Crypto roars as Bitcoin ETF approved

Bitcoin exchange-traded funds (ETFs) have been granted approval to list on the stock market in the US, with the ASX set to approve its first Bitcoin ETF by mid-2024.

The US Securities and Exchange Commission (SEC) has approved the trading of Bitcoin exchange-traded funds (ETFs).

According to reports, the New York Stock Exchange, Nasdaq and Cboe Global Markets have all received permission to list the ETFs, with trading expected to begin as soon as this Thursday (US time).

Reports indicate 11 funds have been given permission to launch Bitcoin ETFs including Grayscale, VanEck and Fidelity.

The move has been long touted and will make it easier for retail investors to access cryptocurrency through traditional stock markets.

Bitcoin ETFs will enables retail investors to hold bitcoin exposure without needing cryptographic keys, bitcoin wallets or to interact with unregulated crypto exchanges.

According to The Australian Financial Review, Australia will also soon get its first Bitcoin ETF, with the Australian Securities Exchange (ASX) approving a timeline for the first local ETF to be launched by Brisbane-based Monochrome Asset Management in the first half of 2024.

Local fund manager Betashares is also expected to expedite plans to launch an ETF on the ASX, following the US approval.

A Betashares ETF, which invests in companies that provide services to the cryptocurrency market, rather than the Bitcoin price itself, is already traded on the ASX.

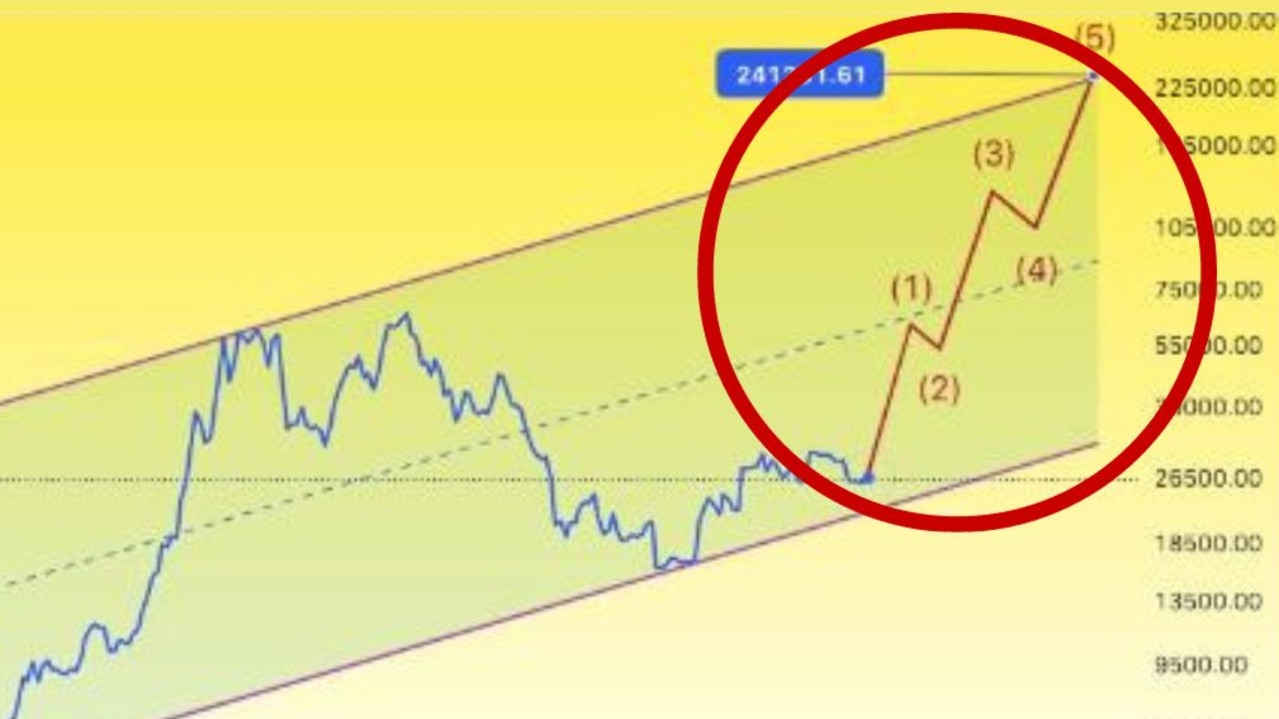

The price of Bitcoin has been surging since January last year, and gained 177 per cent in the 2023 calendar year.

It’s up more than five per cent for the month and this morning it was selling for A$70,188.

One analyst is predicting it could more than triple in value to be worth US$200,000 (A$298,000) by the end of 2025.

In a note, Standard Chartered head of crypto research Geoff Kendrick wrote: “If ETF-related inflows materialise as we expect, we think an end-2025 level closer to US$200,000 is possible.”

The approval news follows a hoax announcement that was posted on X earlier this week, claiming the approval had been granted, which sent markets into a frenzy after hackers used the SEC’s official X account to post the news.

The tweet was deleted and followed by a tweet from SEC chairman Gary Gensler, who posted on his own account that the SEC’s account was “compromised, and an unauthorized tweet was posted”.