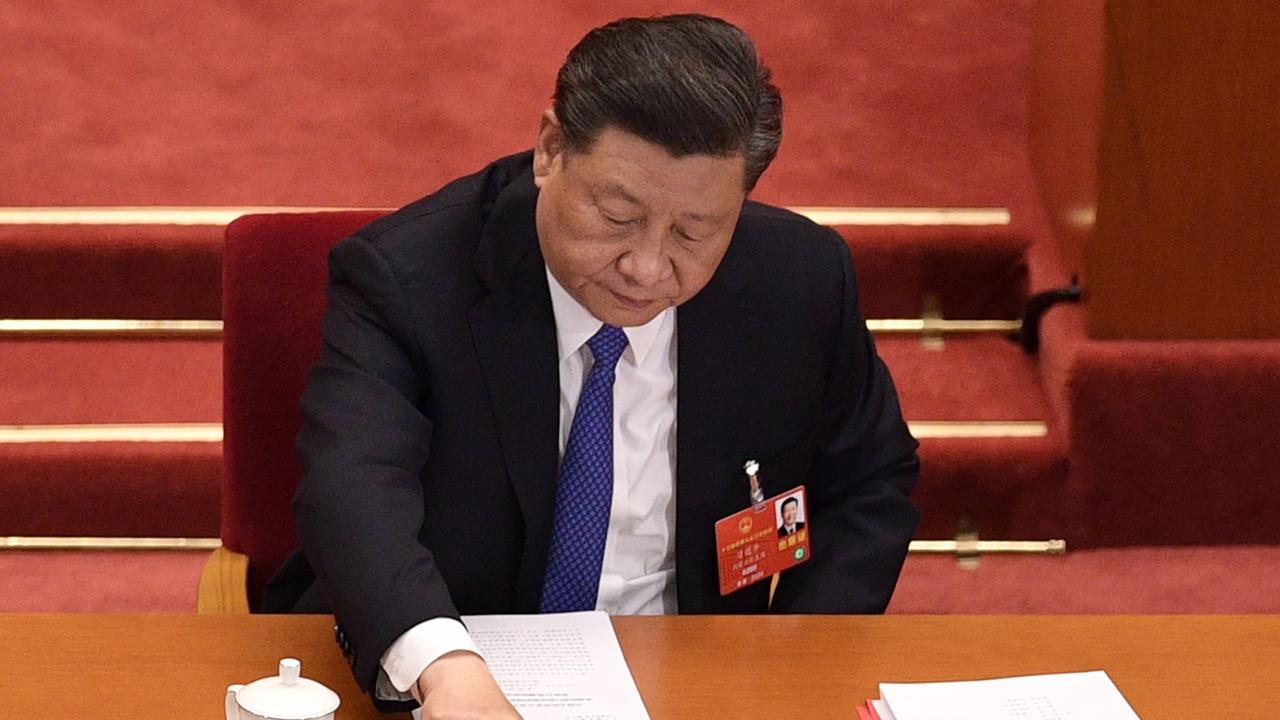

The ruling Chinese Communist Party (CCP) State Council has ordered a halt to bitcoin trading and mining. And it’s all because of its Great Digital Firewall.

Beijing has long sought to isolate its populace from the rest of the world. Foreign media is strictly controlled. Its internet access is severely limited. Most Westerns social media outlets such as Twitter are illegal.

But the emerging trend towards digital currencies had seemed right up its ally.

Turns out, it is too much so.

The core concept behind cryptocurrencies – blockchain code – allows every “digital coin” transaction history to be recorded. That’s how such insubstantial currencies establish their authenticity and trust.

But it can also be a powerful surveillance weapon.

“In theory, following the launch of the digital yuan, there will be no transaction that regulatory authorities will not be able to see – cash flows will be completely traceable,” Peking University’s Digital Finance Research Centre analyst Xu Yuan told the South China Morning Post.

RELATED: Crypto investors out to destroy Elon Musk

China goes crypto

A key CCP financial regulatory body issued a new ruling on Friday. It says cryptocurrencies are “seriously infringing on the safety of people’s property and disrupting the normal economic and financial order”.

This is why, it says, it wants to protect Chinese investors from the dangers of highly volatile virtual currencies. Official state media reported money laundering, smuggling, gambling, drug trades, and black marketeering as some of the council’s concerns.

So Beijing has ordered a halt to foreign virtual currency trading in bank commercial savings and transactions products. It has also thrown the full weight of China’s massive economy behind the People’s Bank of China (PBOC) efforts to establish its Digital Currency/Electronic Payment system (DCEP) – otherwise known as the Digital Yuan.

While monetary policy and law enforcement are the stated reason for the move, a recent report by the CNAS think-tank says such traceable currency “will arm China’s economic planners with a range of data that no other government has ever been able to efficiently assemble”.

It also points out “officials higher in the Chinese government have stressed DCEP’s value as a tool for enforcing party discipline”.

But reigning in the foreign crypto economy will not be easy.

And it will have international fallout.

Unofficial estimates indicate up to 70 per cent of the total value of all virtual currencies is being “mined” in China. That means more computer processing power is being committed there to generating fresh digital “coins” than anywhere else in the world.

Which is why speculation about a Beijing ban sent shockwaves through the global trading network last week.

RELATED: Crypto plunges in two-hour bloodbath

Spy money

Earlier this year, CNAS warned Beijing’s push for a new digital currency would “likely enable the Chinese Communist Party (CCP) to strengthen its digital authoritarianism domestically and export its influence and standard-setting abroad”.

Last week, digital asset analyst Boris Schlossberg of FX Strategy issued a statement warning investors Beijing’s drive to limit cryptocurrencies operating within its borders to the Digital Yuan was an exercise in “absolute power”.

Such technology would enable it to monitor and analyse the wealth of its citizens, he says.

“The digital yuan is both programmable and traceable, giving the Chinese government enormous control over the economy,” he says. “Not only will Chinese policymakers know every consumer choice made in the economy, but they could also directly affect spending behaviour by making the currency expirable by a certain date.”

CNAS says the People’s Bank of China claims it will see all transactions taking place, as they take place. “(This will) enable the CCP to exercise greater control over private transactions, as well as to wield punitive power over Chinese citizens in tandem with the social credit system.”

RELATED: ‘Too weak’: China lashes out at Australia

Behind the move are Beijing’s authoritarian one-party government’s insecurity and its desire to detect “outliers” among its citizens.

That is, those who do not conform to CCP definitions of “normal” behaviour.

When combined with biometric smart cards and an all-pervasive face-recognition surveillance network, Beijing will be able to compile extraordinarily detailed individual profiles that can be monitored by artificial intelligence systems.

And these can be used to identify crime, terror threats, “deviant behaviour” – and political dissenters.

CNAS has urged international governments and financial institutions to react to the privacy threat posed by the widespread use of cryptocurrencies.

Nations must “adapt to the quickly changing payments space, understand the geopolitical implications of this technology, influence its development, counter the DCEP’s threats to political and economic liberty, and ensure that financial technology innovation does not further China’s digital authoritarianism”, it says.

Jamie Seidel is a freelance writer | @JamieSeidel