Bitcoin price drops by 12 per cent, crypto loses $1 trillion

Bitcoin has dropped by a huge amount as experts warn that the digital asset is bottoming out.

Bitcoin hasn’t had a strong start to the year with the coin dropping by a whopping 12 per cent in the first few days of 2022.

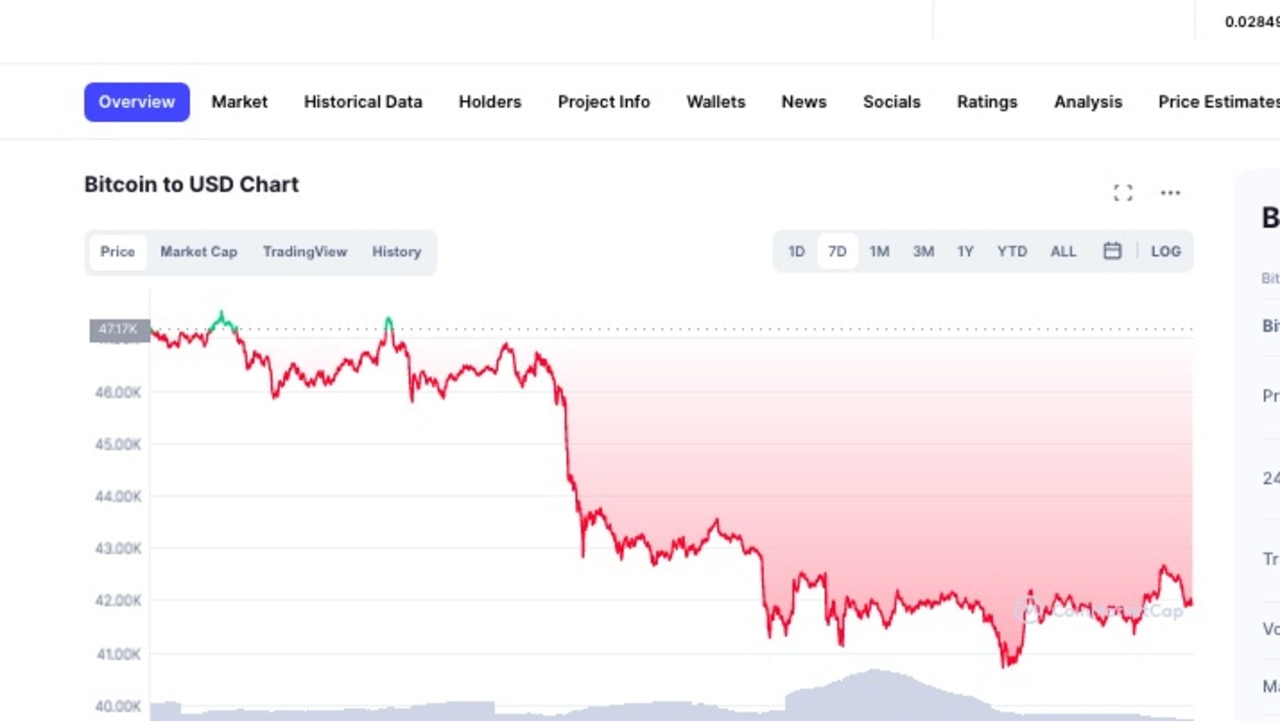

BTC started the year off sitting on about US$47,000 (A$65,000) and now, just 10 days later, the blockchain is worth US$41,721 (A$57,000).

Even that is an improvement from the weekend, when bitcoin’s price plunged to US$40,672, according to CoinMarketCap, the lowest it’s been since September 2021.

That’s a massive fall from grace from the coin’s all-time high of nearly US$69,000 (A$95,000) on November 10 last year, representing a loss of almost A$28,000 (A$38,000).

The combined market capitalisation of cryptocurrency at time of writing is US$1.96 trillion (A$2.7t), according to CoinMarketCap, which is down by $1 trillion (A$1.4t) since its November high.

Bitcoin dropped in price massively because of an internet outage in Kazakhstan last week, which, as a nation, is the world’s second largest centre for bitcoin mining, behind the US.

The internet blacked out because the country’s president, Kassym-Jomart Tokayev, ordered the nation’s telecom provider to stop its services on Wednesday after violent anti-government protests.

Then bitcoin was hit with a double whammy.

In the same week as the Kazakhstan debacle, the US Federal Reserve released the minutes to its December meeting which sent the cryptocurrency community into a spin.

The minutes show that America’s central bank is considering raising interest rates sooner than some had anticipated and selling off some of its assets.

This sparked a mass bitcoin sell-off which unsurprisingly tanked the price.

Other cryptocurrencies including Ethereum have also fallen drastically in the past week.

Ethereum’s value dropped from about US$3,800 on Wednesday to under US$3,200 on Friday. At time of writing, it was even lower, on US$3,147.

But bitcoin billionaire and former Goldman Sachs employee Mike Novogratz thinks the coin has already bottomed out and that it can only get better from here.

We entered the buy zone….

— Mike Novogratz (@novogratz) January 7, 2022

“On the charts, $38,000, $40,000 feels like where we should bottom,” Mr Novogratz told CNBC last week.

He said bitcoin’s low price points would ironically uplift its value because they are “attractive levels to buy”.

However, other experts weren’t so sure.

Katie Stockton, founder of US investing firm Fairlead Strategies, said that if bitcoin dipped below US$44,200, it could go either way — either a big boom or a free fall in price.

Ms Stockton said that US$44,200 could be a “support level” for the cryptocurrency — which means demand could pick up because the lower price is attractive to buyers but not so high that sellers will be dump their tokens.

However, if bitcoin continues to fall beyond that price, “important long-term support at the bottom boundary of the weekly cloud will likely be tested, near $37,000,” she told Bloomberg.

Well known investor Louis Navellier also sent out a warning last month, saying that a drop below US$46,000 didn’t bode well and could easily lead to a slide of just US$28,000.

“I would take a decline below $US46,000 (the 200-day moving average) to be a yellow flag and a decline below the spring low of $US28,500 to be a completed massive double top,” he said, “which points to a decline to below $US10,000, which incidentally would match many of the multiple 80+ per cent declines in its storied history.”

Speaking to news.com.au in December, Greg Rubin, head of trading at Aussie firm Global Prime, predicted bitcoin would hit just $US10,000 next year.

The investing expert reckons bitcoin has one more bull run left in it before it stays at a low price for a long time.

He estimates the top-ranked coin will hit between $US114,000 ($A158,000) to $US130,000 ($A181,000) in the first quarter of next year.

However, after that, prices would drop dramatically, where they would stay until the next surge.

“Looking at the scale of probabilities, it seems the most likely end to the bull run that kicked off in 2020 will be next year,” he told news.com.au.

Bitcoin’s price would plunge to $US10,000-$US20,000 ($A13,000-$A27,000) mark, a drop of around 70 per cent, where it would remain for some time.

“When the volatility dies down, it [bitcoin] will meander on low volume for years,” he explained.