Bitcoin edging towards dangerous ‘support level’ that could result in free fall

After a hellish six weeks, Bitcoin is nearing a dangerous price level with experts warning that once it drops below this number, it might never recover.

Bitcoin is nearing a dangerous price level with experts warning that once it drops below US$44,200, the cryptocurrency could be in free fall depending on how investors react.

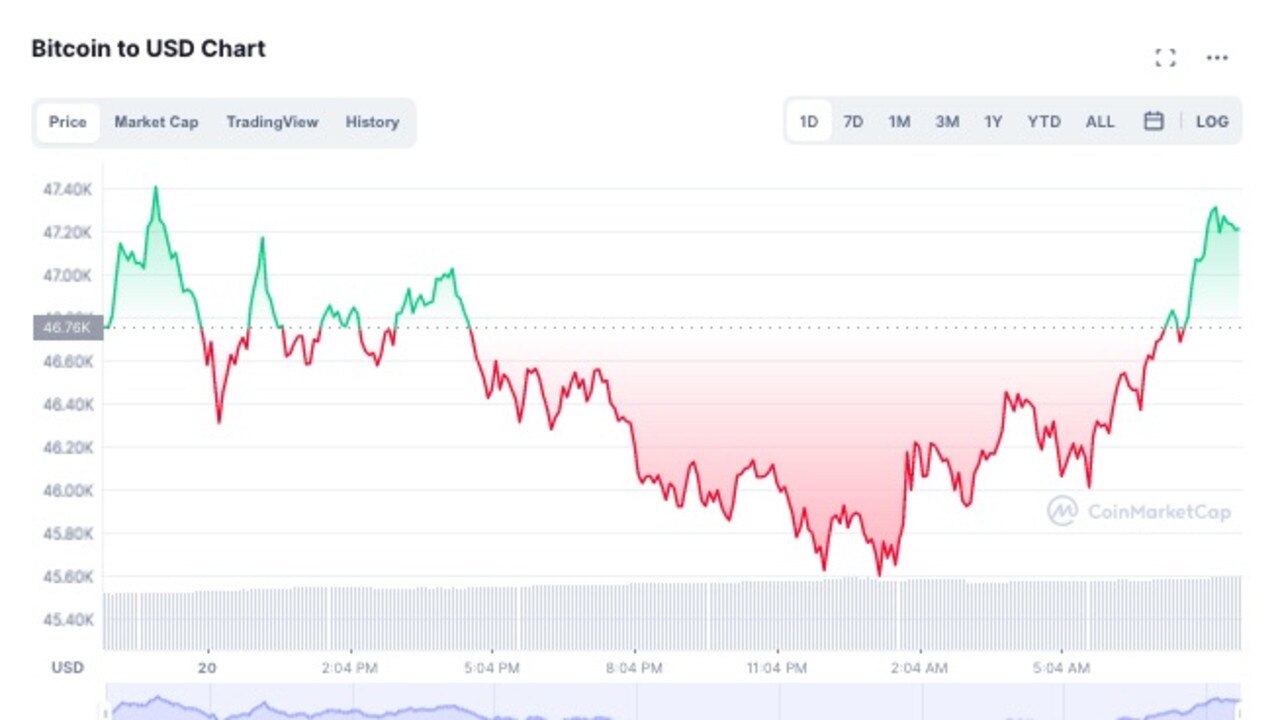

A financial pro issued the grim message on Monday after the sixth consecutive week of the coin hovering around the US$45,000-US$48,000 mark.

At time of writing, the blockchain was on the higher end of that, at US$47,000.

That’s a spectacular fall from grace considering the coin hit an all-time high of nearly $US69,000 ($A96,000) on November 10.

Now, just several weeks later, BTC has shed $US22,000 ($A30,000) in value or 31 per cent.

Katie Stockton, founder of US investing firm Fairlead Strategies, said that US$44,200 could be a “support level” for the cryptocurrency — which means demand could pick up because the lower price is attractive to buyers but not so high that sellers will be dump their tokens.

However, if bitcoin continues to fall beyond that price, “important long-term support at the bottom boundary of the weekly cloud will likely be tested, near $37,000,” she told Bloomberg.

It’s doubtful whether the support will hold out at that price and could result in a mass sell-off.

Bitcoin is edging closer to that level, with a 200-day moving average of just over US$46,000 at the moment.

Ms Stockton isn’t the only one to warn about bitcoin hitting a critical point in recent weeks.

Marc Chandler, chief market strategist at Bannockburn Global Forex, warned that the recent happenings were “deadly” for bitcoin.

“The idea that as it matured, the volatility would ease has not really materialised,” he told Bloomberg.

“The volatility is deadly and its other supposed attributes, like a hedge against inflation, seems spurious.”

Well known investor Louis Navellier also weighed in, saying earlier this month that a drop below US$46,000 didn’t bode well and could easily lead to a slide of just US$28,000.

“I would take a decline below $US46,000 (the 200-day moving average) to be a yellow flag and a decline below the spring low of $US28,500 to be a completed massive double top,” he said, “which points to a decline to below $US10,000, which incidentally would match many of the multiple 80+ per cent declines in its storied history.”

Speaking to news.com.au last week, Greg Rubin, head of trading at Aussie firm Global Prime, predicted bitcoin would hit just $US10,000 next year.

The investing expert reckons bitcoin has one more bull run left in it before it stays at a low price for a long time.

He estimates the top-ranked coin will hit between $US114,000 ($A158,000) to $US130,000 ($A181,000) in the first quarter of next year.

However, after that, prices would drop dramatically, where they would stay until the next surge.

“Looking at the scale of probabilities, it seems the most likely end to the bull run that kicked off in 2020 will be next year,” he told news.com.au.

Bitcoin’s price would plunge to $US10,000-$US20,000 ($A13,000-$A27,000) mark, a drop of around 70 per cent, where it would remain for some time.

“When the volatility dies down, it [bitcoin] will meander on low volume for years,” he explained.

On Monday, news.com.au reported that Eswar Prasad, a senior economics professor at US Ivy-league Cornell University, thought bitcoin was on its last legs.

“Bitcoin itself may not last that much longer,” he told CNBC last week.

The expert, who has authored ‘The Future of Money: How the Digital Revolution is Transforming Currencies and Finance’, is a proponent of blockchain technology but not a huge fan of bitcoin.

“Bitcoin’s use of the blockchain technology is not very efficient,” Prof Prasad said.

The cryptocurrency “is environmentally destructive” and “doesn’t scale up very well,” he explained.